Young individual investors are betting that a change of government will see the UK market soar and increase their stock market holdings.

The survey of 1,000 UK-based retail investors found that almost two-thirds of respondents aged 18 to 44 believe the change in Downing Street will lead to an increase in the value of UK-listed shares.

When all age groups were included, this figure dropped to 44% of all retail investors, with 30% expressing the opposite opinion, according to a survey by trading platform eToro.

68% of Labour voters think a new government would be a boon for UK stocks, while around a quarter of Conservative voters agree.

Dan Moczulski, UK managing director at eToro, said: “When Labour came to power in 1997, the FTSE 100 rose 35% in the following 12 months.

“Nothing quite so dramatic is likely to happen this time around, but the FTSE 100 has already returned 7% so far this year, suggesting the market is comfortable with the expected outcome of this election.”

“With inflation, UK equities and sentiment starting to turn around, the mood music is clearly right for investors heading into this election.”

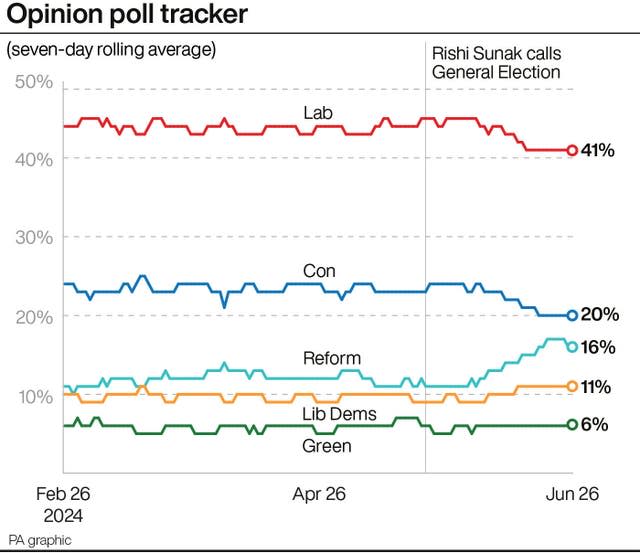

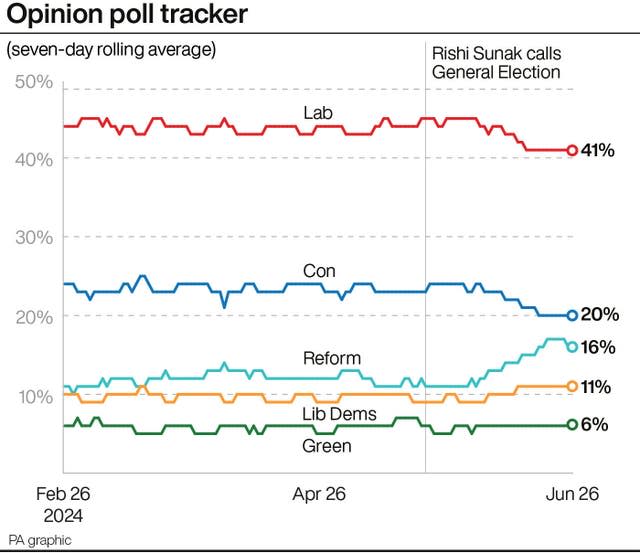

Sir Keir Starmer’s Labour Party is the favourite to win the general election on 4 July.

A recent poll conducted online by Savanta among 2,318 British adults from 21 to 24 June showed Labour leading by 21 percentage points.

The figures are: Labour 42%, Conservative 21%, Reform Party 14%, Liberal Democrats 10%, Green Party 5%, Scottish National Party 3%, Plaid Cymru 1% and other parties 5%.

British markets have surged so far this year, with the FTSE 100 up nearly 7% since the start of January.

Meanwhile, headline inflation is already below the Bank of England’s 2% target, and the central bank is expected to cut interest rates in the coming months.

Economists also predict that key economic indicators such as gross domestic product (GDP) growth will improve further over the next 12 months.

Despite slowing in April, GDP is set to grow again in the first quarter of 2024 after a brief recession late last year.

Meanwhile, Susanna Streeter, head of finance and markets at Hargreaves Lansdown, said the impact of the general election on financial markets was likely to be “minimal” because Labour already held a large lead in the opinion polls.

“A Labor majority is unlikely to spook investors dramatically, allowing the new government to implement policies that have been largely digested by the market.”

“Anything other than Labour dominance is likely to cause more uncertainty than anticipated, weakening the position of Sir Keir Starmer and his ministers and hindering their ability to push through reform.”