It’s worth trying to beat market index fund returns to justify the effort of picking individual stocks, but you’ll almost certainly end up buying stocks that underperform the market — and unfortunately, that’s what happens over the long term. Wilmar International Limited (SGX:F34) shareholders will be concerned, as the share price has fallen 33% over the past three years, well below the broader market decline of around 6.9%, and more recent news is of little comfort, with the share price down 25% in a year.

So let’s look at the fundamentals of the company to see if long term shareholder returns are aligned with the performance of the underlying business.

Check out our latest analysis for Wilmar International

In his essay Graham and Doddsville’s Superinvestors Warren Buffett has said that share prices do not always rationally reflect the value of a company. An imperfect but simple way to think about how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) against the share price movement.

Although the share price has been declining over three years, Wilmar International has actually managed to grow EPS by 0.4% per year over that period. Given the share price reaction, one might wonder if EPS is not a good indicator of business performance during the period (perhaps due to a one-time loss or gain), or if past growth expectations were unreasonable.

Three years ago, the market was probably too optimistic about growth, but a look at other indicators could be enlightening.

Given the health of the dividend, I don’t think it’s spooked the market. I like that Wilmar International has grown its earnings over the past three years. But I don’t understand why the stock price has fallen. It might be worth digging deeper into the fundamentals to make sure you don’t miss out on any opportunities.

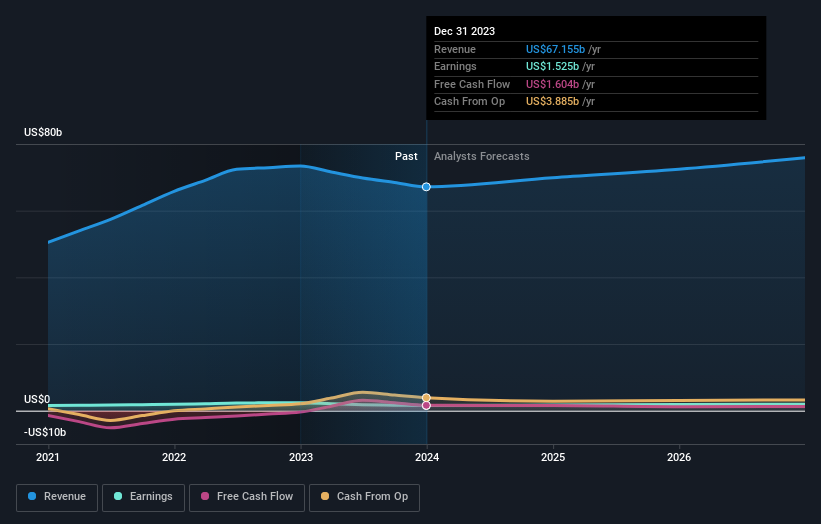

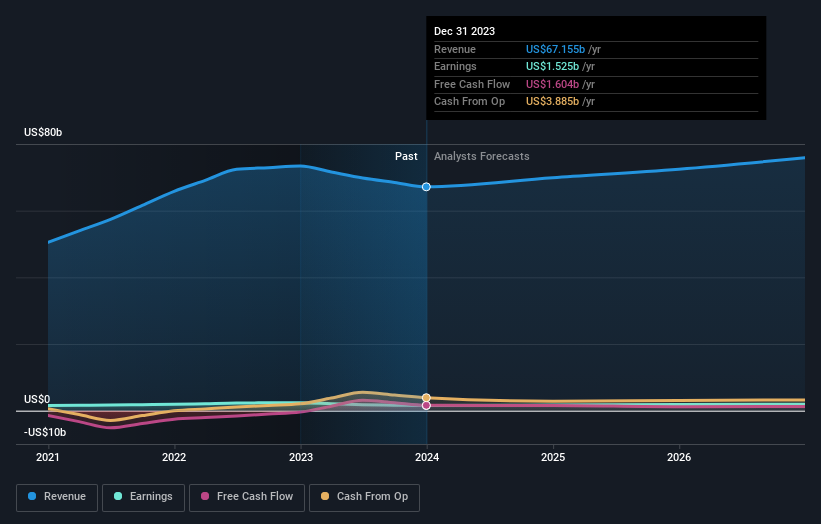

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We’re pleased to see that there has been significant insider buying in the last three months, which is a good thing. Having said that, we think earnings and revenue growth trends are even more important factors to consider, so it makes a lot of sense to see if analysts are forecasting Wilmar International’s future earnings (free profit forecasts).

What about dividends?

When looking at investment returns, it’s important to consider the following differences: Total shareholder return (TSR) and Price Earnings RatioThe TSR is a return calculation that accounts for the value of cash dividends (assuming any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Therefore, for companies that pay large dividends, the TSR is often much higher than the share price return. Note that in the case of Wilmar International, the TSR for the last 3 years was -24%, which is better than the share price return shown above. The dividends paid by the company have thus boosted the share price. total Shareholder returns.

A different perspective

Wilmar International shareholders are down 21% this year (even including dividends), while the market itself is up 2.1%. Even the share prices of blue chip stocks fall from time to time, but we want to see improvements in a company’s fundamental metrics before getting too interested. Longer term investors will likely not be too upset, as the stock has returned 0.7% annually over five years. The recent sell-off could be an opportunity, and it may be worth checking the fundamental data for signs of a long term growth trend. It’s always interesting to track the long term movement of a share price. But to understand Wilmar International better, there are many other factors to consider. Still, it’s hard to say whether Wilmar International is 3 Warning Signs in Investment Analysis one of which makes us a bit uncomfortable…

Wilmar International isn’t the only stock that insiders are buying. Lesser known companies this free This free list of growing companies with recent insider purchasing, could be just what you need.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singapore exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com