UK stocks have seen a remarkable rise since the start of 2024. FTSE 100Its value rose 6%. But the strong gains have fueled fears of a possible stock market crash.

These dire warnings aren’t just coming from a minority of commentators. It was none other than the Bank of England that warned of a potential storm in financial markets.

The central bank warned on Thursday (27 June) that prices of many assets such as stocks and bonds remain high relative to historical levels and some continue to rise, suggesting that financial market investors continue to expect the economy to recover and inflation to fall.

They are downplaying risks such as geopolitical developments and continued high inflation that could lead to slower growth and keep interest rates higher than expected.

These risks increase the likelihood of a sharp correction in asset prices.

What do I do now?

Investors can take steps to protect themselves, and they can do this by searching the market for cheap stocks.

Companies with low stock prices relative to their earnings, assets, dividends, and future cash flows (known as intrinsic value) have a built-in cushion against losses.

Bharat Development (LSE:BDEV) is one stock I’m considering buying today, as it is currently trading with a forward price-to-earnings growth ratio (PEG) of 0.7, which is below the value watermark of 1.

Meanwhile, its dividend yield this year is above the market average at 4.1%, above the average expected 3.5% for FTSE 100 stocks.

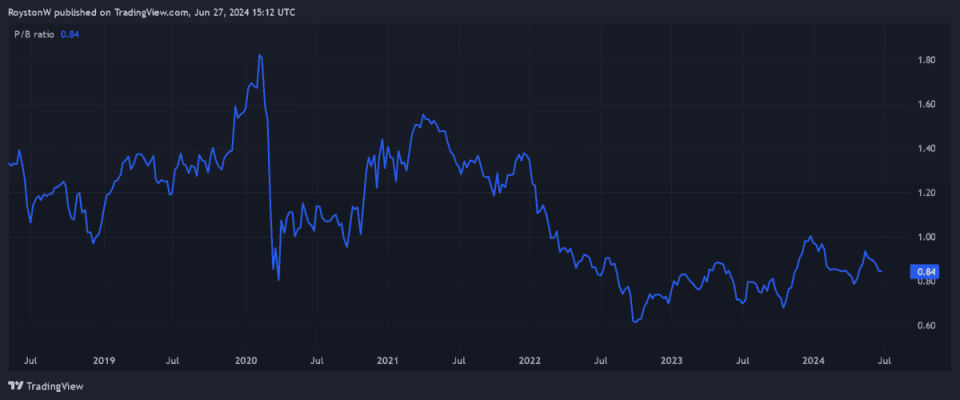

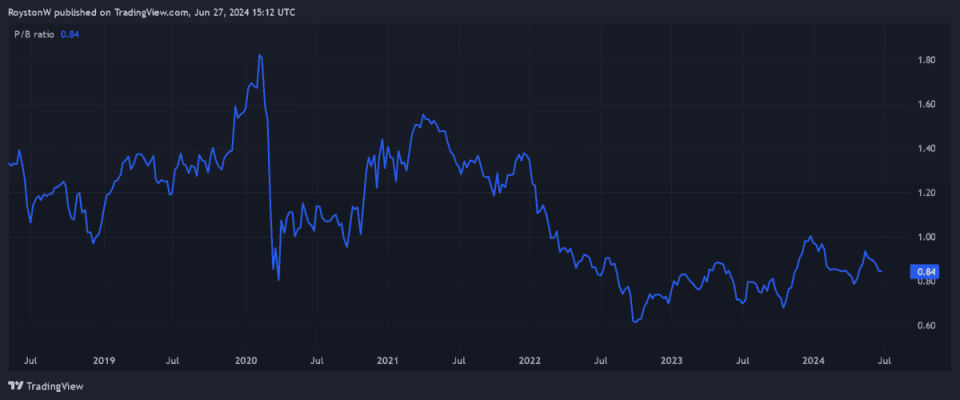

And finally, Barratt looks cheap when compared to its price-to-book (P/B) multiple (see below). Like the PEG multiple, a P/B ratio of less than 1 indicates that a stock is undervalued.

A bright future

Barratt could experience short-term turmoil if the stock market corrects, but in the longer term, I believe the company has the potential to deliver exceptional returns.

However, there are risks involved. Lloyds Bank Chief Charlie Nunn Sky News Mortgage rates are expected to be between 3.5% and 4.5% this week.The new normal” is set to continue, having risen by more than 1.5-2.5% over the past decade.

An environment of rising mortgage rates will have a negative impact on new home sales and house prices, but overall I still believe there is huge investment potential for housebuilders like Barratt.

Demand for new homes is set to rise steadily as the population grows, as evidenced by Labour’s pledge to build 1.5 million new homes over five years.

Moreover, as cost inflation steadily eases, homebuilders’ profit margins should soar.

Keep the faith

A sudden stock market correction is always a risk, but as an investor, the threat of renewed volatility is not enough to deter you from buying UK shares.

Past performance is no guarantee of the future, but history has shown that stocks always recover strongly from periods of extreme weakness.

Footsie has weathered several economic crises since it was founded in 1984, and hit a new closing high of 8,445.80 points last month.

As a long-term investor, I’m prepared to accept some short-term pain in order to secure bigger gains in the future, which is why I plan to continue buying UK shares despite the Bank of England’s warning.

The article Will the Stock Market Crash? What to Do Next? first appeared on The Motley Fool UK.

Show more

Royston Wilde has invested in Barratt Developments Ltd. The Motley Fool UK recommends Lloyds Banking Group Ltd. Views expressed on companies mentioned in this article are those of the author and may differ from official recommendations we make in subscription services such as Share Advisor, Hidden Winners or Pro. At The Motley Fool we believe considering a diverse range of insights makes us better investors.

Motley Fool UK 2024