Wall Street has been in full swing since the start of 2023. In the last 17.5 months or so, we have seen a number of mature, equity-driven Dow Jones Industrial Average (DJINDICES: ^DJI) 17% increase in benchmark S&P 500 (SNPINDEX: ^GSPC) 42% increase, driving growth Nasdaq Composite Index (NASDAQINDEX: ^IXIC) They surged by 69%. More importantly, all three indexes achieved record closing prices, cementing their place in the bull market.

On paper, things are going well on Wall Street: Most S&P 500 stocks are beating consensus earnings estimates and the U.S. economy is thriving, even as a historically accurate forecasting index projects the U.S. will fall into recession in 2023.

But history also teaches us that stock markets rarely rise in a straight line for long periods of time, and while the hype around artificial intelligence (AI) is undoubtedly boosting stock prices, that doesn’t mean they won’t crash at some point in the future.

While there’s no foolproof indicator for predicting the short-term direction of the Dow, S&P 500, or Nasdaq Composite Index, certain forecasting tools have a remarkable track record of correlating with big stock market moves throughout history. One such valuation indicator, with 153 years of data, offers big clues about whether the stock market will crash.

Are stocks heading for disaster?

Over the past year, I have looked at a variety of forecasting tools that have been found to be highly correlated with significant directional changes in Wall Street’s three major stock indexes. These include the U.S. M2 Money Supply, the ISM Manufacturing New Orders Index, and the Conference Board’s Leading Economic Index (LEI).

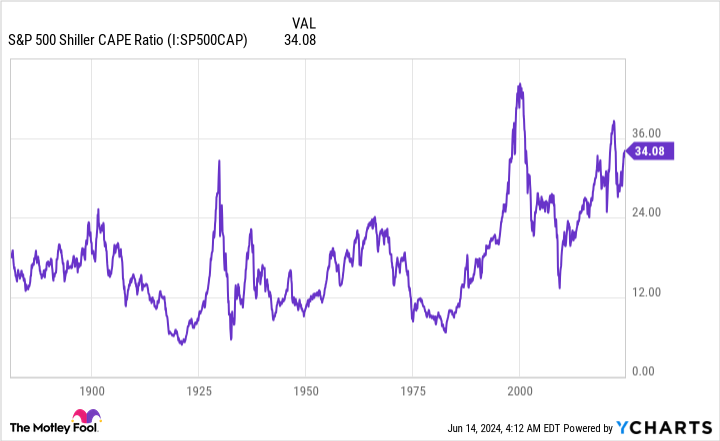

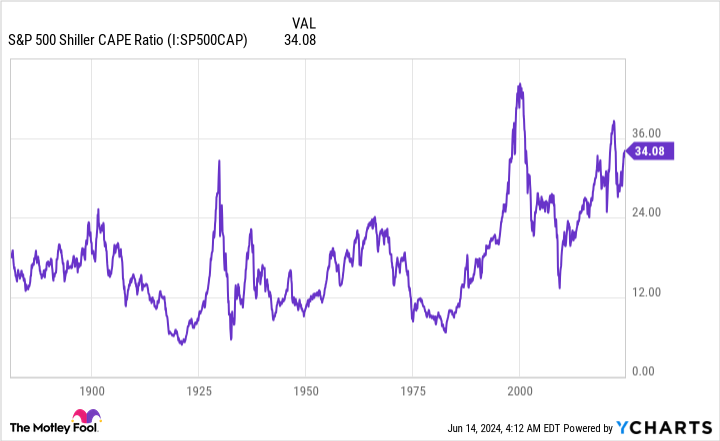

But if there’s one metric with a time-tested track record that predicts big moves on Wall Street better than anything else, it’s the valuation-based Shiller price-to-earnings ratio (P/E), also commonly known as the cyclically adjusted price-to-earnings ratio or CAPE ratio.

A traditional P/E ratio divides a company’s stock price by its earnings per share over the past 12 months, but the S&P 500’s Shiller P/E ratio is based on the average of inflation-adjusted earnings over the past 12 months. 10 yearsLooking at 10 years of earnings data helps filter out one-off events, such as COVID-19, that may negatively impact valuation analysis.

As of the June 13 close, the S&P 500’s Shiller P/E was 35.38. Going back to early 1871, this is one of the highest ever recorded during a bull market rally. It’s also more than double the 153-year average of 17.13. That said, access to public data (thanks, internet!) and a period of historically low interest rates certainly encouraged increased risk-taking and higher earnings multiples over the past 30 years.

But the Shiller P/E ratio being more than double its historical average isn’t the biggest concern. Rather, every instance in which the S&P 500’s Shiller P/E ratio has risen above 30 during a bull market rally has seen the following results:

-

August 1929 – September 1929: Just before the Great Depression spread in the United States, the Shiller Stock Price Index rose above 30 for the first time. The Dow Jones Industrial Average then fell 89% before reaching its bottom.

-

June 1997 – August 2001: During the dot-com bubble, the S&P 500’s Shiller P/E hit an all-time high of over 44. Since then, the S&P 500 has lost 49% of its value and the Nasdaq Composite has fallen more than 75% from its peak.

-

September 2017 to November 2018: The S&P 500 plunged 20% in the fourth quarter, but that was followed by a long rally that pushed the Shiller P/E ratio above 30%.

-

December 2019 – February 2020: In the months leading up to the COVID-19 crash, the Shiller P/E ratio rose above 30. In the 2020 COVID-19 crash, the S&P 500 lost 34% of its value in 33 days.

-

August 2020 – May 2022: In the first week of January 2022, the Shiller P/E ratio hit 40 for only the second time in history. During the 2022 bear market, the S&P 500 lost up to 28% of its value, with the Nasdaq taking an even bigger hit.

-

November 2023 – Present: As mentioned above, the Shiller P/E is above 35 as of the June 13, 2024 close.

The Shiller price-to-earnings ratio has exceeded 30 six times in the past 153 years, and each of the past five times was associated with declines of between 20% and 89% in the S&P 500, Dow, and Nasdaq Composite Index. Given the long history of valuations, a significant decline, or even a short-term “crash,” may be in store.

Remember, the Shiller P/E is not a timing tool. As we saw during the dot-com bubble, stock prices remained abnormally high for over four years. The current stock market high, history suggests, may continue for the next few weeks, months, or years before reversing.

History is a two-sided coin that strongly favors long-term optimists.

With the Nasdaq Composite, S&P 500 and Dow Jones Industrial Average all in bull mode, prospects of a bear market or stock market crash are probably not what you want to hear, but the good news is that history is nonlinear and highly favorable for optimistic investors who are committed to the long term.

In all fairness, nothing we do, say or think as investors can prevent economic downturns or the occasional stock market declines (corrections, bear markets and crashes) that are a natural part of economic cycles and long-term investing.

But there is a big difference between periods of growth and contraction in the US economy. Since the end of World War II in September 1945, nine of the 12 US recessions have lasted less than 12 months; none of the remaining three lasted more than 18 months.

On the other side of this uneven coin, most economic expansions have lasted for many years. In fact, since the end of World War II, two periods of growth lasted longer than a decade. If you’re an investor, you’re probably right to bet that the U.S. economy will expand for the long term.

On Wall Street, we see similar differences between bear and bull markets.

A year ago, researchers at Bespoke Investment Group published a dataset on the social media platform X, formerly known as Twitter, to examine the calendar-day length of S&P 500 bear and bull markets since the start of the Great Depression in September 1929. As you can see in the post, the analysis covered 27 separate bear and bull markets.

The average bear market in the S&P 500 lasted about 9.5 months (286 calendar days), while a typical bull market lasted 1,011 calendar days, about 3.5 times longer. Additionally, there have been 13 bull markets that lasted longer than the longest bear market, which lasted 94 years.

In the short term, the direction of the Dow, S&P 500 and Nasdaq Composite is always unpredictable. Stock market crashes are possible, but the history of stock market valuations, historical data on stock market earnings and economic growth make it clear that optimism and long-term investing are winning strategies.

Don’t miss out on this second chance to potentially make a profit.

Have you ever felt like you missed out on the opportunity to buy the most successful stocks? Then listen to this.

In rare cases, our team of expert analysts “Double Down” stock We recommend companies that are on the verge of collapse. If you’re worried you might have missed out on an investment opportunity, now is the best time to buy before it’s too late. The numbers speak for themselves.

-

Amazon: If you had invested $1,000 when it doubled in 2010 That works out to $20,685.!*

-

apple: If you had invested $1,000 when it doubled in 2008 That comes to $40,151.!*

-

Netflix: If you had invested $1,000 when it doubled in 2004 That comes to $360,991.!*

We currently have “Double Down” alerts on three great companies, but we may not have another opportunity like this in the near future.

See the 3 “Double Down” stocks »

*Stock Advisor returns as of June 10, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Will the stock market crash? 153 years of valuation history gives big clues. This was originally published by The Motley Fool.