In just over six months, Americans across the country will head to the polls or mail in their ballots to decide who will lead our great country for the next four years.

Although there are many aspects of the presidency and legislation in general that have nothing to do with Wall Street or investing, fiscal policy changes are typically drafted by Congress and signed into law by the president. do It affects the health of the U.S. economy and the profits of U.S. companies.

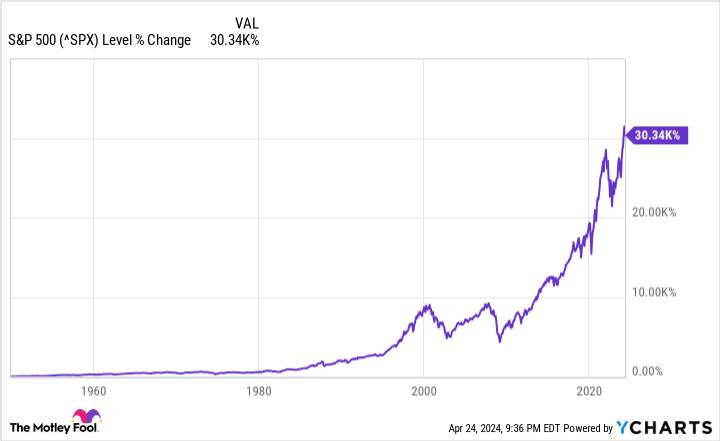

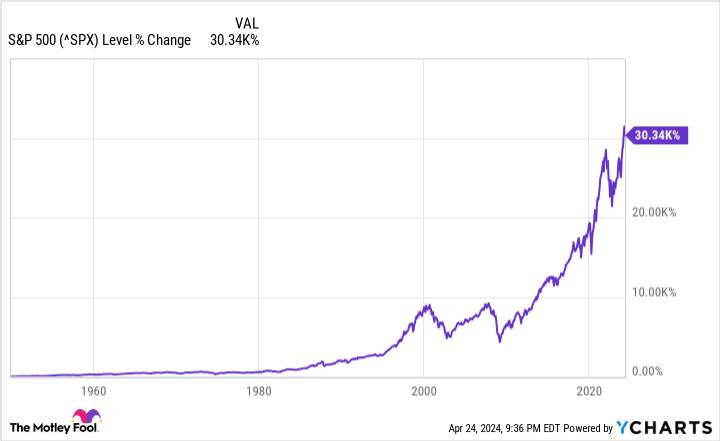

As of the closing bell on April 24, incumbent Joe Biden had won 3,237 delegates in the presidential primary. This far exceeds the 1,968 delegates needed to secure the Democratic presidential nomination. Since taking office as president on January 20, 2021, Biden has achieved a 23% gain in symbolic elections. Dow Jones Industrial Average (DJINDICE: ^DJI)32% in benchmark S&P500 (SNPINDEX: ^GSPC)17% for growth-driven Nasdaq Composite (NASDAQINDEX: ^IXIC).

Like his predecessor Donald Trump, Biden worked with a unified, party-controlled Congress during his first two years in the Oval Office, but worked with a divided Congress in the second half of his presidency (Republicans controlled the House of Representatives). (under control). Representative on January 3, 2023).

But could Joe Biden’s second term, combined with Democrats controlling both houses of Congress, cause stocks to crash? Let’s dig into the challenges Biden and a Democratic Congress will face, and let history be the final judge.

Will stocks collapse if Joe Biden wins in November and Democrats control Congress?

It’s impossible to predict exactly when a big stock market decline will occur, but the trigger for a “crash” will likely come down to specific policy proposals by Biden and his colleagues, as well as some economic headwinds. Either way, it could lead to a troublesome situation. Who will be elected president in November?

Two policy proposals in particular could give Wall Street and investors reason to head for the proverbial hill. First, President Biden said in his State of the Union address in March that he wanted to quadruple the stock buyback tax to 4%. As companies repurchased their own shares, earnings per share (EPS) rose, which played a key role in boosting valuations. Quadrupling the existing stock buyback tax would make stock buybacks less attractive and would have a negative impact on profit multiples at a time when stock prices are so expensive.

Another proposal that could knock the Dow, S&P 500, and Nasdaq Composite off their respective pedestals would raise the top marginal tax rate for corporations from 21% to 28% and raise the alternative minimum tax rate for corporations from 15% to 21%. It is to raise it to . Higher corporate tax rates would not only discourage companies from buying back their own stock, but also reduce their disposable income.

However, as mentioned above, the Democratic Party’s policy proposals are not the only cause for concern. Regardless of whether Biden or Trump wins in November, there are two economic headwinds that could cause problems for Wall Street.

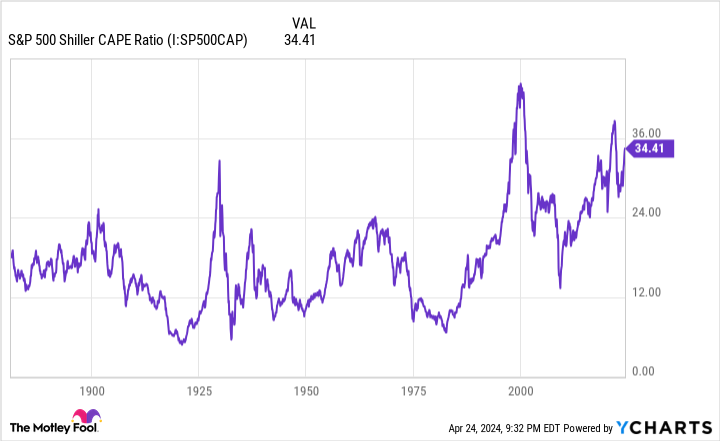

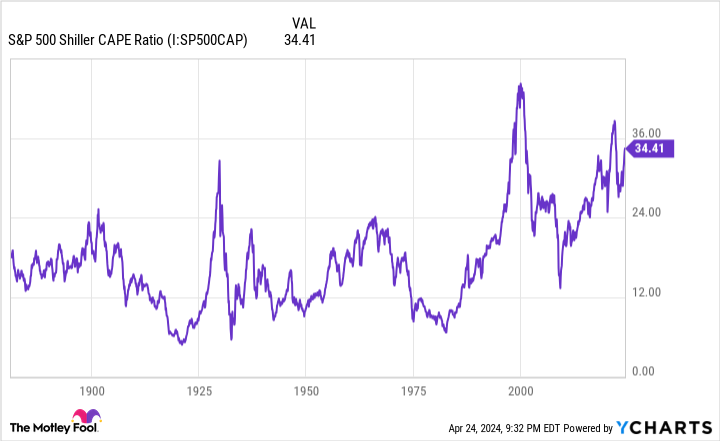

The first problem is that stock prices are historically overvalued. As of April 24, the S&P 500’s Shiller price-to-earnings ratio (also known as the economy-adjusted price-to-earnings ratio, or CAPE ratio) was well above historical levels.

While the traditional P/E ratio is a company’s stock price divided by its trailing 12-month EPS, the Shiller P/E ratio is based on the average inflation-adjusted earnings over the past 10 years. By removing single-year issues that can distort the P/E, the Shiller P/E may become a more attractive valuation tool over the long term.

The S&P 500’s Shiller P/E ratio as of April 24 was 33.67, nearly double the backtested average of 17.11 going back to 1871.

An even bigger concern is that the Shiller P/E exceeded 30 only six times in 153 years during a bull market. Following his previous five cases, the S&P 500 or Dow Jones Industrial Average continued to lose between 20% and 89% of their respective values. Extended valuations ultimately lead to large declines in stock prices.

Warning: Money Supply is officially in contract. 📉

This has only happened four times in the past 150 years.

Each time was followed by a Great Depression with double-digit unemployment rates. 😬 pic.twitter.com/j3FE532oac

— Nick Gurli (@nickgerli1) March 8, 2023

Another trigger for a potential stock market crash is the historic decline in the US money supply, M2. M2 money supply accounts for all of M1 (cash and coins in circulation, demand deposits in checking accounts), plus savings accounts, money market accounts, and certificates of deposit of less than $100,000. (CD) will be added.

Since the U.S. economy expands very steadily over long periods of time, there is usually little reason to focus on M2. However, M2 money supply peaked in March 2022 and has since declined by nearly 4.4%. This is the first time since the Great Depression that M2 has declined by at least 2% year over year.

Since 1870, M2 has declined by at least 2% year over year only five times, according to data compiled last year by Nick Ghaly, CEO of Reventure Consulting. The past four years (1878, 1893, 1921, and 1931-1933) were all periods of deflationary recession and high unemployment.

A caveat to the above is that M2 money supply expanded at the fastest rate in history during the COVID-19 pandemic. The decline we are currently seeing may simply be a regression to the mean. Nevertheless, the reduction in capital available for trading has historically been the cause of recessions in the United States.

If Democrats control Congress and the White House, the combination of policy proposals and economic headwinds could create problems for stock prices.

What history says will happen if the Democratic Party establishes a unified government

With a better understanding of the potential challenges that lie ahead if President Biden wins and Democrats take control of Congress in November, let’s take a closer look at what history has to say.

According to research conducted by CFRA Research, no political scenario dating back to 1945 has resulted in negative average annual returns. No matter how the pieces of the puzzle fall into place, patient investors will always win.

According to CFRA Research, Democrats controlled Congress and the White House for 23 years, from December 31, 1944 to December 31, 2021. During his 23 years, the average return on the benchmark S&P 500 was 10.5%. That’s slightly lower than the average annual return of 12.9% under a unified Republican administration, but still an above-average return.

Retirement Researcher went a step further and looked at the average annual return of the S&P 500 from 1926 to 2023 using different political climates. His average annual return over 36 years of this nearly century of unified Democratic government was 14.01%.

The point here is simple. The stock market tends to benefit patient shareholders in the long run, regardless of which political party is in power.

The reason stocks have outperformed all other asset classes over the past century is because they benefit from long periods of economic expansion.

On the other hand, recessions are an inevitable part of the economic cycle. Since World War II, the U.S. economy has weathered more than a dozen downturns. However, while nine of these depressions resolved within his year, none of his remaining three lasted longer than 18 months.

On the other hand, periods of economic growth often last for multiple years. After World War II, two of the expansions lasted more than 10 years. It is this long-term expansion that enables true growth in corporate profits.

Perhaps the most compelling dataset on the power of patience and perspective was provided by analysts at Bespoke Investment Group.

Last June, Bespoke calculated the length of every bull market and bear market in the S&P 500, going back to the beginning of the Great Depression in September 1929. According to the data, the average S&P 500 bear market lasted 286 calendar days, while the typical bull market lasted 286 calendar days. This 94-year period lasted 1,011 calendar days, or about 3.5 times as long.

Additionally, since September 1929, there have been 13 bull markets in the S&P 500 index, which have lasted longer than the longest bear market of any broad index.

Regardless of which party is in power, patience and perspective have a way of rewarding investors. Investors with a long-term mindset should do well if Joe Biden wins in November and Democrats take control of Congress.

Where to invest $1,000 right now

whenyour analyst team With stock tips, you can pay just to listen. After all, the newsletter they’ve been running for over a decade is Motley Fool Stock Advisor, the market has nearly tripled. *

they just made it clear what they believe Best 10 stocks Investors can buy now…

See 10 stocks

*Stock Advisor will return as of April 22, 2024

Sean Williams has no position in any stocks mentioned. The Motley Fool has no position in any stocks mentioned. The Motley Fool has a disclosure policy.

Will stock prices plummet if Joe Biden wins and Democrats control Congress? Here’s what history says about stock market returns if Democrats win.Originally published by The Motley Fool