Anya Becht

introduction

As a dividend-only focused investor, Business Development Companies have always intrigued me as an income vehicle, and while they are considered riskier, I think the current macro environment has made them an even better long-term investment.

News I say “even better” because I believe BDCs will always be attractive investments over the long term due to their business models and stable, consistent dividends — at least for those that are considered higher quality. In this article, I discuss why a high interest rate environment and other factors are changing investors’ outlook on this sector to be more positive.

Performing under uncertainty

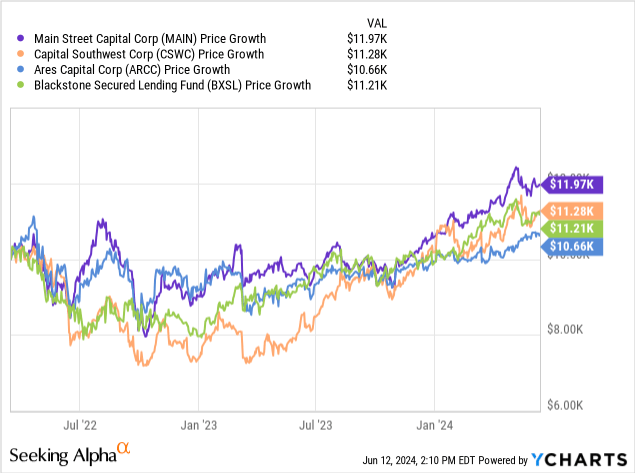

If you look at the chart below, you can see that there are several BDCs in this sector that have performed extremely well over the past two years. Since the Fed decided to raise interest rates to combat inflation starting in March 2022, several BDCs like Main Street CapitalMajor), Capital Southwest (CSWC), Ares Capital (ARCC), Blackstone Secured Lending (BXSL) has been profitable for investors.

Main Street Capital has been the best performer, growing a $10,000 investment into roughly $12,000 since the day interest rates began rising. So investors who held these four BDCs have seen gains over the last couple of years.

For comparison, this is a period in which the Fed has raised interest rates a total of 11 times and has kept them high for seven consecutive times as of this writing.

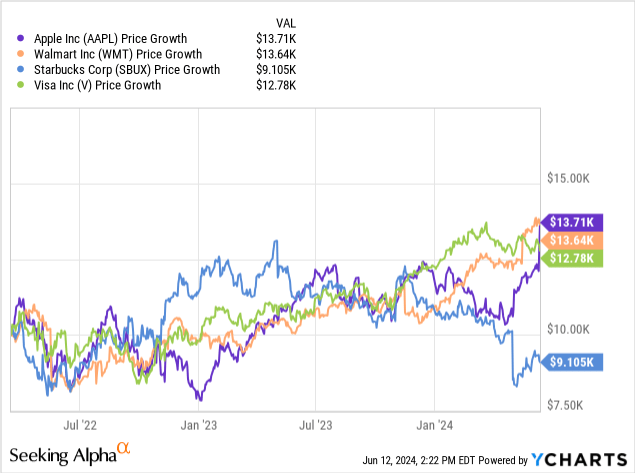

Additionally, BDCs performed better during this period compared to some of the biggest and most popular companies like Walmart (WMT), Starbucks (SBUX), Apple (AAPL), and Visa (V). If you look at the chart below, you’ll see that these four companies, on average, turned a $10,000 investment into about $12,400, compared to about $11,300 for BDCs. So, while they’re outperforming the BDCs, the difference isn’t large.

Certainly, investors have been seeking higher-yielding investments during these uncertain times. But in a high-interest rate environment, not all BDCs remain safe havens. Some BDCs have seen borrowers default on their loans, hurting their revenues and profits, as well as their stock prices.

One BDC in particular that has seen a sharp rise in accrued interest this year is FSK KKR Capital (FSK), which we covered here. FSK managed to get three companies off its accrued interest balance in the most recent quarter, but it was still significantly higher than the four BDCs mentioned above.

But banks with strong balance sheets, strong portfolio credits, and good underwriting practices will continue to perform well, and I expect that even if rates fall, the prices of these BDCs may not return to pre-rate hike levels.

One reason is that investors who flocked to the sector in search of high yields are likely to continue to invest in companies with stronger, defensive portfolios that will reward them with growing dividends in the future.

Experience of overcoming adversity

When companies go through tough times, one or two paths can lead: They will weather the rough seas, continue to perform well despite some volatility and headwinds, and emerge from the storm stronger than before. Or, alternatively, fundamentals will begin to crack due to poor portfolio quality, causing performance to stagnate. As a result, these companies may suffer long-term negative consequences.

While both scenarios would face similar headwinds, the BDC with a stronger foundation and better management team is more likely to weather some of the bumps and become a preferred lender in the long term. That’s why, when investing in companies, I like to choose companies that have been through tough times like the Global Financial Crisis, the dot-com bust and even the COVID-19 pandemic.

Banking crisis of 2023

BDCs benefited from tighter lending standards in the wake of Silicon Valley Bank’s collapse in 2023, and as a lender to small and mid-sized businesses, many companies looking for loans are likely to turn to this sector.

Many BDC executives have spoken out on the subject: ARCC’s CEO mentioned the subject on its Q2 2023 earnings call shortly after the banking crisis.

Over the past two decades, direct lenders have demonstrated their ability to provide a stable source of capital to support the growth of U.S. companies when bank and syndicated capital markets are volatile and difficult to access. More recently, this trend has accelerated, with direct lenders such as Ares stepping in to fill the void.

The CEO of FSK KKR also touched on this during the company’s Q2 2023 earnings call.

In terms of how this plays out, we expect it to probably be a long-term situation. There are new rules associated with Basel III. There are obviously concerns about liquidity and how banks manage their assets. We’ve seen this in various forms, starting with the financial crisis and continuing to now, but I think this is a tailwind for the private credit space as a whole. I think we’ll benefit from that. I think the emphasis on what we call the normal direct lending space will probably fade a little bit. This is probably a tailwind for our asset-backed finance business, but as I said, I think it’s something that will play out over several years.

Some of these benefits may be short-lived, but I suspect that increased lending regulations will mean that some banks will be less aggressive in extending loans in the long run, which will benefit the sector as a lending option in the long run.

Imagine your business offers some kind of discount or free service for a limited time. If this brings in 10,000 new customers, how many will you retain after the trial period? 20%? Half?

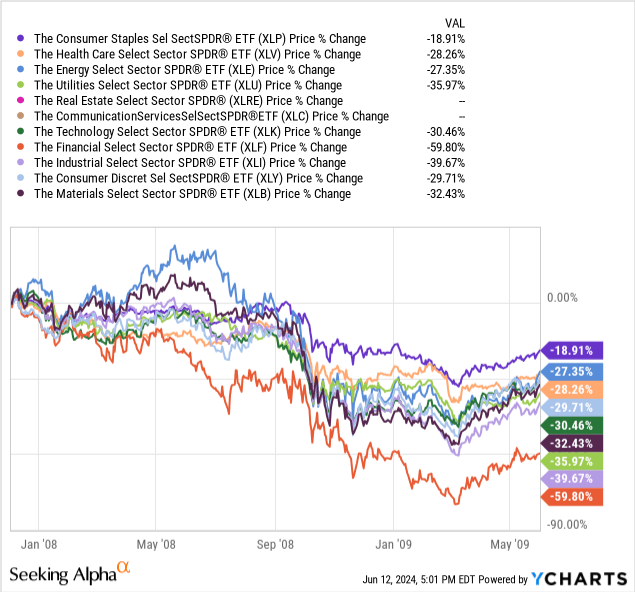

This number varies depending on the service, quality, etc., but it’s safe to say they’re able to retain some of their customers. If you look at the chart below, you can see that consumer staples, utilities, and healthcare stocks performed the best during the downturn. Meanwhile, financials, industrials, and utilities performed the worst.

Many stocks in these sectors are considered recession-proof because no matter how tough times get, consumers will always need healthcare, food, and basic necessities, since these are essential to all life.

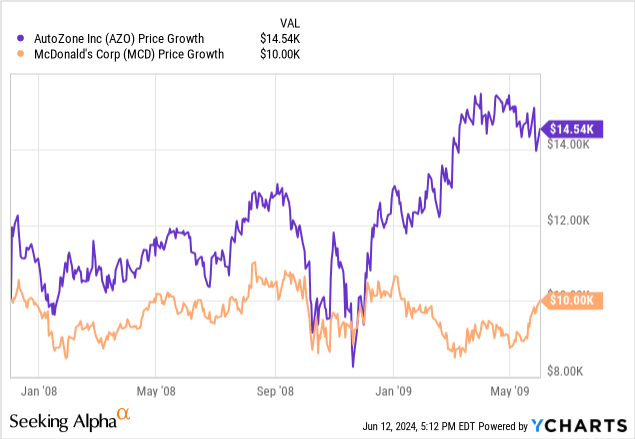

Below we look at two stocks that performed well during the 2008-2009 crisis and did not split their stocks: AutoZone (AZO) and McDonald’s (MCD). We can see that AZO increased by over $4,500 over the same period, while MCD’s stock price remained flat. Both are impressive considering many stocks fell by over 50% during the same period. This means that while investors did not always see capital appreciation, they did not lose capital either.

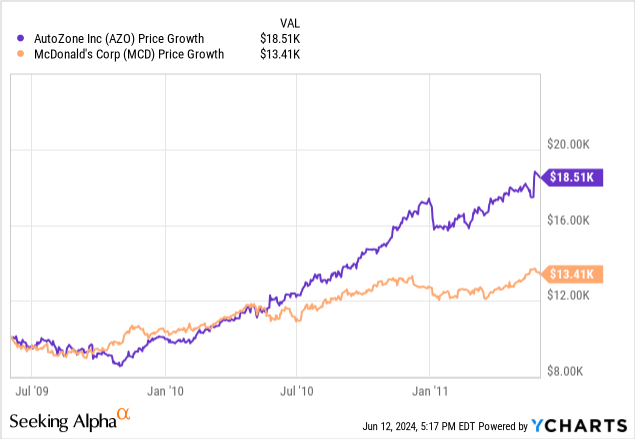

And as you can see in the chart below, two years after the global financial crisis, both stocks have continued to trend higher, even as investors shifted to other sectors. Of course, there are some caveats to this. Past performance is not a predictor of future performance.

While BDCs and companies like AZO and McDonald’s have very different business models and are in different industries, they have both performed well during uncertain times and have solidified themselves as an integral part of the economy. BDCs have performed well in a high interest rate environment, and like the other two stocks mentioned above, they are likely to continue their upward trend.

Conclusion

I believe BDCs that have outperformed as a result of superior underwriting, strong management teams, and defensive portfolios are likely to continue to outperform and see their stock prices rise.

Moreover, investors will begin to view these bonds as more than just short-term, high-yield investments — they will be viewed as long-term income streams to hold as a result of their strong fundamentals and performance during uncertain times.

And while I believe that many stocks in this sector will fall if interest rates fall, some may never revert to their historical mean. The current macro environment is favorable for these stocks, and the outlook for the sector as a whole is likely to continue to be positive in the near future.