Cathie Wood’s Ark Innovation ETF has struggled even as the U.S. stock market has soared this year, according to DataTrek Research, and the fund remains in a bid until the Federal Reserve starts cutting interest rates. It is said that there is a low possibility that they will respond.

Jessica Rabe, co-founder of DataTrek, said the ETF is a “struggling disruptor that has yet to return to the winning ways of the pandemic, even though the S&P and Nasdaq just hit new all-time highs.” “We are focusing on technological themes.” The memo was emailed Friday.

Most Read on MarketWatch

Shares of the Ark Innovation ETF ARKK, managed by Wood, the founder and chief executive of investment firm Ark Invest, have fallen more than 13% so far this year, according to FactSet data. did. In contrast, the S&P 500 SPX and the tech-heavy Nasdaq Composite COMP are both up nearly 11% year-to-date, after the indexes closed at record highs on May 15. Ta.

The Ark Innovation ETF, a proxy for U.S. speculative technology stocks, is “very volatile and its one-year performance relative to the S&P has been a roller coaster going back to its inception in 2014,” Raab said. It pointed out.

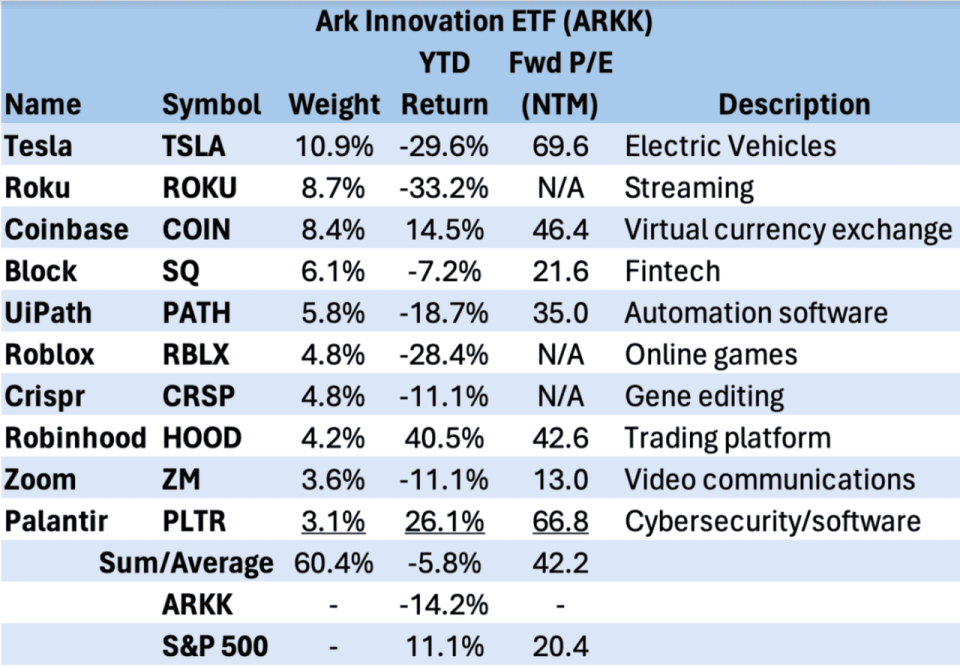

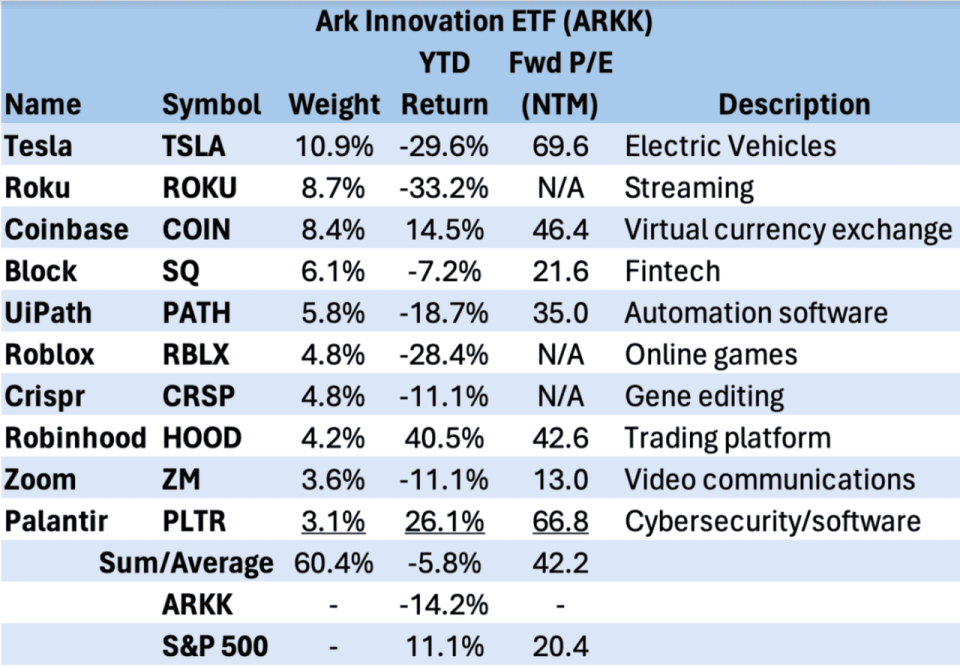

DataTrek has highlighted the ETF’s top holdings in the table below.

The ETF’s 10 largest holdings account for about 60% of its weight, and seven of them have declined this year, according to a DataTrek note. While three of the fund’s top 10 exposures (including Roku Inc., Roblox Inc. RBLX, and Crispr Therapeutics CRSP) are unprofitable, “the rest have very large trades on average in the S&P. ,” Raab said.

The S&P 500 index fell modestly Friday afternoon around 5,288 points, but the widely followed index remains on track for a fourth straight week of gains, FactSet data shows. It was shown in The Ark Innovation ETF was up 0.8% Friday afternoon, bringing its month-to-date gain to about 4.3%.

One thing the Ark Innovation ETF’s top 10 holdings have in common is that they all peaked during the coronavirus pandemic, Rabe found.

“We don’t expect ARKK’s name to be bid until the Fed starts cutting rates and yields fall sustainably to support its lofty valuations,” he said, citing the ETF’s ticker. I wrote.

“As we have said many times over the past few years, we see the Nasdaq Composite Index, or the Nasdaq 100 Index NDX, tracked by Invesco QQQ Trust Series I QQQ, as a better way to deliver on our theme of disruptive innovation. I like it,” Raab added.

Wood and a spokeswoman for her company had no immediate comment on the Ark Innovation ETF’s performance.

According to the CME FedWatch tool, many investors expect the Fed to begin lowering the benchmark rate before the end of the year, with federal funds futures pointing to the possibility of the first rate cut in September. Suggests.

Meanwhile, U.S. stocks rose this month as Treasury yields fell. As of May, the S&P 500 is up 5.1%, the Nasdaq is up 6.3% and the Dow Jones Industrial Average DJIA is up 5.6%, according to FactSet data.

In the bond market, the yield on the 10-year US Treasury note BX:TMUBMUSD10Y was trading around 4.42% as of Friday afternoon.