I made the following post twitter this week:

It’s shaping up to be another good year for the U.S. stock market (for now).

Here’s a good follow-up question about these numbers:

This is a valid concern.

Since 2020, the S&P 500 has grown by over 14% compound annually. And this isn’t just a pandemic phenomenon: Since the beginning of 2009, the S&P 500 has posted a 14.5% annualized return.

Since its bottom in early March 2009, the S&P has risen about 17% for the year.1

Trees don’t grow to the sky. Above average returns are followed by below average returns and vice versa. That’s what averages are like.

The US stock market cannot sustain this state forever, and mean reversion will eventually rear its ugly head… right?

I am confident that at some point this will happen. Markets will always be cyclical forever, because economies are cyclical and human nature is cyclical.

Peter Bernstein has an excellent chapter on the challenge of mean reversion in his classic book on risk. Against the Gods:

Mean reversion provides a philosophical foundation for many decision-making systems. And for good reason. It is highly unlikely that big things in life can become infinitely big, or small things can become infinitely small. Trees never reach the sky. When we are tempted to extrapolate past trends into the future (as we often are), we should remember Galton’s peapod. But if mean reversion follows such a consistent pattern, why is forecasting such a frustrating activity? Why can’t we all be as far-sighted as Joseph in his negotiations with Pharaoh? The simplest answer is that the forces at work in nature are not the same as the forces at work in the human mind. The accuracy of most predictions depends on human decisions, not on Mother Nature, who, despite her fickleness, is far more trustworthy than a group of humans trying to make decisions about anything.

It is not possible to monitor regression to the mean because averages can change over time, there is fluctuation around the average, and market conditions are always different.

However, looking back at the historical performance of the U.S. stock market, there are clear cycles of above-average and below-average performance.

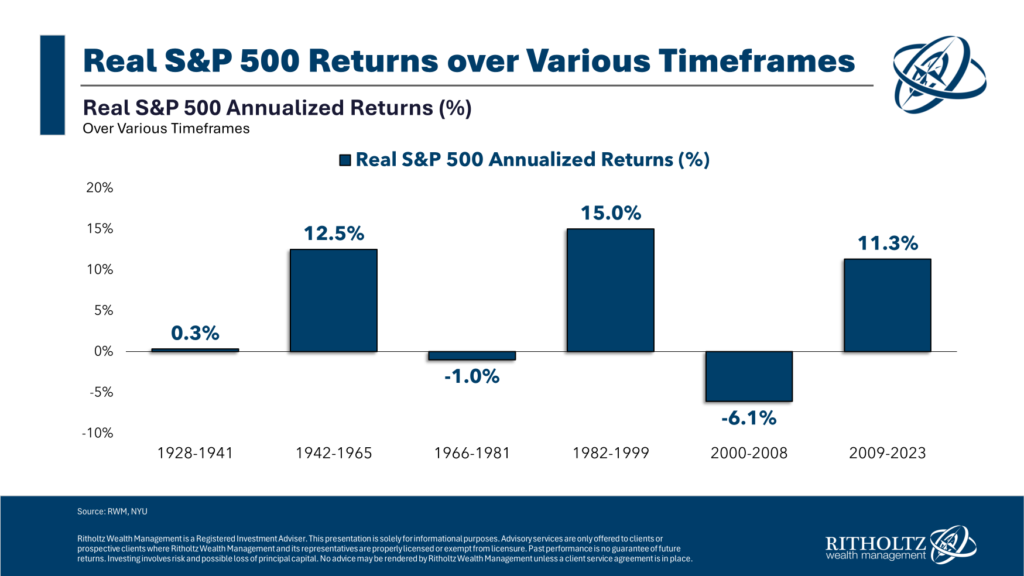

Here we use inflation-adjusted returns to look at some of the longer-term cycles going back to the late 1920s.2 About the S&P 500:

I’ve cherry-picked the start and end dates here to illustrate the point, but you’ll see that there were some horrible cycles and some great runs.

All you have to do is avoid the long down cycles and go all out during bull markets. Easy, right?

The tricky thing about investing is that no one can tell the difference between a cyclical bull market and a secular bull market in real time.

When the Black Monday crash of 1987 happened, investors assumed we were heading for a recession. No one expected the bull market to continue for another 12 years or so.

The incredible rise of the 1940s began during World War II. Between 1942 and 1965, the U.S. stock market saw 13 double-digit declines, including four bear markets with losses of more than 20%.

The current bull market has seen eight double-digit corrections, two of which were bear markets, resulting in declines of -34% and -25%, respectively.

Even in the worst times, there are moments like that.

During the terrible inflation of the 1970s, the S&P 500 rose a total of more than 260% from 1975-1980.

Between the dot-com bubble burst and the global financial crisis, there was a respectable total return of 81% from 2003 to 2007 (12.7% annualized).

Despite the dire economic environment of the 1930s, the U.S. stock market rose 140% between 1933 and 1938, only to plummet the following year when war began.

It is much easier to define a secular market after the fact than it is to define it in the moment.

Returns will slow down eventually. I don’t know when or why. That’s why I diversify.

References:

Long-term recency bias

1Since its bottom, the Nasdaq 100 has risen an astounding 22.2% for the year.

2I used real rates of return here mainly because in the 1970s, nominal rates of return were decent but inflation was much higher.

This content, including any security-related opinions or information, is for informational purposes only and should not be relied upon in any way as professional advice or a recommendation of any practice, product or service. There is no guarantee or assurance that the views expressed herein will apply to any particular facts or circumstances and they should not be relied upon in any way. Please consult your own advisors regarding legal, business, tax and other related matters regarding investments.

Comments in this “Post” (including any associated blogs, podcasts, videos and social media) reflect the personal opinions, viewpoints and analysis of the Ritholtz Wealth Management employees providing the comments and should not be considered as the views of Ritholtz Wealth Management LLC or any of its affiliates, nor as a description of the advisory services provided by Ritholtz Wealth Management or the performance returns of any client of Ritholtz Wealth Management Investments.

References to securities or digital assets or performance data are for illustrative purposes only and do not constitute an investment recommendation or the provision of investment advisory services. Charts and graphs provided are for informational purposes only and should not be relied upon when making an investment decision. Past performance is not indicative of future results. Content speaks only as of the date indicated. Projections, estimates, forecasts, goals, prospects and/or opinions expressed in these materials are subject to change without notice and may differ from or be contrary to opinions expressed by others.

Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payments from various entities for advertising in affiliated podcasts, blogs and emails. The inclusion of such advertisements does not constitute or imply an endorsement, sponsorship, recommendation or affiliation of those advertisements by the content creator or Ritholtz Wealth Management or its employees. Investing in securities involves risk of loss. For additional advertising disclaimers, please see: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosure here.