Markets started the day again with uncertainty and lack of direction as investors digested Netflix’s gains and crypto traders braced for Bitcoin’s halving.

Netflix Inc. reported earnings after the bell on Thursday, with investment coming as the tech and media giant reported strong subscriber numbers but the company gave a weaker-than-expected outlook for second-quarter profits. The family became pessimistic. Netflix fell about 8% Friday morning, dragging down the tech-heavy Nasdaq.

Netflix was one of the first big tech companies to report earnings, but it stumbled with a weak outlook and hasn’t been able to provide investors with the boost it needs to shake off the recent market pullback.

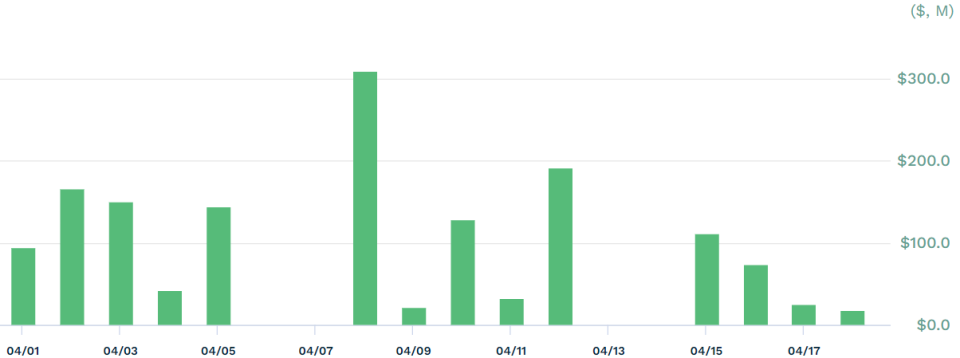

QQQ, Invesco QQQ Trust The Nasdaq-tracked stock fell on Friday, dropping 1%. Outflows to QQQ exceeded $425 million on Thursday, according to data from etf.com.

QQQ April flow

Source: etf.com

XLK, Technology Select Sector SPDR Fund Friday was a similar struggle. The fund doesn’t own Netflix, but investors are taking a broader view of the tech sector, weighing the potential for disappointing tech company earnings. Next week, investors will focus on Meta, Alphabet (Google), and Microsoft.

spy, SPDR S&P 500 ETF Trust It was Red Friday morning, when the S&P 500 Index was volatile. DIA, SPDR Dow Jones Industrial Average ETF Trust It was the only index on Green Friday as investors overlooked rising tensions between Iran and Israel.

Cryptocurrency ETFs rise as Bitcoin halving approaches

And crypto ETFs gained momentum on Friday. The rally comes as investors await Bitcoin’s long-anticipated halving. BTOP, Bitcoin and Ether equal weight strategy ETF in bits It was one of Friday’s top gainers, according to data from etf.com.of GraniteShares 2x Long COIN Daily ETF (CONL)and the First Trust Skybridge Crypto Industry and Digital Economy ETF (CRPT) It was also in the green.

Simply put, this event is when Bitcoin miners receive half the reward for creating new Bitcoins. Halvings occur every four years and maintain Bitcoin’s scarcity. Historically, these events precede Bitcoin price increases. It is unclear exactly when the halving will occur, but traders predict it could occur between Friday and Sunday morning.

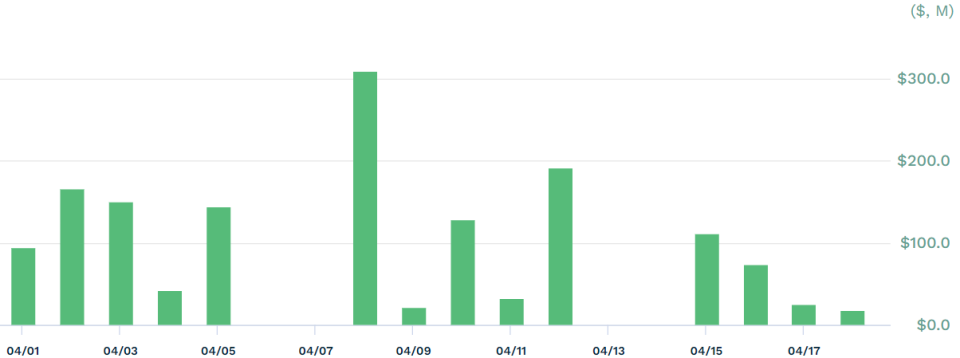

IBIT, the largest spot Bitcoin ETF, is iShares Bitcoin Trust It rose nearly 2% ahead of its half-life. Inflows into ETFs have been increasing since early April, topping $1 billion in the past two weeks, according to data from etf.com.

IBIT April flow

Source: etf.com

Many investors are eyeing the halving as a potential buying opportunity, hoping for a potential spike in Bitcoin prices. However, it is unclear whether this year’s halving will have the same effect since the launch of the Spot Bitcoin ETF, which has already accelerated the rise in Bitcoin prices.

Permalink | © Copyright 2024 etf.com.All rights reserved