The excitement of investing in a company that could reverse fortunes is a big draw for some speculators, and even companies with no revenues, no profits, and a record of failure can find investors. But as Peter Lynch said: Winning on Wall Street“Long-term investments rarely pay off,” he said. Unprofitable companies have yet to prove themselves by turning a profit, and they may eventually see outside capital inflows dry up.

If this isn’t your style, but you like companies that generate revenue and make a profit, you might be interested in companies like these: Brimstone Investments (JSE:BRT). This isn’t necessarily an indication that it’s undervalued, but the profitability of the business is good enough to justify some valuation, especially if it’s growing.

Check out our latest analysis for Brimstone Investment

How fast is Brimstone Investment growing?

If a company can continue to grow earnings per share (EPS) over the long term, the share price should eventually follow. Therefore, many investors like to buy shares in companies with growing EPS. Amazingly, Brimstone Investment has grown its EPS at 17% per year over the past three years. If the company can maintain this kind of growth, shareholders should be happy.

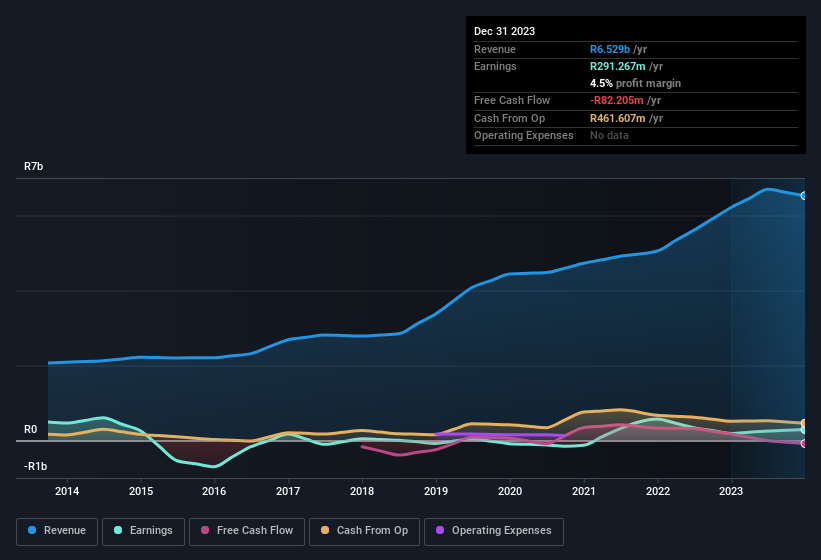

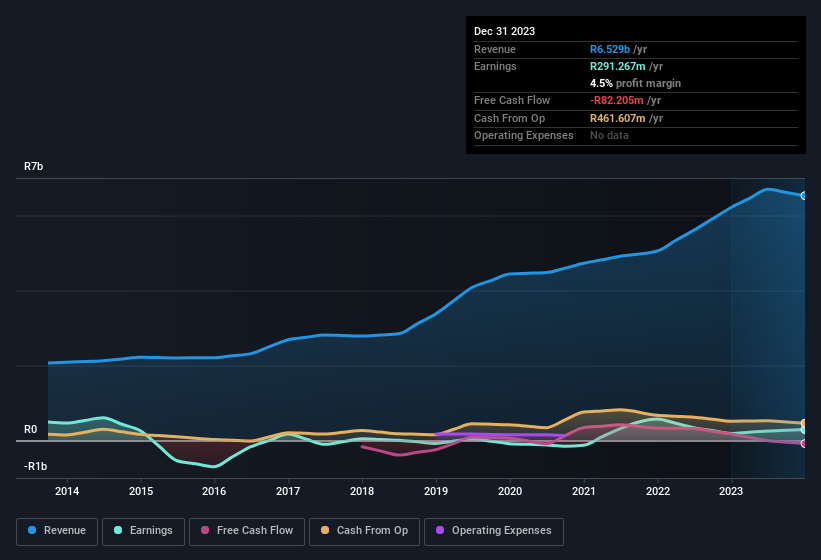

Careful consideration of revenue growth and earnings before interest and tax (EBIT) margins can help us derive a view on the sustainability of the recent profit growth. While Brimstone Investment’s EBIT margins were little changed over the last year, the company should be pleased to report that revenue grew by 5.1% to R6.5b in the period, which is a real positive.

You can see the company’s revenue and earnings growth trend in the chart below, or just click on the chart to see the actual numbers.

Brimstone Investments is not a huge company, with a market capitalization of R1.2b, so you should always check its cash and debt. in front I’m just too excited about the prospect.

Are Brimstone Investment insiders aligned with all shareholders?

There is no smoke without fire, as the saying goes. For investors, insider buying is often the smoke that indicates which stocks will ignite the market. This is because insider buying often indicates that those closest to the company are confident that the stock price will perform well. However, insiders can also be wrong, and you don’t know the exact thinking behind the acquisition.

Over the course of twelve months insiders have sold R42k worth of Brimstone Investments shares, while executive chairman Frederick Robertson paid R163k for shares at a price of about R5.11 per share. Overall, this is a good haul.

Along with the insider buying, the good news for Brimstone Investment bulls is that insiders (collectively) have a significant investment in the stock. In fact, their holdings are worth R290m. This significant investment should help increase the long-term value of the business. Their holdings represent over 23% of the company, so they’re clearly involved.

Is Brimstone Investment worthy of being on your watch list?

For growth investors, Brimstone Investment’s earnings growth rate is a light in the night. On top of that, when it comes to the company’s shares, insiders own a significant portion, with one of them adding to their holdings. With that in mind, this is one stock worth keeping an eye on. Don’t forget that there may still be risks. For example, we’ve identified: 4 warning signs for Brimstone Investments (Number 1 should not be ignored) You need to know.

The good news is that Brimstone Investment is not the only stock that has received insider buying. Below is a list of South African small cap undervalued companies that have received insider buying in the past three months.

Please note that the insider transactions discussed in this article are reportable transactions in the relevant jurisdictions.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com