See below for 07/13 update. This post was originally published on July 10th.

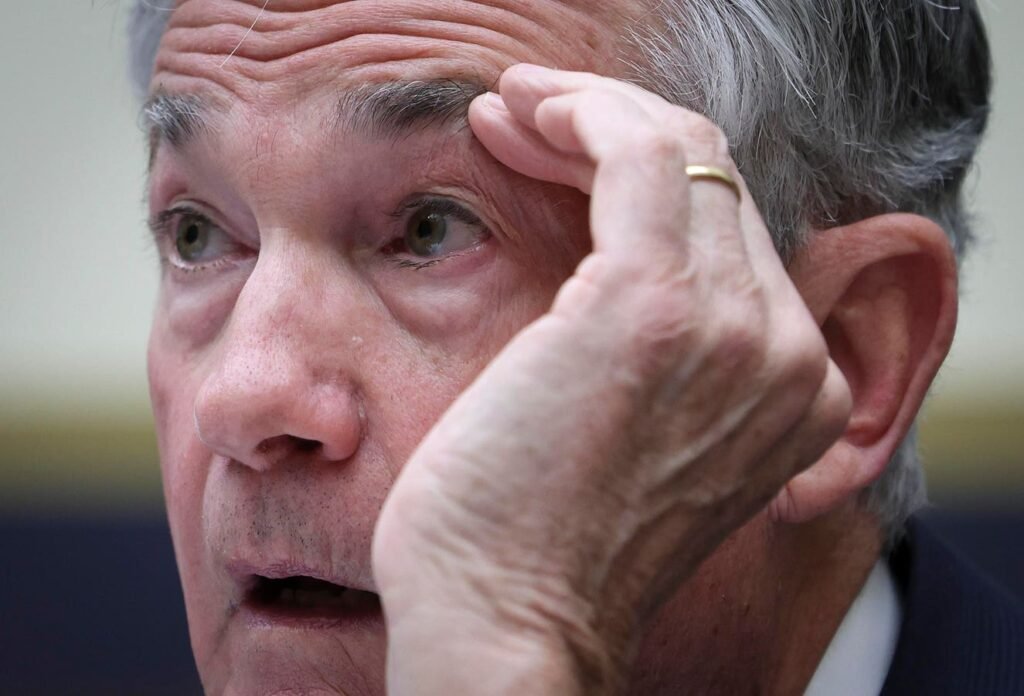

Stocks are soaring after Federal Reserve Chairman Jerome Powell stoked hopes of a rate cut in September shortly after he issued a “significant” warning.

Subscribe now Crypto and Blockchain Advisor to Forbes And in the aftermath of Bitcoin’s halving, “discover the blockchain blockbuster that’s poised to deliver gains of over 1,000%.”

Even as renewed worries about a debt spiral have unsettled traders, the S&P 500 and Nasdaq have hit fresh all-time highs, following the Dow’s record high in May.

Now, with uncertainty hanging over the White House, one analyst says warning lights are suddenly flashing red in the stock market.

Register now for free Encryption Code—A daily 5-minute newsletter for traders, investors and crypto enthusiasts. Stay up to date and get an edge on the Bitcoin and cryptocurrency market bull market.

Federal Reserve Chairman Jerome Powell helped bolster the S&P 500 index, … [+]

Barry Bannister, managing director and chief equity strategist at Stifel, said the recent sell-off in bitcoin and cryptocurrencies has wiped $500 billion from the market in just over a month and could trigger an “imminent S&P 500 summer correction.” Market Watch.

Update 7/13: Stocks rebounded on Friday, with the Dow Jones Industrial Average closing above 40,000 points for the second time in history as second-quarter earnings season gets underway. Wall Street giants JPMorgan, Citigroup and Wells Fargo all reported mixed results and ended the session lower.

Traders are hoping that companies outside of Big Tech can translate slowing inflation and an improving economic environment into earnings growth in the coming weeks.

“It’s going to be important to see a turning point in earnings growth from the market as a whole, and we’ll be watching that closely over the next few weeks,” said Zachary Hill, head of portfolio management at Horizon Investments in Charlotte, North Carolina. Reuters.

Update July 11: The S&P 500 and related indexes fell sharply on Thursday, posting their worst performance since late April, as shares of big technology companies including Nvidia, Apple and Tesla fell back after recent gains.

The drop came after the latest inflation data stoked expectations that the Federal Reserve will cut interest rates in September. Interest rate futures now show traders see a more than 90% chance that the Fed will cut rates by its September meeting, up from about 74% on Wednesday, according to CME Group’s FedWatch.

“Clearly, the continued downward trend in headline inflation will support the case for a Fed rate cut in the fourth quarter of this year, as widely expected by the market,” Adrian Lee, managing director at corporate finance adviser Centrus, said in emailed comments.

“However, the exact timing of a rate cut remains unclear and may ultimately depend on how the Fed balances the risks of inflation and the perceived risks of higher interest rates against the continued strength of the U.S. economy. Attention will be focused on any further indications of the direction ahead ahead of the rate decision later this month. The next nonfarm payrolls and unemployment rate figures are not due until early August.”

Bannister pointed to the correlation between Bitcoin and the stock market, particularly the tech-heavy Nasdaq in recent years.

“It’s the Fed’s cheap liquidity that drives the price of bitcoin,” Bannister said. “Every dovish shift in the last 13 years has been indicative of a sharp rise in bitcoin, which is a non-interest-paying asset that thrives on low interest rates and liquidity” — much like the stock market.

In his second day of congressional testimony this week, Fed Chairman Jerome Powell said he has “some confidence” that inflation is falling but is not ready to declare the battle against inflation won.

“Bitcoin has been a great leading indicator for the Nasdaq 100 for many years,” Jonathan Krinsky, chief market technologist at BTIG, wrote in a note ahead of this week’s rallies for the S&P 500, Nasdaq and Dow.

Register now Encryption Code— A free daily newsletter for anyone interested in cryptocurrencies

Bitcoin prices have fallen sharply in recent weeks, raising concerns that the stock market will follow suit. … [+]

For now, the momentum is with stocks as traders continue to bet on a Federal Reserve interest rate cut.

“Increasing confidence in a U.S. rate cut kept the market upbeat and led to broad-based stock gains,” Dan Coatsworth, investment analyst at brokerage AJ Bell, said in emailed comments.