(Bloomberg) — Some of the world’s biggest asset managers are looking for the next wave of artificial intelligence winners beyond the United States.

Most Read Articles on Bloomberg

Global excitement about AI caused Nvidia’s stock to triple in less than a year, and the U.S. chipmaker’s main stock index rose 50%. Investors are turning to emerging markets for better value and returns. Larger option pool.

Goldman Sachs Group Inc.’s asset management unit said it is specifically looking for stakes in manufacturers of AI supply chain components such as cooling systems and power supplies. While JPMorgan Asset Management supports traditional electronics manufacturers that are transforming into AI leaders, Morgan Stanley investment managers believe that AI will reshape business models in non-tech sectors. are betting on companies that are

“We see AI as a driver of growth in emerging markets,” said Gitania Kandari, deputy chief investment officer at Morgan Stanley Investment Management. “Up until now, we have invested in companies that directly benefit from AI, such as semiconductors, but going forward it will be important to look for companies in a variety of industries that are implementing AI to improve profits.”

AI stocks have already led a $1.9 trillion rally in emerging markets this year, with Taiwanese and South Korean semiconductor companies such as Taiwan Semiconductor Manufacturing and SK Hynix leading the way, according to data compiled by Bloomberg. It accounts for 90% of the total.

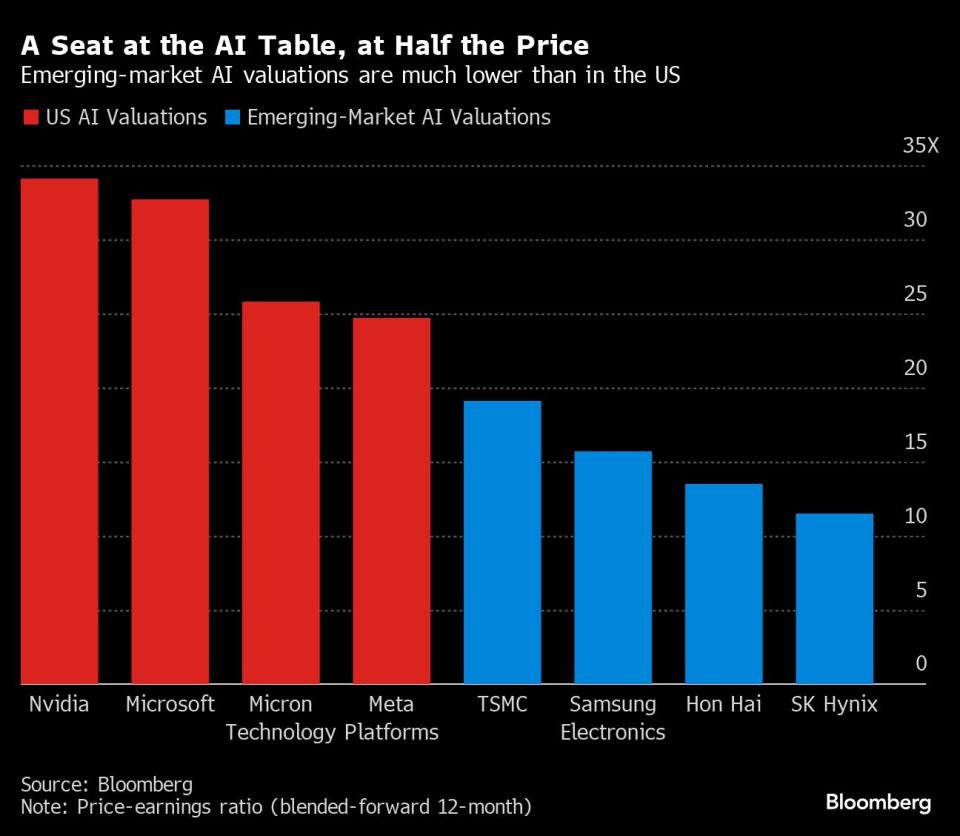

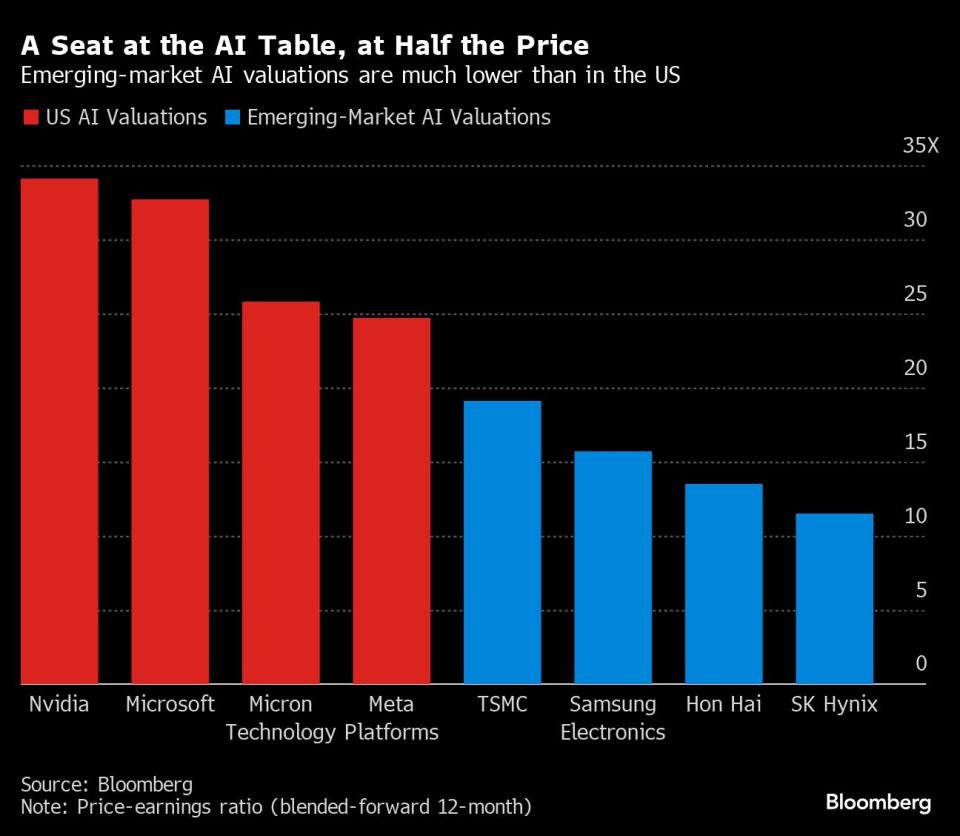

Despite this rise, most emerging market AI stocks still offer significantly better value than their U.S. peers. Nvidia’s stock trades at 35 times forward earnings, compared to the typical valuations of Asia’s AI giants at 12 to 19 times.

Faster growth is also expected in developing markets. Analysts expect profits for emerging market technology companies overall to rise 61%, compared with a 20% rise for their U.S. peers, according to data compiled by Bloomberg.

So far, the stars of the show have been companies that were already technology leaders before the AI gathering, such as TSMC and Hon Hai Precision Industries.

Like both companies, chipmaker MediaTek participates in JPMorgan’s single-country fund that invests in Taiwanese stocks, outperforming 96% of its 1,400-plus peers. The three stocks are also among the top 10 holdings in the iShare MSCI Emerging Markets Foreign ETF, which has doubled in value over the past five months.

“It’s also very possible that tech companies that have traditionally been suppliers to major corporations will emerge as major players themselves,” said Anuj Arora, head of emerging markets and Asia-Pacific equities at JPMorgan Asset Management. said. “Early adaptation of this technology means these companies are far ahead of their competitors in taking advantage of new advances.”

Still, word is spreading and more investors are pouring money into it.

For example, South Korea’s Hanmi Semiconductor, which is majority owned by billionaire Kwak Dong-shin’s family, has soared about 120% this year, making it the highest gainer among MSCI Emerging Markets Index constituents. The proportion of foreign shareholders has increased in recent weeks, according to data compiled by Bloomberg.

In Vietnam, IT services provider FPT Corp. has soared nearly 20% this year, making the Ashmore Emerging Markets Frontier Equity Fund the best performer among actively managed emerging market funds in the United States.

Among exchange traded funds (ETFs) focused on emerging markets, more than half of this year’s inflows have gone to the iShares MSCI Emerging Markets ETF (excluding China), which ranks among its top holdings, according to data compiled by Bloomberg. The 10 companies include companies that are investing in AI.

Elsewhere, established companies have announced their move to AI, attracting new investor interest.

Saudi Arabia is becoming a hotbed for Chinese AI ventures, including cloud partnerships with Alibaba Group Holding and Saudi Telecom.

India’s Reliance Industries, the oil giant run by billionaire Mukesh Ambani, has developed a chatGPT-style model that supports 22 Indian languages. The company is also involved in the digital transformation of this country of 1.4 billion people.

“I would like to point out the potential ‘national champion’ mentality that is developing around AI in some markets,” said Luke Bars, global head of fundamental equities client portfolio management at Goldman Sachs. said. “Countries are focusing on developing their own companies that can be future leaders.”

Trading is not without risk.

Emerging markets are closely tied to the United States, so a decline in AI could have ripple effects around the world. Or, if the stock market gains more ground, other sectors could catch up and AI names could fall behind.

Still, investors are increasingly finding emerging-market alternatives to overstretched U.S. tech stocks, Morgan Stanley’s Kandari said.

“AI is considered an underappreciated future driver in emerging markets,” she says. “There are a lot of low hanging fruit out there.”

what to see

-

In Brazil, March inflation data will provide clues as to whether the central bank can tone down its hawkish message, according to Bloomberg Economics.

-

In Argentina, inflation probably slowed for the third month in a row in March.

-

Mexico’s headline inflation rate is likely to rise in March, driven mostly by increases in non-core food and energy prices.

-

The central banks of the Philippines, Thailand, and South Korea are scheduled to announce their interest rate decisions.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP