(Bloomberg) – Wall Street’s most powerful trading desks, from JPMorgan Chase & Co. to Citigroup Inc., are warning investors that they should brace for the possibility that the lull in the markets could be shattered.

Most Read Articles on Bloomberg

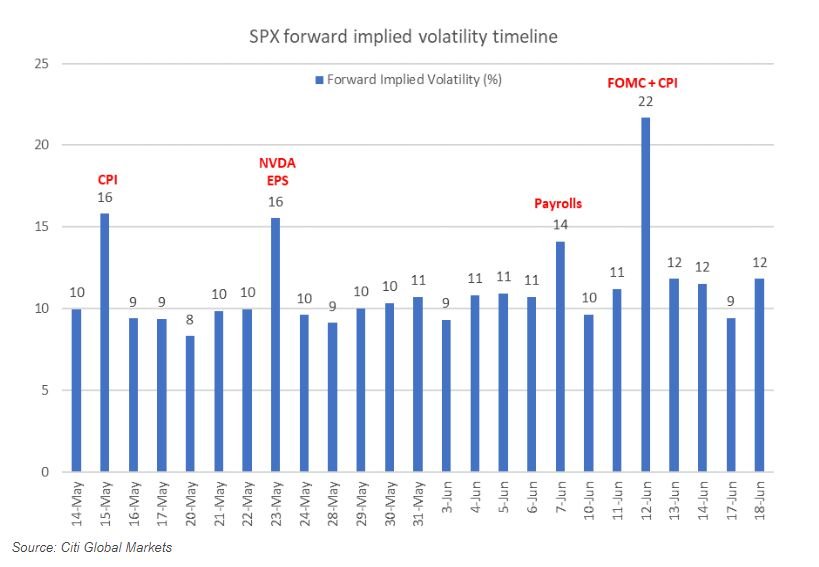

Andrew Tyler, JPMorgan’s head of U.S. market intelligence, said the options market will continue to move after Wednesday’s consumer price report, with the S&P 500 index moving 1 in either direction based on that day’s at-the-money straddle prices. It is expected that the stock will move by %. Chase trading desk. According to Stuart Kaiser, head of U.S. equity trading strategy at Citigroup, on May 23, the day after Nvidia announced its latest financial results, the market as a whole was bracing for a move centered on CPI that was in line with expectations. It is said that there is

Traders are watching the CPI report for a signal on how much the Federal Reserve is likely to cut interest rates this year. That said, what parts of CPI traders focus on and how they bet in different scenarios is what makes the difference in how much stock benchmarks move, according to Tyler. Thing.

“The primary risk is an increase in CPI,” Tyler and his team wrote in a note to clients on Monday. For example, if the month-over-month core CPI is above 0.4%, the S&P 500 index will decline between 1.75% and 2.5% as investors find refuge in commodity markets, spurring a decline across all risk assets. Tyler says it’s likely that the

However, if core CPI stays between 0.3% and 0.35% month-on-month (close to JPMorgan and consensus expectations), the S&P 500 result could range from a 0.5% decline, depending on whether rent inflation remains high. It’s in the range of 1% increase, Tyler added. Consecutive declines in core month-on-month results, especially if the number is below 0.2%, will be “interpreted positively by the market,” reviving bets on a June rate cut and even potentially sending the S&P 500 higher. be. It increased by 2% to 2.5%, he added.

As overall market volatility has subsided, there have been large fluctuations in CPI reporting. The VIX index, which measures S&P volatility, is near its lowest point this year, while the volatility of VIX options, used to protect against large market declines, fell to a nine-year low last week.

Despite employers cutting back on hiring in April, these implied moves represent a bigger swing than expected after the government’s next jobs report on June 7, according to Citigroup. This suggests that the labor market, which got off to a strong start this year, is cooling.

“Inflation has been the No. 1 event for traders over the past two years and continues to be so,” Citigroup’s Kaiser said by phone. “Despite the recent payroll data debacle, investors will generally be happy with any print showing that more than 150,000 jobs were created in a given month, because it remains That reflects a strong labor market. If job growth falls below that, the market will start to focus on job growth rather than inflation.”

Overall, lower volatility and lower put premiums have made broad hedging of the stock market more attractive, and we saw buying in VIX call spreads last week and Monday.

“The rise in interest rates that has pushed up SPX forwards is driving up call premiums relative to puts,” said Tanvir Sandhu, chief global derivatives strategist at Bloomberg Intelligence. “This made it easier to enter a collar strategy of selling calls and buying puts. His lower SPX skew, near its lowest in the past 10 years, also reduced the cost of this strategy.”

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP