Bitcoin traders are optimistic and believe bulls still have the power to push the price above $72,000 and towards all-time highs. Expectations for further developments are mainly driven by massive inflows into spot Bitcoin exchange-traded funds (ETFs), but Capriole Investments founder Charles Edwards points out several factors that could limit the current uptrend to $100,000.

Here’s why Bitcoin is still trading below $100,000

In a post by X, Edwards said Said A confluence of factors is holding back gains, but most of it has to do with a battle between new institutional money and a wave of selling by long-time holders.

Nearly six months after the U.S. Securities and Exchange Commission (SEC) approved the first spot Bitcoin ETF, billions of dollars continue to flow into these derivative products.

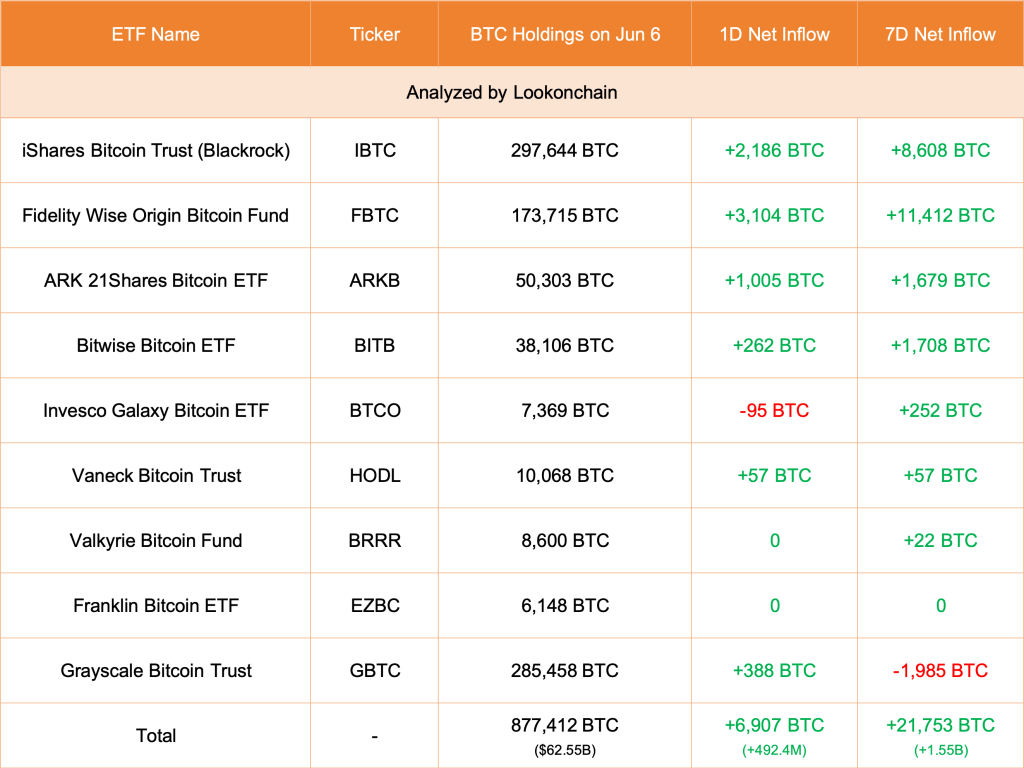

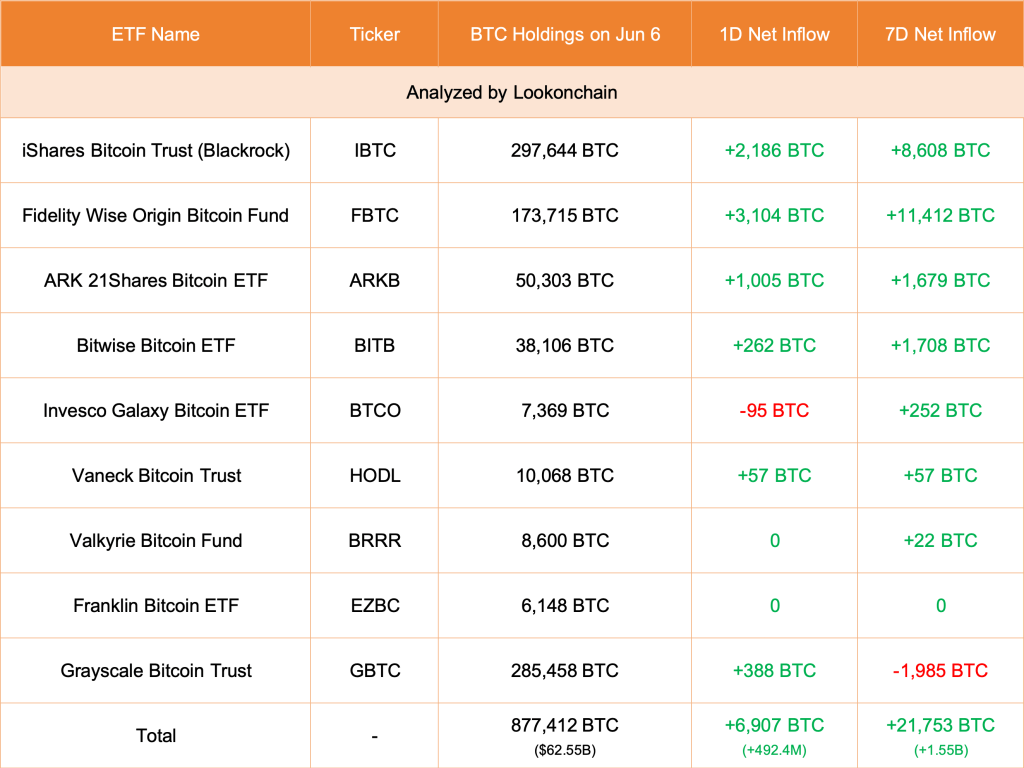

According to Lookonchain, all nine US spot BTC ETF issuers added 6,907 BTC on June 6, bringing its value to over $492 million. Fidelity added 3,104 BTC, while BlackRock bought 2,186 BTC.

Pleasingly, following the May 20 rally, institutional investors have been increasing their purchases of BTC via spot ETFs.

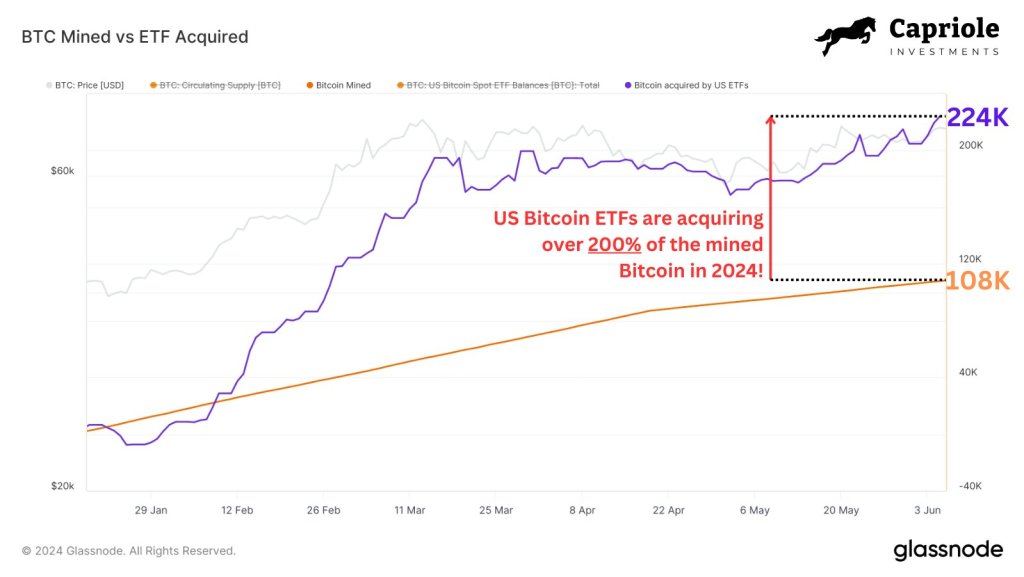

Edwards noted that over the past six months or so, U.S. spot Bitcoin ETF issuers have been aggressively buying into the fund, so far buying 200% of the BTC mined since its debut in January.

This means that the institutional investment flowing into Bitcoin has been steady and impressive. Following this development, BTC price has been on an upward trend, surpassing its 2021 high and hitting a new all-time high in March 2024.

While the upward trend is clear, the pace of expansion has been disappointing. Edwards noted that long-term holders are increasingly selling aggressively. Their share of the total supply has fallen to 54%, down from a peak of 57% in December 2023, shedding 630,000 BTC in the process. This figure far exceeds the combined holdings of all BTC accumulated by U.S. spot Bitcoin ETF issuers.

Spot Bitcoin ETF Inflows, USD Liquidity, and Long-Term Holder Behavior are Key

During this waiting period, the founder believes Bitcoin can still break through local resistance and rise to $100,000. For this level to be tested, institutional demand for BTC would need to surge and exceed $1 billion in daily purchases.

Additionally, long-term holders should delay sales to reduce supply, which, if it happens amid a growing U.S. M2 money supply, could see the coin perform better than expected and break out of the current range.

Featured image from DALLE, chart from TradingView