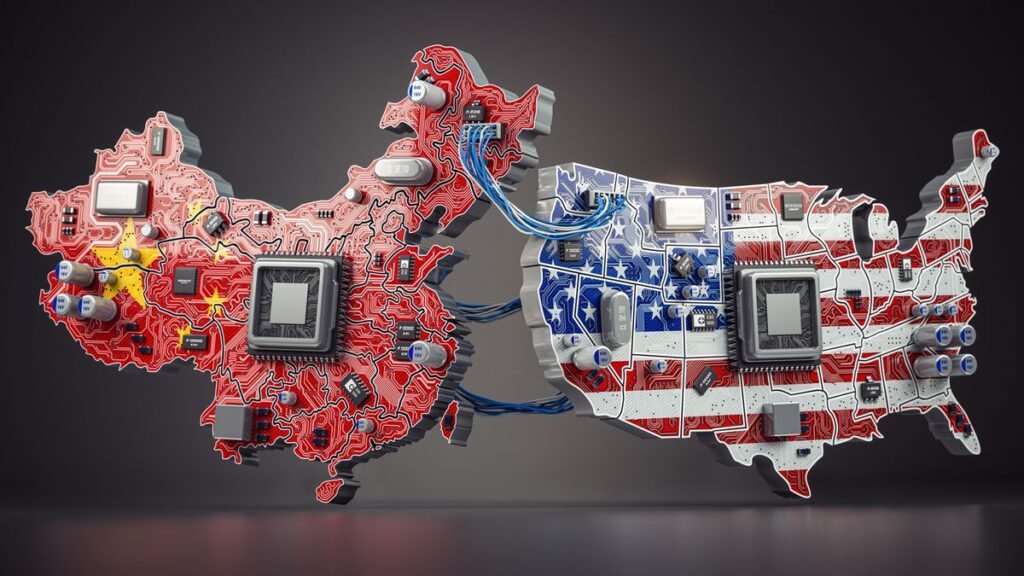

According to Bloomberg, the US government is moving ahead with plans to restrict investment by US individuals and companies in China, targeting key sectors such as AI, semiconductors and quantum computing. Reuters reports that these restrictions stem from an executive order issued by President Joe Biden in August and are aimed at preventing US expertise from helping China advance its technology. The Treasury Department aims to finalize these rules by the end of the year and is accepting public comments until August 4th.

The proposed foreign investment restrictions specifically target investments in AI, semiconductors, and quantum computing, technologies that are critical to future military, intelligence, mass surveillance, and cyberwarfare capabilities and could pose risks to the U.S. Meanwhile, they aim to curb U.S. investments that could help China develop advanced technologies, gain a competitive edge in global markets, and become more competitive against the U.S.

These measures are part of a broader strategy to limit China’s access to U.S. technology and know-how, but there are some exceptions, such as transactions that serve the U.S. national interest or involve publicly traded securities.

The proposed rules would affect private equity, venture capital funds, and investments by U.S. limited partners in foreign funds and convertible debt. The planned restrictions cover a variety of transaction types, including equity acquisitions, debt financing convertible into equity, greenfield investments, joint ventures, and certain limited partner investments in non-U.S. pooled funds.

These rules cover areas such as AI, semiconductors, quantum information technology, and AI systems. Initially, the regulations will focus on China, Macau, and Hong Kong, but may be expanded to other regions. U.S. companies investing in these regions will need to conduct increased due diligence to comply with the new rules.

The new restrictions are consistent with existing restrictions on exports of advanced technology to China and strengthen the U.S. strategy to limit China’s military modernization efforts. Those who violate the rules could face severe penalties, including criminal and civil prosecution, and may have their investments cancelled. Certain transactions may be exempt, including publicly traded companies, fund investments of certain sizes, and full ownership acquisitions.

The United States has been consulting with its allies on these investment restrictions to ensure that the new restrictions are effective and to ensure a coordinated approach to limiting Chinese access to U.S. technology and capital. As a result, the European Commission and the United Kingdom are also considering measures to address similar foreign investment.