Ore Media

Cloud Computing Background

As momentum continues to grow around AI unleashed in 2023, one thing we’ve learned is that cloud infrastructure is a critical component to the growth of AI.), Cloud Computing is:

“It provides computing services – servers, storage, databases, networks, software, analytics and intelligence – delivered over the Internet (the “cloud”) to enable faster innovation, flexible resources and economies of scale.”

The benefits that cloud computing brings to businesses include cost savings, on-demand access to computing power, economies of scale, and the performance, security, and disaster recovery that come with a data center network equipped with cutting-edge hardware. Cloud computing has a bright growth outlook, projected to grow 16.5% annually through 2032.[1]So how can investors get exposure to companies focused on this space? The answer isn’t as clear-cut as you might think.

Companies involved in cloud computing can be divided into two categories: There are companies that have most of their revenue tied to cloud-related services, which we call “pure plays.” Equinix, Inc. (EQIX) (cloud data centers) and Arista Networks (ANET) (cloud networking software) are examples of such pure plays, as they have 100% of their revenue tied to cloud computing.

The other category is large technology-based companies that have cloud-related product lines whose combined revenues account for less than 50% of their total revenues. For example, cloud computing services account for about 38% and 16% of Microsoft’s and Amazon’s (AMZN) revenues, respectively.

When evaluating an ETF’s holdings, it is important to distinguish between pure-play companies and large, diversified technology companies. Looking across product lines in the S&P 500, cloud computing makes up just under 5% of the overall index. However, if exposure is measured by a company’s primary line of business, the index weighting is less than 1%. This indicates that much of the exposure to cloud computing is held as a secondary or tertiary line of business for larger companies, with a relatively small weighting allocated to pure-play cloud computing companies.

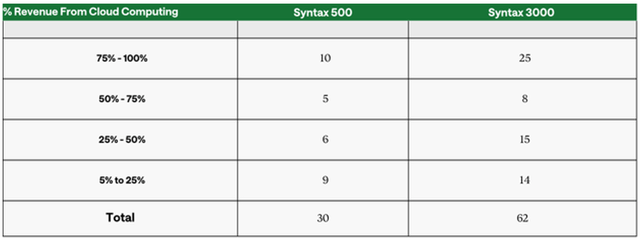

This fact makes it difficult to build a diversified cloud computing portfolio that focuses only on companies that specialize in cloud computing. To illustrate this point, Figure 1 breaks down the Syntax 500 (largest U.S. companies) and Syntax 3000 (the overall U.S. market) companies by the percentage of their revenue that is attributable to cloud computing.

Figure 1: Distribution of Cloud Computing Revenue (%) in the Syntax 500 and Syntax 3000 Universes

The number of companies is as of March 31, 2024. (Source: Syntax Data)

The result will be:

- Of the 30 companies in the Syntax 500 that have some involvement in cloud computing, only a third have more than 75% of their revenues tied to the cloud, while in the Syntax 3000 the figure is around 40%.

- In both verticals, roughly half of the companies derive the majority of their revenue from cloud computing, with the other half of their revenue unrelated to cloud. Expanding the vertical from Syntax 500 to Syntax 3000 nearly doubles the number of companies involved in some way with cloud computing.

- Expanding the scope from Syntax 500 to Syntax 3000 nearly doubles the number of companies involved in cloud computing in some way.

What this analysis tells us is that there are only a limited number of pure play companies to choose from, and if you want exposure to the various components of cloud computing, you will need to invest in both pure play companies and large diversified companies.

Cloud Computing ETF Market Analysis

What this analysis tells us is that there are only a limited number of pure play companies to choose from, and if you want exposure to the various components of cloud computing, you will need to invest in both pure play companies and large diversified companies.

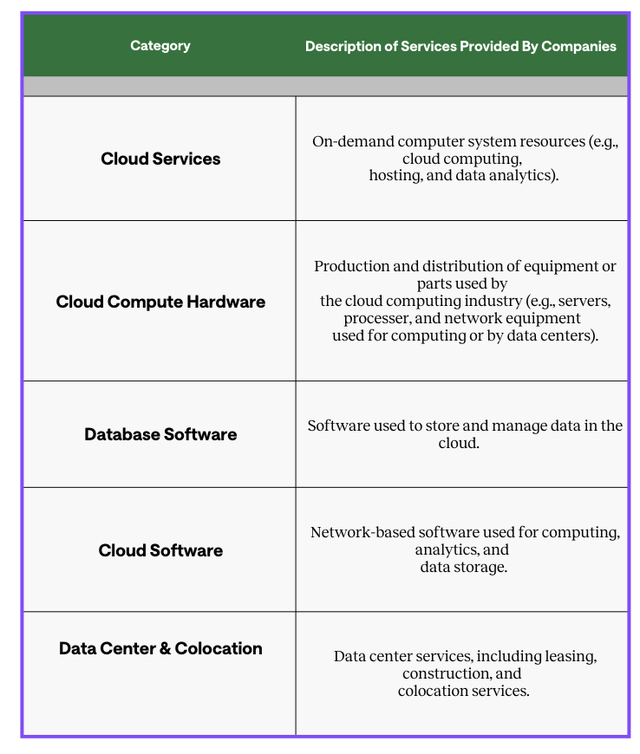

Figure 2: Syntax Cloud Computing Lens Components

Source: Syntax Data

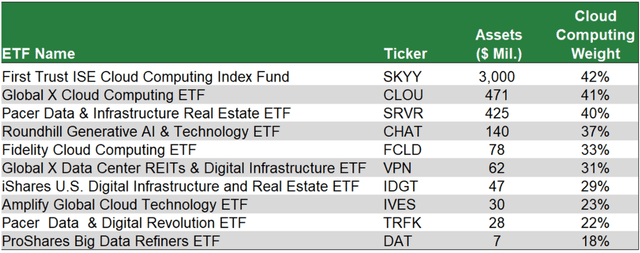

The results of the screening are shown in Figure 3 .

Figure 3: ETFs with large cloud computing investments

Highlights of the exhibit include:

- The ETFs shown have exposure to cloud computing ranging from 18% to 42%.

- With $3 billion in assets, First Trust ISE Cloud Computing Index Fund is by far the largest ETF, while the Global X Cloud Computing ETF and Pacer Data and Infrastructure Real Estate ETF hold significant assets of $472 million and $425 million, respectively.

- The ETFs’ names reflect a variety of themes: Four ETFs’ names include “cloud computing” or “cloud,” while other terms include “digital infrastructure,” “data center” and “big data.”

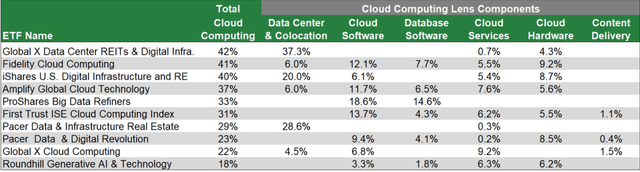

To better assess the focus of each of these ETFs’ exposure to cloud computing, we expand on our analysis in Figure 4 to present the six components that make up the cloud computing lens: The table is sorted by highest total exposure to cloud computing.

Figure 4: Exposure to cloud computing components

The ETFs have various exposures to cloud computing as a whole and its components.

- The largest weighting towards cloud computing is 42%, confirming the fact that the pure opportunity is limited.

- Six of the ETFs invest in data centers, including the top four ETFs by concentration. Note that many of these companies are organized as REITs and typically fall into the real estate sector.

- Exposure to cloud services and cloud hardware is found in most ETFs, and exposure to software (cloud and database software combined) is around 50% or more in five out of 10 ETFs.

- The level of diversification within the ETFs varies: four ETFs invest in five of the six component categories within the cloud computing lens, and three ETFs invest in four categories.

Conclusion

The cloud computing investment landscape is a complex and nuanced space. Based on Syntax’s product line classification data, we can gain a deeper understanding of the opportunities presented by cloud computing ETFs. We identified the top 10 ETFs with meaningful allocations to this space and showed that:

- The ETFs analyzed listed a variety of themes in their titles, including “Cloud Computing,” “Digital Infrastructure,” “Big Data” and “Generative AI.”

- Building a portfolio that relies heavily on cloud computing can be difficult because many cloud computing companies are not pure play businesses. [PK1]However, our analysis shows that there are three ETFs that have between 40% and 42% of their assets invested in cloud computing.

- There are four ETFs with total assets over $100 million, with the largest having total assets of roughly $3 billion.

We highlighted that the market is split between pure play companies and those where cloud computing represents a minority of revenue. ETF issuers may choose to invest in large technology companies such as Microsoft or Amazon to gain exposure to the cloud services segment of the market, which makes sense. The challenge is that, for example, cloud services represent only 16% of Amazon’s total revenue, meaning the ETF also has exposure to e-commerce, which is 84% of Amazon’s revenue, and other business lines. This is one reason why for most of the 10 ETFs we analyzed, the total exposure to the cloud computing lens ranged from roughly 25% to 45%. The takeaway here is that an ETF focused on the entire cloud computing opportunity would be a combination of cloud computing and other technologies. We believe this highlights the need to go beyond the ETF name and focus on holdings at the product line level.

Additionally, investors with significant exposure to the S&P 500 should be mindful of whether they may be multiplying their concentration risk in certain large technology companies.

Investors should also recognize that there is a degree of subjectivity involved in defining an investment category or theme such as cloud computing based on the above nuances. Individuals and companies have different perspectives, so it is difficult to categorically say that one view is better than another. However, we believe that if you are going to invest in a theme, it needs to be clearly defined. It also highlights the need to look across sectors. Cloud computing is an amalgamation of various business lines across sectors, so we need to identify and quantify these exposures using our cloud computing lens.

footnote

1]Cloud Computing Market Size, Share, Value and Forecast [2032] (fortunebusinessinsights.com)

Original source: author