Trupanion Inc. (NASDAQ:TRUP) shareholders should be happy that the stock price has risen 26% in the last month. However, that doesn’t change the fact that earnings over the past three years have been disappointing. In fact, the share price is down 66% in the past three years, so it’s really good to see some improvement. While many remain nervous, if the company does what it does best, there’s hope for further gains.

Shareholders have been declining over the long term, so let’s look at the underlying fundamentals over that period to see if that is consistent with the returns.

Check out our latest analysis for Trupanion

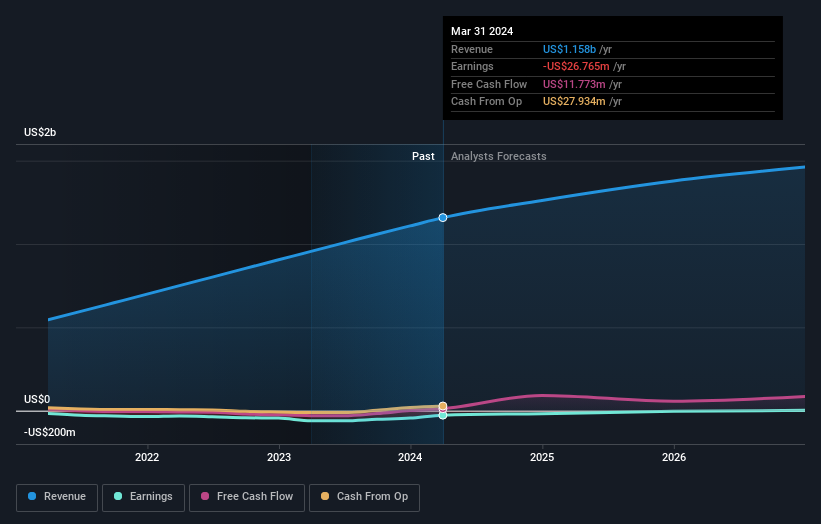

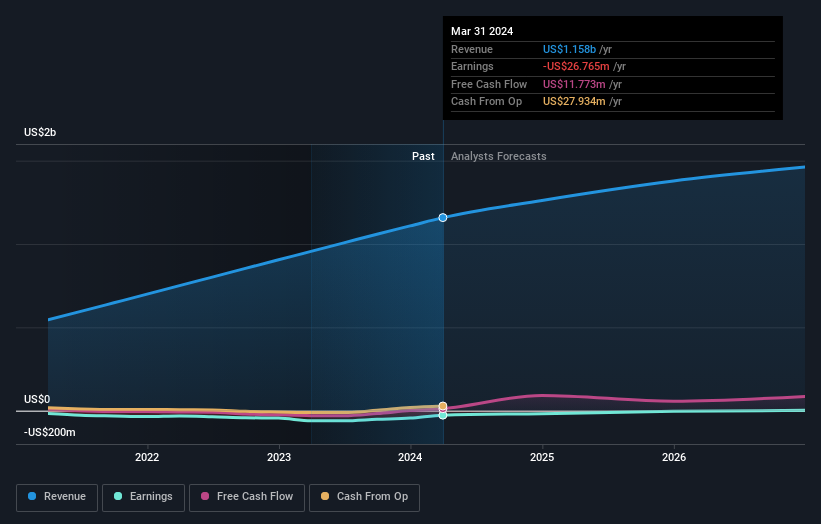

Trupanion hasn’t made a profit in the last twelve months, so we’ll look at revenue growth as a quick way to get a sense of how the business is developing. When a company isn’t making profits, we’d usually expect to see good revenue growth, and fast revenue growth can easily be extrapolated to forecast profits, which are often quite substantial.

Trupanion has grown its revenues by 24% annually over three years, well above most other pre-profitable companies. In contrast, the stock price has fallen 18% over the three years, disappointing by most standards. This may mean the stock hype is over as losses have become a concern for investors. When revenue growth and a falling share price combine, it’s hard not to wonder if there’s an opportunity for investors willing to dig deeper.

The graph below depicts how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It’s probably worth noting that there has been significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are the more important factors to consider. You can see what analysts are forecasting for Trupanion in this report. Interaction Future profit forecast graph.

A different perspective

We’re pleased to report that Trupanion shareholders have received a total shareholder return of 30% over one year. Notably, the five-year TSR loss of 1.5% per year compares very unfavourably with recent share price movements. This is a bit alarming, but the business could have turned around. I find it very interesting to look at share price as a proxy for business performance over the long term. But to gain real insight, other information needs to be considered. For example, consider risks. Every company has risks. We believe that: 1 warning sign for Trupanion You should know.

If you like buying stocks with management teams, you might like this free A list of companies. (Hint: most of them are in plain sight.)

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.