(Bloomberg) — The big market rally of 2024 looks dangerously close to collapse as Wall Street’s once-invincible bull force begins withdrawing its winnings.

Most Read Articles on Bloomberg

With bond yields soaring, a hawkish Federal Reserve in the ascendancy and conflict in the Middle East escalating, money is being pulled out of stocks and junk bonds at the fastest pace in more than a year. Opportunities to buy on the spur of the moment were silenced. The S&P 500 index suffered consecutive losses this week as stock price volatility increased, with seven big tech companies closing down nearly 8%.

It is the rising tensions that are fueling the reversal, and the bulls, who have made trillions of dollars in trading profits since late October, may be less inclined to ignore them. The first is evidence that inflation has replaced recession as central bankers’ main enemy. With commodities soaring and economic data remaining strong, speakers led by Chairman Jerome Powell poured water on hopes for a long-awaited shift in monetary policy.

Kathryn Rooney-Bella, chief market strategist at StoneX Group, says this justifies defensiveness.

“In a world where there is high geopolitical risk, high upside risk to commodity prices, high upside risk to inflation, I think we need to be more conservative with our allocations,” Rooney Vella said by phone. “At this point, I’m going to rotate out of appreciation stocks and invest it in very high-yield short-term paper.”

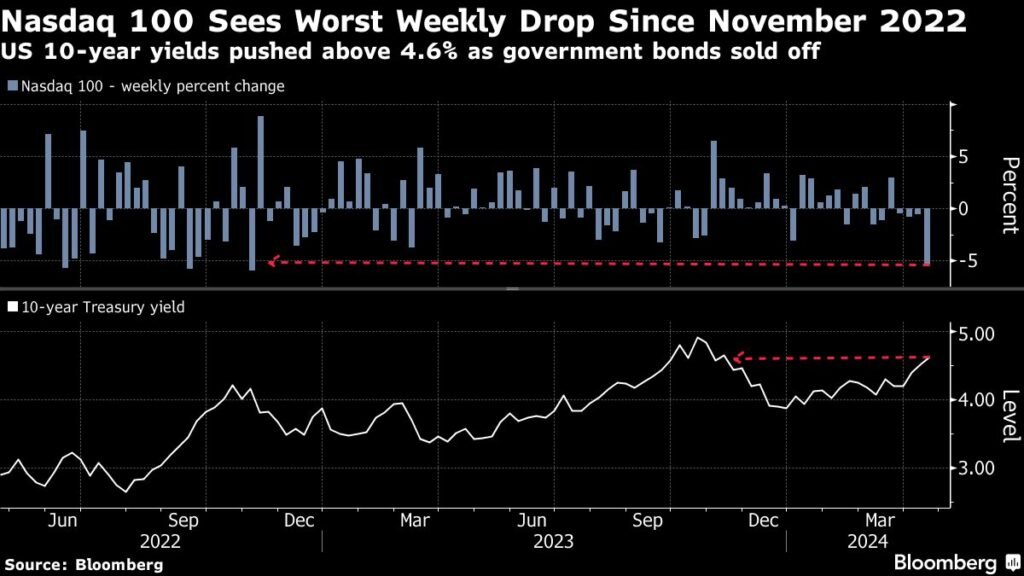

This view suggests that the often-ignored imbalance in valuations between assets is starting to become an issue again. Amid the bond sell-off, the 10-year Treasury yield rose above 4.6%, about 40 basis points above the S&P 500’s so-called earnings yield. This gap is the rough basis for a valuation tool known as the Fed model. Relatively speaking, this is the most unfavorable situation for stocks since 2002.

After six days of decline since last Friday, the S&P 500 recorded its worst losing streak since 2022, widening its drop in April to more than 5%. Yields on two-year notes briefly rose above 5% on Tuesday, part of a sell-off in bonds that erased gains in high-yield and investment-grade bonds this month.

Traders this week sensed deliberate efforts by central bankers to rein in bets on impending easing. Powell said on Tuesday that it would “take longer than expected” to gain the confidence needed to cut rates. The next day, Fed Governor Michelle Bowman warned that inflation progress may be stalling. “Potentially,” Minneapolis Fed President Neel Kashkari said Thursday when asked if it would be appropriate to keep interest rates unchanged for the rest of the year.

The hawkish stance fueled selling pressure that has been mounting among investors overall. Redemptions from equity funds reached $21.1 billion in the two weeks ending Wednesday, the highest amount since December 2022, Bank of America said, citing data from EPFR Global. . Investors pulled cash out of junk bonds at the fastest pace in 14 months, according to LSEG Lipper data. Hedge funds are increasing their short positions in U.S. exchange-traded funds at the fastest pace since 2022, according to data from Goldman Sachs Group Inc. Prime Brokerage.

“There are weak sellers and they will continue to sell because they weren’t as keen to buy in the first place,” said Peter Chill, head of macro strategy at Academy Securities. The stock was valued highly, but now, almost a month later, the trade is no longer working. ”

Traders have priced in less than two rate cuts this year, and the market’s implicit hopes for monetary easing have crumbled in the past two weeks. This is down from his six cases at the beginning of 2024.

Tensions in the Middle East have prompted a more cautious stance. Israel reportedly fired back at Iran on Friday morning, sparking a broader war in a region already roiled by the Israeli-Hamas conflict, although recent tensions have been contained, and oil prices plummeting by a barrel. There remain concerns that the price could exceed $100.

Investors face mounting risks today, but in the past they have been able to withstand them thanks to resilient corporate earnings and strong economic growth. The S&P 500 index is up 16% since Hamas attacked Israel, 17% since the 2023 peak in 10-year Treasury yields, and about 20% since the Fed began raising interest rates two years ago.

However, the market’s huge gains now threaten to negatively impact risk assets in the future.

Valuation concerns are growing in the equity ecosystem, particularly in the Nasdaq 100, with the top seven stocks on the Nasdaq 100 experiencing their worst weekly decline since November 2022. Companies that look cheap are back to outperforming growth companies that are often powered by artificial intelligence. The Russell 1000 Value Index fell 0.7% for the week, while the Growth Index fell 5%.

“There has been a huge amount of faith-based investment in AI, driving up the valuations of many of the biggest tech companies,” said Max Gochman, head of MosaicQ investment strategy at Franklin Templeton Investment Solutions. ” he said. “Focusing on value is looking increasingly attractive, and it’s something we’re actively discussing.”

–With assistance from Lu Wang.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP