The easiest way to invest in stocks is to buy exchange traded funds. But you can do much more by acquiring high-quality companies at attractive prices. for example, Visa Co., Ltd. (NYSE:V) stock is up 69% over the past five years, slightly outperforming the market return. It’s also good to see that the share price is up 17% in one year.

With that in mind, it’s worth checking whether a company’s underlying fundamentals are driving its long-term performance, or if there are any discrepancies.

Check out our latest analysis for Visa.

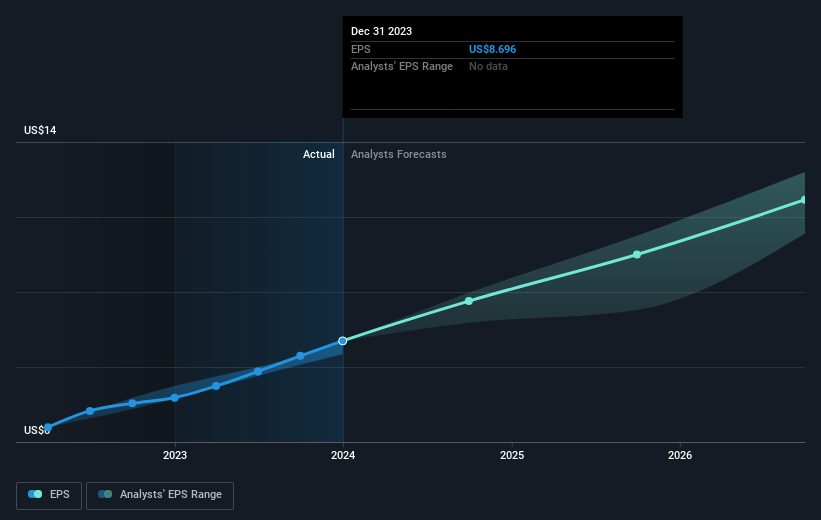

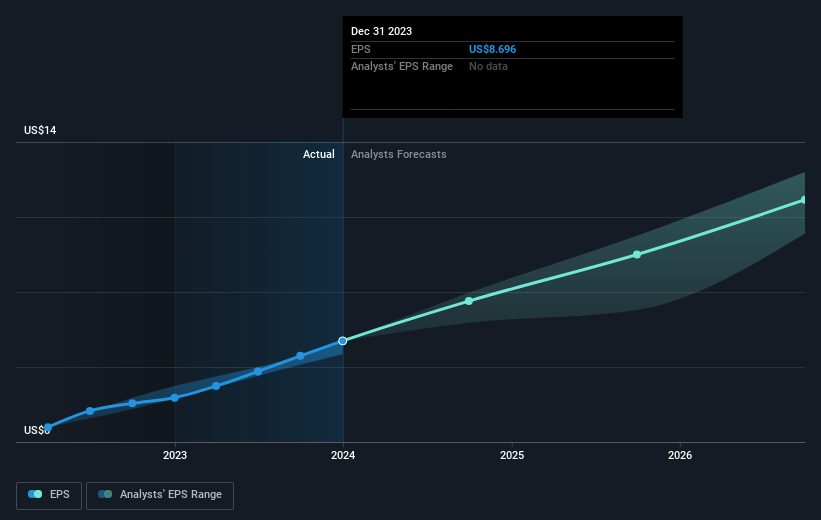

Although the efficient markets hypothesis continues to be taught by some, it has been proven that markets are dynamic systems that overreact and that investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Visa managed to grow its earnings per share at 19% per year over five years. This EPS growth is higher than the average annual increase in stock price of 11%. Therefore, the market seems to have a relatively pessimistic view of the company.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Of course, it’s great to see how Visa has grown its profits over the years, but the future is more important to shareholders.Now let’s take a more thorough look at Visa’s financial health. free Report the balance sheet.

What will happen to the dividend?

When looking at return on investment, it is important to consider the following differences: Total shareholder return (TSR) and stock price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, based on the assumption that the dividends are reinvested. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Visa, the TSR for the past five years is 75%. This exceeds the stock return mentioned earlier. And there’s no kudos to speculating that dividend payments are the main explanation for the divergence.

different perspective

Visa offered a TSR of 18% over the past 12 months. Unfortunately, this falls short of market returns. The silver lining is that this return was actually better than his five-year average annual return of 12%. This could indicate that the company is attracting new investors as it pursues its strategy. If you want to investigate Visa further, you might want to see if insiders have bought or sold shares in the company.

of course Visa may not be the best stock to buy.So you might want to see this free A collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.