Investing can be difficult, but the potential for big returns in individual stocks inspires us. Mistakes are inevitable, but if he chooses one of the top stocks, he can cover his losses and do more. One of those superstars is Tidewater Co., Ltd. (NYSE:TDW) stock has soared 665% in three years. It’s also good to see that the stock price is up 47% quarter-over-quarter. If you’ve enjoyed this rewarding ride, you’ll probably want to talk about it.

So let’s assess the underlying fundamentals over the past three years, and see if they have kept pace with shareholder returns.

See our latest analysis for Tidewater

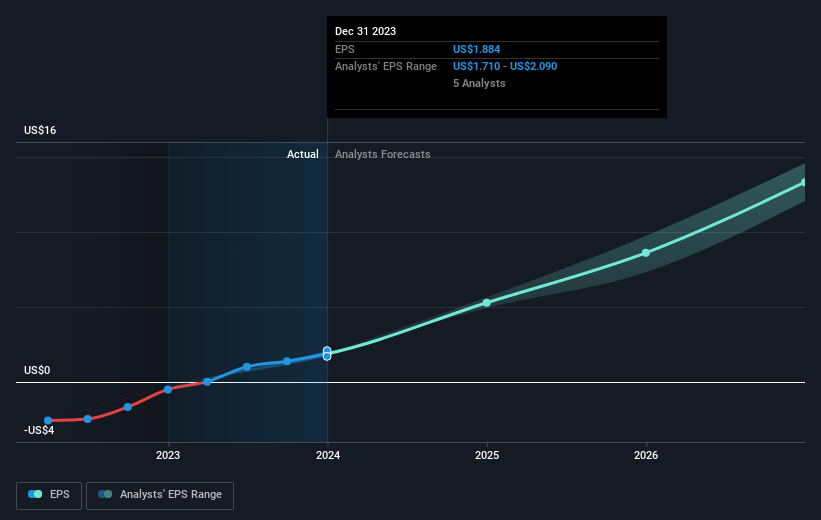

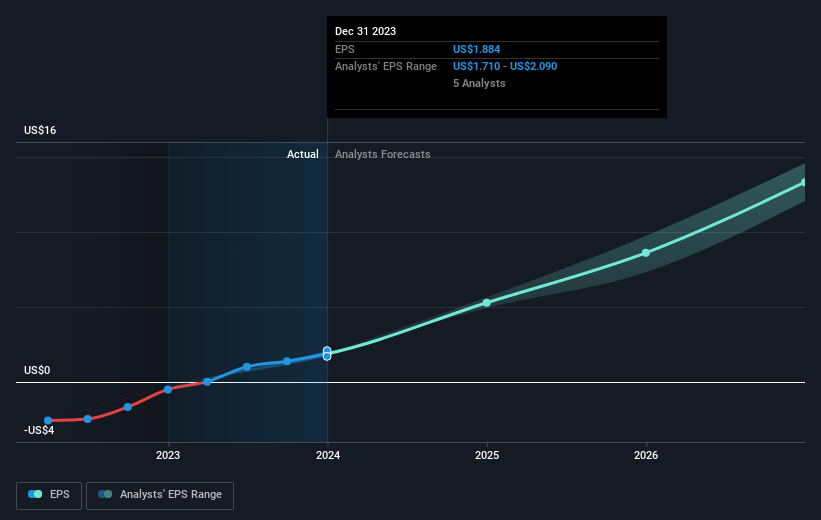

Although the efficient markets hypothesis continues to be taught by some, it has been proven that markets are dynamic systems that overreact and that investors are not always rational. One imperfect but simple way to consider how the market perception of a company has changed is to compare the change in the earnings per share (EPS) with the share price movement.

Tidewater has been profitable for the past three years. Given the importance of this milestone, it’s not too surprising that the stock price has risen significantly.

The image below shows how EPS has changed over time (unveil the exact values by clicking on the image).

We’re pleased to report that our CEO is paid more modestly than most CEOs at similarly capitalized companies. But while CEO pay is always worth checking, the really important question is whether the company can grow its earnings going forward. Dive deeper into its earnings by checking this interactive graph of Tidewater’s earnings, revenue and cash flow.

different perspective

We’re pleased to report that Tidewater shareholders have received a total shareholder return of 111% over one year. The stock’s performance appears to be improving recently, as the 1-year TSR is better than his 5-year TSR (the latter at 33% per annum). Optimists might think that the recent improvement in TSR indicates that the business itself is improving over time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we discovered that 3 warning signs for tidewater (1 is important!) You should be careful before investing here.

However, please note: Tidewater may not be the best stock to buy.So take a look at this free A list of interesting companies that have grown their earnings in the past (and are predicted to grow in the future).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.