Economic growth, while still strong, is slowing. At the same time, inflation continues to run above the Federal Reserve’s 2% target, hurting consumer confidence in the process. Unemployment is running at its lowest in a half-century, but a continuing tight labor market is fueling inflation even more, and those job openings are nothing to brag about. But the economy’s most obvious strength is the stock market, which is booming.

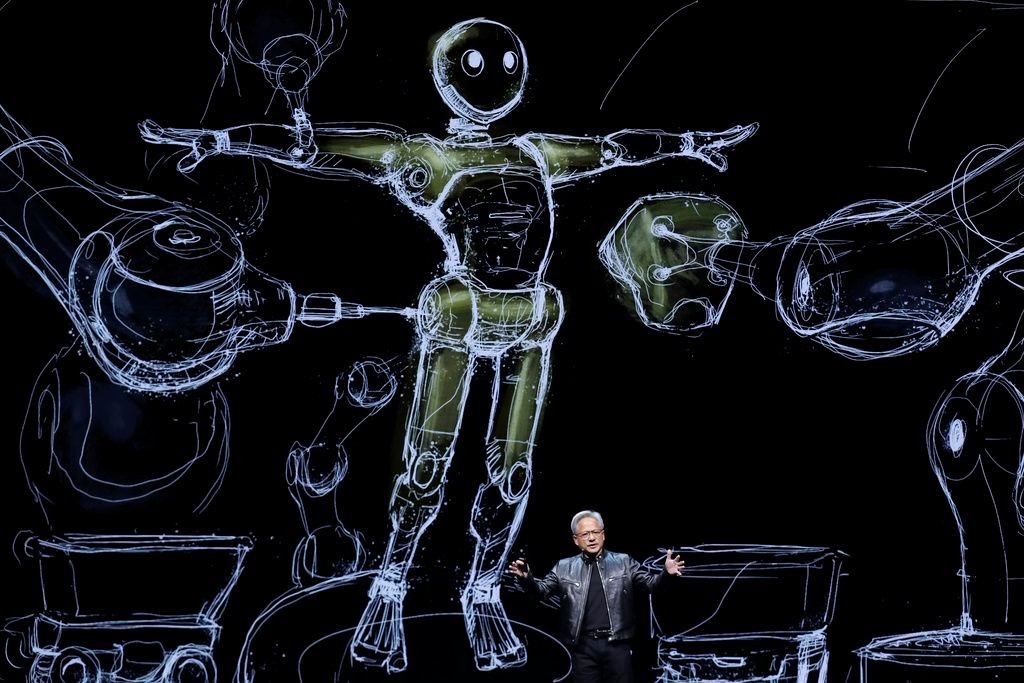

The biggest market headline this year has been the rise of Nvidia, which has become the third company in history to reach a $3 trillion market capitalization, overtaking Apple to become the second-largest company behind Microsoft. Fueled by the Western preference for “friend-shoring” semiconductor manufacturing away from Chinese influence and the artificial intelligence boom, Nvidia’s shares have risen 217% in the past year, making it a clear success story in an otherwise lackluster economy.

Stocks are not reflective of the economy as a whole, and the president should not take full credit or responsibility for market movements. But compared to other dull or even terrible metrics that President Joe Biden brags about, the strength of the stock market is his strongest appeal to inflation-wary voters. In absolute terms, the New York Stock Exchange composite index has risen about 27% since Biden took office, outpacing both about 20% inflation and a 5% decline in real average weekly wages in that time. While the wealthy own a disproportionate share of assets traded on the stock market, Gallup polls show that nearly two-thirds of all Americans report owning some form of stock, including direct stock holdings as well as individual retirement accounts and 401(k) plans.

But of course, not all markets are created equal. When you factor in inflation, the stock market rally isn’t all that big. And it’s not just a “stock market” boom, it’s a “Magnificent Seven” surge driven by the explosive growth of AI and Nvidia.

Adjusted for inflation, the S&P 500 is up 17% since Biden took office. That’s respectable, but pales in comparison to the 54% gain during former President Donald Trump’s four years in the White House. Adjusted for inflation, the Nasdaq 100 is up 22% under Biden, which is good, but still a long way from the 140% gain under Trump. And digging deeper into this growth, it’s clear that “Bidenomics” has primarily benefited big corporations, just as inflation has exacerbated the divide between the working class and the wealthy.

Last year alone, the Magnificent Seven (NVIDIA, Alphabet, Amazon, Apple, Meta, Microsoft and Tesla) grew 76%, making up the majority of the S&P 500’s overall 26%. From October 2022 to the beginning of this year, the Magnificent Seven rose more than 60% compared to the other 493 companies in the index, whose stock prices rose less than 30%. Over the past year, earnings forecasts for the 493 companies have fallen, but the Magnificent Seven’s earnings have increased by nearly 30%.

But even to Mag7’s credit, Nvidia seems to be doing all the heavy lifting. In the first five months of the year, Nvidia’s shares are up more than 100%. In contrast, Meta is up 32%, Alphabet is up 23%, Amazon is up 16% and Microsoft is up 10%. Apple and Tesla shares have fallen since the start of 2024, while the S&P 500 as a whole is up just 11%.

Remember, Mag7 makes up less than 30% of the S&P 500 and 41% of the Nasdaq. When people brag about the stock market soaring, they’re referring to Mag7, and when they brag about Mag7 performance, they’re referring to Nvidia.

To read more from the Washington Examiner, click here

Again, given the diplomatic realities that we cannot continue to rely on the South China Sea for our semiconductor and generative AI potential, it’s not a bad bet to assume that Nvidia will continue to grow explosively. In terms of size alone, Nvidia’s market cap is now larger than the entire annual economic output of Russia and Canada, and equal to the entire trading value of the London Stock Exchange. In the world of finance, a rising tide lifts all boats. Nvidia’s continued growth means pensions, retirement benefits and real wealth will dramatically outpace the threat of inflation.

The stock market as a whole hasn’t performed as well as The Magnificent Seven would suggest, but we have Nvidia in particular to thank for that.