FatCamera/E+ via Getty Images

The “rise” of the S&P 500 may seem confusing, but it’s not. The rise is just a handful of stocks that continue to drive up the entire concentrated index. At this point, most of the rise is coming from In volatility variance trading, traders play Ring Around the Rosie using the name Magnificent 7.

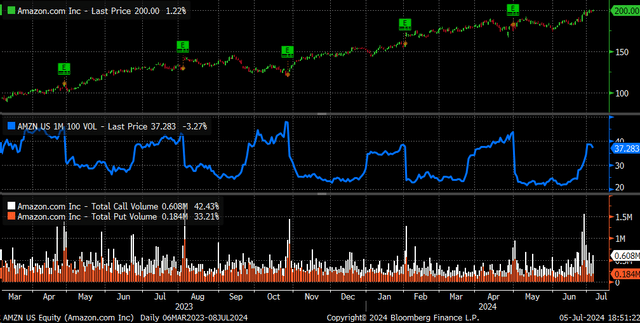

It may seem like pure coincidence that Amazon (AMZN) suddenly broke out on June 20 after struggling for several months due to a surge in call volume and rising implied volatility. “It must be AI trading. That’s the only explanation! Absolutely.” However, if you look at the chart below, you can see that once call volume settled and implied volatility stabilized, the gains appeared to stall.

Bloomberg

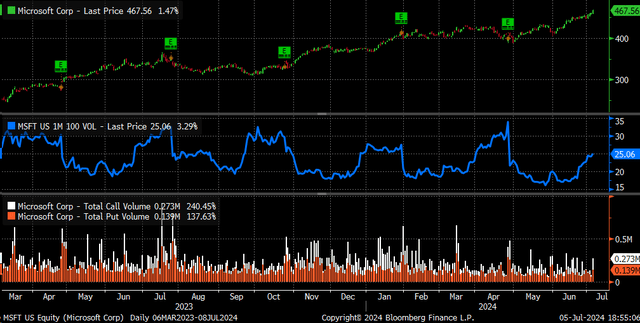

Amazon isn’t the only company to get in on the action. Microsoft (MSFT)) was no different. Stocks surged on a massive increase in implied volatility and rising options volume.

Bloomberg

Alphabet (GOOGL) (GOOG) exhibited similar characteristics during the week of June 20th with a surge in call volume, rising share price, and rising implied volatility levels.

Bloomberg

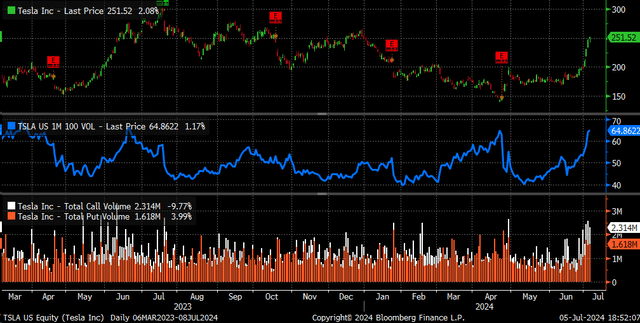

What’s interesting is that when Amazon, Microsoft and Alphabet were halted, Tesla (TSLA) took over on June 26th. The stock price skyrocketed, implied volatility levels on at-the-money 30-day options skyrocketed and call volume soared.

Bloomberg

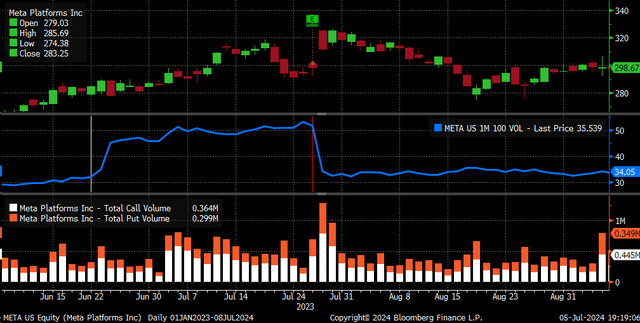

On July 5th, it seemed like it was Meta’s (META) turn, as it seemed like a largely ignored stock until now: the company’s shares rose nearly 6%, implied volatility increased, and call volume more than doubled.

Bloomberg

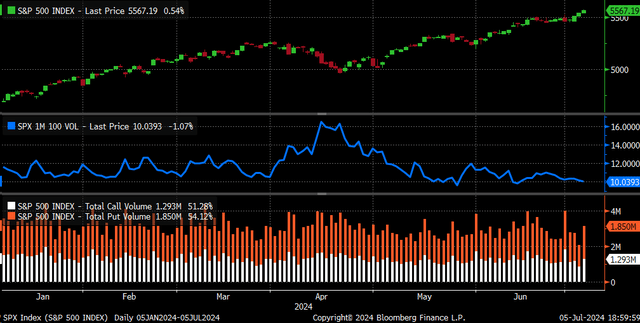

This comes as the S&P 500 continues to climb and the index’s one-month at-the-money expected volatility continues to fall after spiking above its normal range several times.

Bloomberg

Quarterly Games

Typically, when we see a stock price surge, rising call volume, and rising implied volatility, we think of a gamma squeeze. However, when a rolling gamma squeeze occurs across multiple stocks in the S&P 500, causing the index’s implied volatility to fall, it adds an element of the volatility dispersion trade we’ve noted before.

This trade is most pronounced during earnings season, where it follows seasonal and quarterly patterns: implied volatility for these stocks typically rises about a month before the earnings release due to earnings risk, then drops sharply after the earnings release.

Last year, Meta’s trading began toward the end of June, with IV leveling off around July 6th. This also coincided with a surge in call volume starting July 5th, followed by a slow decline. The stock price rose from $285 to $325 at the time. However, after the earnings release, IV crashed, and the stock price fell back to around $285 in the weeks that followed.

Bloomberg

This pattern begins a month before earnings season begins and ends once financial results are reported, repeating each quarter.

Bloomberg

Correlation is at an all-time low

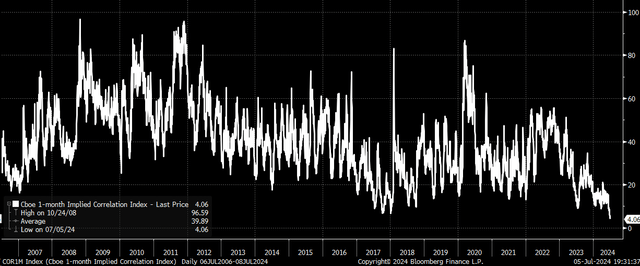

This has pushed the one-month implied correlation index to new lows below 4 and is currently trading nearly 3 handles below the all-time low recorded in 2017/18. This indicates that the current implied volatility of the top 50 companies in the S&P 500 and the implied volatility levels of the index are not moving in the same direction and that the lower the value, the weaker the correlation.

Bloomberg

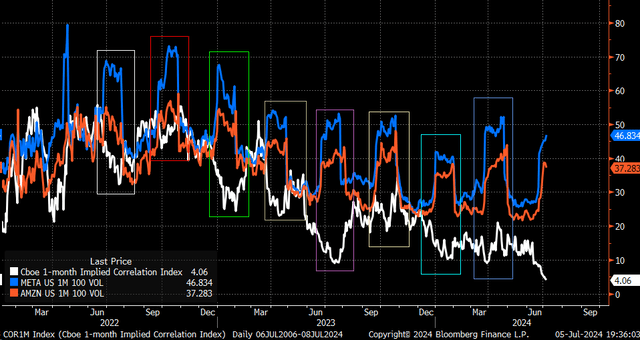

However, when stocks’ implied volatility levels peak, the implied correlation index forms a local bottom and almost always reverses upwards, suggesting that some sort of local bottom in the 1-month implied correlation may soon occur and reverse upwards.

Bloomberg

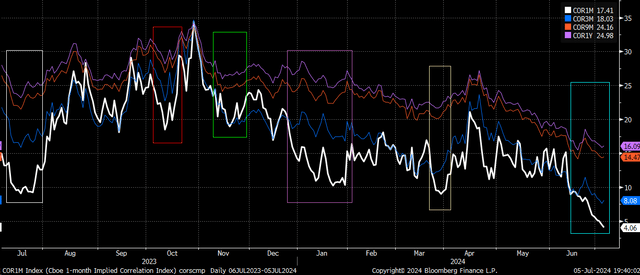

The 3-, 9-, and 12-month implied correlation indices often plateau or rise before the 1-month implied correlation indices. This has happened multiple times in the past year alone. The 3-, 9-, and 12-month indices may already be nearing a turning point.

Bloomberg

Blurred vision

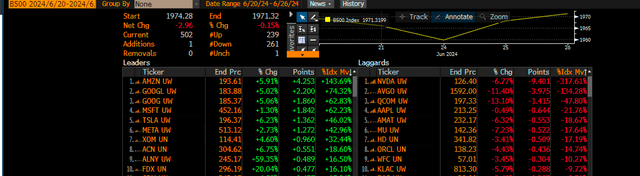

But this rotation into these different stocks due to this trade is exactly why we see this never-ending rotation of large cap stocks with big moves. And it becomes noticeable when you analyze the stocks’ movements and weightings in these preferred time frames. From June 20 to June 26, in the Bloomberg 500, the stocks that had the biggest impact on this index, which is a proxy for the S&P 500, were Amazon, Alphabet, and Microsoft, with Tesla coming in fourth. This was a period in which 229 stocks rose and 261 fell.

Bloomberg

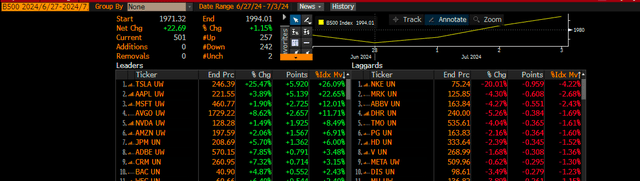

Between June 27 and July 3, Tesla shares soared, driving the Bloomberg 500 Index higher, followed by Apple and Microsoft. Tesla shares surged more than 25% in that short trading period, adding more than $130 billion to its market capitalization. During that period, 257 stocks saw their share prices rise, while only 242 stocks fell.

Bloomberg

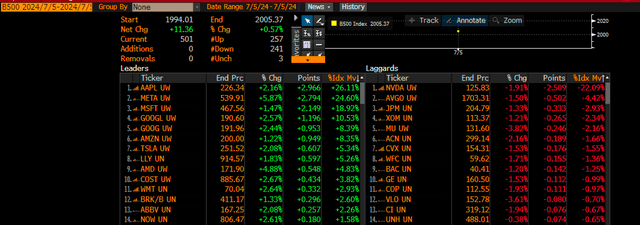

On July 5th, Apple and Meta led the tracker index rally, accounting for 50% of the day’s gains, with Meta up nearly 6%. This was during a massive gamma squeeze, with only 257 stocks advancing and 241 stocks declining.

Bloomberg

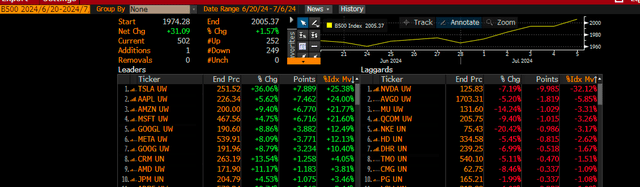

Overall, the Bloomberg 500 rose about 1.6% between June 20 and July 5, with 252 stocks advancing and 249 declining during that time, likely due in large part to volatility-diversifying trades among a few of the market’s largest stocks.

Bloomberg

Again, it may seem like we’re looking at stock prices on a weekly basis, but we’re not. Stock prices are accurate and there’s a reason for that.

Due to seasonal cycles, this deal is nearing an end.