Paul Souders/DigitalVision (via Getty Images)

The S&P 500 is down about 4.6% from its recent high, but this shouldn’t cause much concern. However, the decline to date is not due to geopolitical tensions as reported in many media outlets, but rather to changes in market expectations regarding the direction of monetary policy. market experts point out. The evidence is within the market and is important to understand because it can determine the direction of the market.

In this case, geopolitical tensions are an easy and obvious headline to explain the recent decline in stock prices. But when you dig deeper, that’s not what’s actually happening, because interest rates, the dollar, the yen, and oil don’t reflect the typical flight to safety trade that people expect.

No flight to safety

In most safe escape situations, we clearly observe that bond yields fall, the dollar appreciates against most major currencies, and the yen appreciates against the dollar. Rising tensions in the Middle East and soaring oil prices.

Since the higher-than-expected CPI report, the 10-year rate has spiked, but has not fallen, instead rising to about 4.61% from its March 9th close of 4.36%. Yes, the dollar has risen. However, the yen fell from 151.70 to around 154.40. Meanwhile, oil prices are falling. The typical flight-to-safe haven trade just isn’t happening.

Financial situation is tight

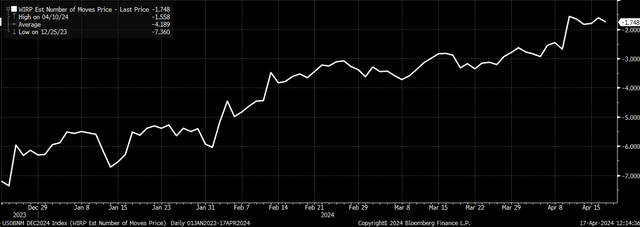

What you’re seeing is credit spreads widening, coupled with rising interest rates, creating tougher financial conditions. This is in response to the Fed’s monetary policy, which, as Jay Powell pointed out on April 16th, will remain high for an extended period of time due to inflation. This means the Fed no longer has the confidence it needs to cut rates “soon.” This means the market is pricing in fewer than two rate cuts in 2024, with the first expected in November.

bloomberg

Tight financial conditions make the latest decline unlike anything seen since the October lows, when financial conditions began to ease. The market is correcting its mistakes, and now the Fed is cutting rates again for 2024. That means the stock price decline we’ve seen so far is near the beginning, not the end. This is because monetary conditions will need to tighten significantly further to advance policy. It starts to cool down the economy and bring down inflation.

fantasy

bloomberg

The stock market rally was driven by easing financial conditions and multiple business expansions, not because earnings prospects are improving, but because 2024 earnings forecasts remain unchanged from fall 2022. . As financial conditions tighten, the S&P’s P/E ratio has declined. 500 will be contracted and the profits will be returned.

If you think this is a normal pullback in a bull market, you may be very disappointed. What’s happening is that the market has made a mistake and now we need to correct that mistake.

Join Reading The Markets risk-free with a 2-week trial!

(*Free trial benefits are not available on the App Store)

Reading the Markets helps readers cut through all the noise and prepare for upcoming events with daily video and written market commentary.

We use an iterative and detailed process that monitors fundamental trends, technical charts, and options trading data. This process helps you isolate and determine where a stock, sector, or market is likely to head over different time frames.