(Bloomberg) — Asian stocks were mixed following Jerome Powell’s hawkish comments, which spurred a third straight decline in the S&P 500 index and sent the yield on two-year U.S. Treasuries to 5% at one point.

Most Read Articles on Bloomberg

Benchmark futures for Australia and Hong Kong showed declines, while benchmark futures for Japan showed gains. US yields are expected to rise in 2024 as the Fed chief says it will likely take more time to gain confidence on inflation, adding that it is appropriate to give restrictive policy time to take effect. rose to new highs. The dollar hit its highest level in five days since October 2022, while the fall in U.S. stocks from record highs deepened.

Powell’s comments signal a change in his message after key inflation indicators came in better than expected for the third consecutive month. He also suggested the U.S. central bank is likely to keep interest rates on hold for a longer period of time than originally planned, according to Jeffrey Roach of LPL Financial.

“Chairman Powell’s comments make it clear that the Fed is now looking beyond June,” said Evercore’s Krishna Guha. “His comments are consistent with his ‘Plan B’ of two rate cuts in July this year, but if disappointment over inflation persists, there remains the possibility that rates will remain on hold for even longer. ing.”

The S&P 500 index fell to around 5,050, and the Golden Dragon index of U.S.-listed Chinese companies also fell for the first time in three days. The yield on the 10-year US Treasury note rose 7 basis points to 4.67%.

From the start of the year, the Fed had priced in up to six rate cuts, or 1.5 percentage point easing, through 2024, but traders are now skeptical of even a 0.5 percentage point cut. Market expectations for Fed rate cuts, which have collapsed over the past two weeks, have fallen further following Chairman Powell’s comments on inflation. Easing of about 40 basis points per year is still priced in.

“If you were looking for some moderation or dovish rhetoric from Mr. Powell, you didn’t miss it. Mr. Powell didn’t give it,” said Andrew Brenner of NatAlliance Securities.

Federal Reserve Vice Chairman Philip Jefferson said early Tuesday that while current interest rates would continue to moderate inflation, sustained price pressures would justify keeping borrowing costs high for an extended period of time. showed the outlook. Richmond Fed President Thomas Barkin said some recent data, such as the consumer price index, “does not support” a soft landing.

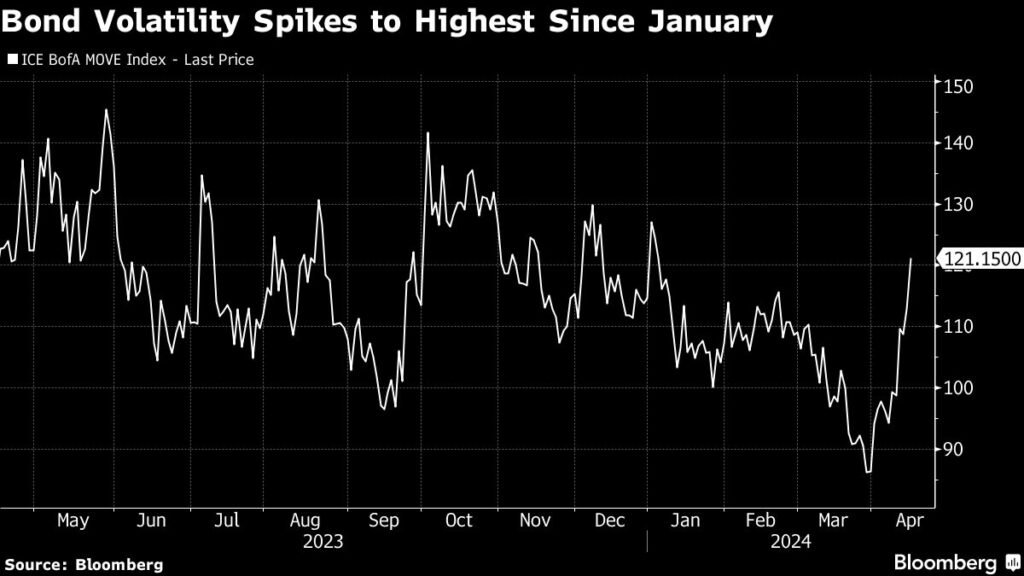

Amid all the uncertainty, the widely watched MOVE index, an option-based measure of expected volatility in U.S. Treasuries, has soared to its highest level since January.

Rising bond yields are a sign that the global economy and corporate profits are strong and resilient, said James DeMart of Main Street Research. As a result, there may be fewer rate cuts than expected, or no rate cuts for some time, but it won’t destroy the stock bull market, he said.

“In the early stages of a new economic cycle, it’s earnings that drive stock prices, not the Fed,” he said. “Earnings were well ahead of expectations, and we expect similar results as earnings season gets back into full swing. We are buyers of this stock market correction.”

Company highlights:

-

United Airlines Holdings Inc. expects profit for the current quarter to be better than expected, allaying concerns about limits to growth.

-

Delays in the delivery of Lockheed Martin’s F-35 fighter jets with computer hardware and software upgrades are likely to last until August or September, Pentagon officials said.

-

Seafood restaurant chain Red Lobster is considering filing for Chapter 11 bankruptcy in an effort to restructure its debt, according to people familiar with the matter.

-

UnitedHealth Group beat Wall Street’s profit expectations and affirmed its outlook for this year, despite costs associated with a cyberattack on its subsidiary that disrupted the health care industry.

-

Johnson & Johnson’s first-quarter drug sales beat the company’s profit expectations and narrowly beat Wall Street expectations, a step toward improving profitability after the separation of its consumer division.

-

LVMH’s sales growth slowed at the beginning of the year as wealthy consumers refrained from spending on expensive Louis Vuitton handbags and Hennessy Cognac.

-

Adidas AG has raised its profit target for this year after strong demand for classic sneakers like the Samba and a boost in sales of its dwindling inventory of Yeezy footwear.

This week’s main events:

-

Eurozone CPI, Wednesday

-

Fed issues beige book on Wednesday

-

Cleveland Fed President Loretta Mester speaks Wednesday

-

Federal Reserve President Michelle Bowman speaks on Wednesday

-

BOE Governor Andrew Bailey speaks on Wednesday

-

Taiwan Semiconductor’s financial results, Thursday

-

US conference board leading index, number of existing home sales, number of new unemployment insurance claims, Thursday

-

Federal Reserve President Michelle Bowman speaks Thursday

-

New York Fed President John Williams speaks Thursday

-

Atlanta Fed President Rafael Bostic speaks Thursday

-

BOE Deputy Governor Dave Lumsden and ECB Board Member Joachim Nagel speak on Friday

-

Chicago Fed President Austan Goolsby speaks on Friday

The main movements in the market are:

stock

-

Hang Seng futures were down 0.2% as of 7:22 a.m. Tokyo time.

-

S&P/ASX 200 futures down 0.3%

-

Nikkei 225 futures rose 0.3%

-

The S&P 500 fell 0.2%.Futures rose 0.1%

-

The Nasdaq 100 was little changed.Futures rose 0.1%

currency

cryptocurrency

-

Bitcoin rises 1% to $63,704.43

-

Ether rose 0.4% to $3,083.89

bond

merchandise

This article was produced in partnership with Bloomberg Automation.

–With assistance from Rita Nazareth.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP