micro stock hub

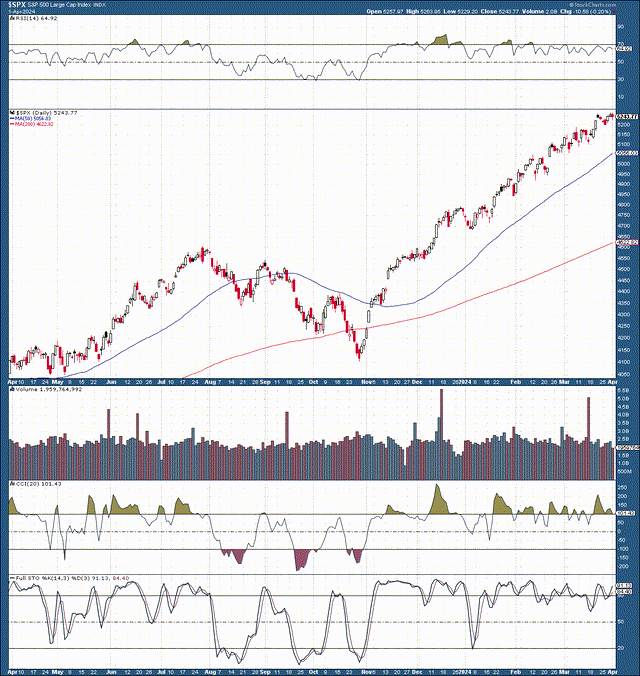

Despite a solid 2023 and strong gains toward the end of the year, the S&P 500 (SPX) fearlessly overcame the wall of fear, rising about 10% in the first quarter. The Fed believes that more accessible monetary policy, a more resilient economy, higher corporate profits, advances in AI, Other factors continue to keep the market strong, with the stock moving higher and higher this year towards the new ATH.

However, the $64,000 question remains. Will the stock market continue to do well? Is there a fix? If so, when and how deep?

When the correction ends in October 2023 and SPX bottoms around 4,100, it’s time to get greedy. However, after a 30% jump in about five months, SPX is now at about 5,300, making it time to be cautious again in the short term.

SPX 1 year chart

SPX (StockCharts.com | Advanced Financial Charting and Technical Analysis Tool)

Trying to time the correction may be a fool’s errand, but more attention may be needed in the short term. SPX’s technical momentum is currently declining, as many stocks have risen significantly in a relatively short period of time. Even as SPX continues to rise, the RSI has fallen off its highs, increasing the possibility of a rebound, rotation, or consolidation in the short term.

However, over the medium to long term, the technical picture remains solid, and the market has excellent fundamentals to support further stock price growth. Therefore, it is likely that SPX will end 2024 fairly high as 5,800-6,000 remains my year-end target range despite the potential for hikes/adjustments.

In my view, there are several possible fixes. SPX could retreat by 5% to around 5,000 in the base case and correct by about 10% to the 4,700-4,800 zone in the worst case scenario.

Timing the market is more difficult than it seems, especially when it comes to identifying short-term ceilings. Therefore, I only implement light hedges (mainly covered call dividends or CCDs) until important support levels start to break down. Initial support is around 5,200 and the key support zone remains between 5,100 and 5,000.

Earnings season is about to begin

Earnings are usually a favorable catalyst for stocks in a bull market, and we look forward to announcements from important companies in the coming weeks. Still, the stock could weigh on earnings, creating a buying opportunity ahead of any major news.Banks begin to see significant profits Around April 12th, only 10 days left. The most important period of earnings season comes around April 22-26, when major technology companies report their results.

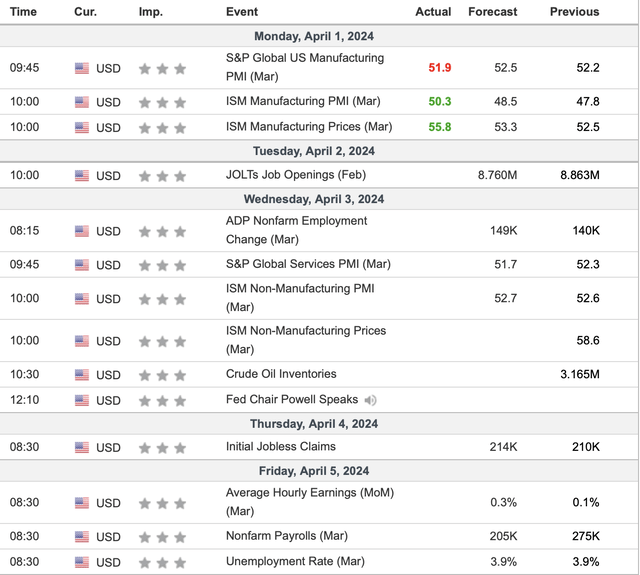

This week – important data coming up

Economic Data (Investing.com – Stock Market Quotes and Financial News)

ISM manufacturing data released on Monday was slightly better, suggesting that inflation may not be as subdued as expected. Meanwhile, ISM manufacturing data shows that the economy is in better shape than expected and remains highly resilient at this stage.

ISM non-manufacturing statistics are scheduled to be released on Wednesday, and the results may also be somewhat grim. Furthermore, Fed Chairman Jerome Powell is scheduled to give a speech on Wednesday, which could have an impact on market sentiment.

Of course, the key data point will be released Friday in the all-important non-farm payrolls report. I would like to see the numbers in the 100-200K zone. If we see above 300,000, the market may react negatively as the first rate cut is likely to be pushed back further.

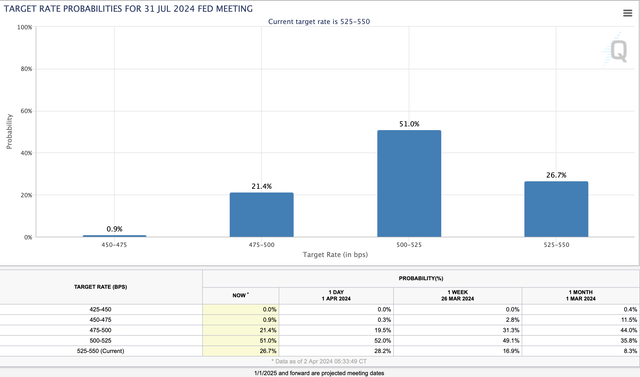

First rate cut remains likely in June

Rate Probability (CMEGroup.com)

We expect the first rate cut to occur, probably in June or July. The probability of a rate cut before the July FOMC meeting is about 73%, and the probability of a rate cut at the June FOMC meeting is about 59%. In a worse scenario, the first rate cut could occur in September. There is a 90% chance that interest rates will be cut by the September FOMC meeting.

Evaluation checkup

Index valuation (WSJ.com)

Despite recent gains in major averages, stock valuations remain relatively cheap given the resilience of the economy, growth prospects, and the possibility of a shift to more accessible monetary policy in the near future. SPX’s forward 12-month P/E ratio is approximately 21.5, suggesting that its 2025 P/E ratio may currently be below 20. Additionally, the Nasdaq 100 has a forward P/E of approximately 27x and R2K is below 25x. This move shows that technology, small-cap, and mid-cap stocks are still relatively cheap.

conclusion

This year is off to a strong start with the S&P 500 up 10%. It may be time to enter a phase of pullback, integration, and rotation. Nevertheless, the economy remains very resilient and in many ways stronger than expected. Additionally, the Fed is likely to cut interest rates soon, providing a favorable backdrop for the economy and stock prices.

We also have a number of growth areas, including a lucrative AI sector, which should expand significantly over time, increasing profitability and overall efficiency for many companies. This dynamic means that blue-chip stocks are expected to rise significantly over the medium to long term, despite the possibility of corrections and pullbacks. I maintain my year-end target range for the S&P 500 at 5,800-6,000, as the technical, fundamental, and psychological factors surrounding the economy and stock market remain favorable.