For many people, the main point of investing is to generate higher returns than the overall market. But the main battle is finding enough winners to compensate for the losers. Therefore, there is no long-term liability. Suntec Real Estate Investment Trust (SGX:T82U) shareholders have questioned their ownership decisions, and the share price has fallen 41% in five years.

So let’s take a look at whether the company’s long-term performance is in line with the progress of its underlying business.

Check out our latest analysis for Suntec Real Estate Investment Trust

in his essay Graham and Doddsville Superinvestors Warren Buffett has said that stock prices do not always rationally reflect the value of a company. By comparing earnings per share (EPS) and share price changes over time, we can learn how investor attitudes to a company have changed over time.

Suntec Real Estate Investment Trust has been profitable for the past five years. Most people would think that’s a good thing, so it’s counterintuitive to see the stock price fall. Using other metrics might give you a better idea of how that value changes over time.

Recent dividends have actually been lower than in the past, which may have caused the share price to fall.

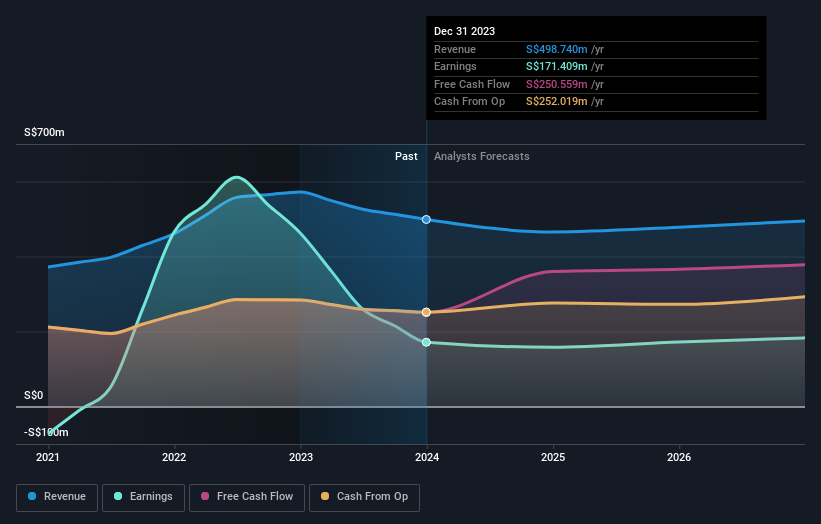

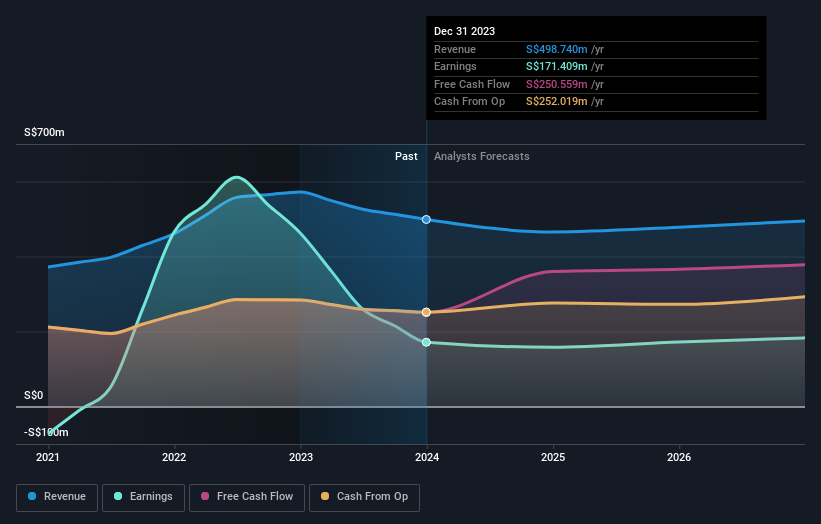

The image below shows how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Suntec Real Estate Investment Trust is a well-known stock with many analysts covering it, which suggests some future growth is visible.Given that there are quite a few analyst forecasts, it might be well worth checking this out free Graph showing consensus estimates.

What happens to the dividend?

As well as measuring share price return, investors should also consider total shareholder return (TSR). Whereas the price/earnings ratio only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. We note that Suntec Real Estate Investment Trust’s TSR over the last 5 years was -22%, which is better than the share price return mentioned above. Therefore, the dividend paid by the company is total Shareholder returns.

different perspective

Suntec Real Estate Investment Trust shareholders are down 13% for the year (even including dividends), while the market itself is up 4.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year’s performance ended on a down note, with shareholders facing a total annual loss of 4% over five years. I know that Baron Rothschild said investors should “buy when there’s blood on the streets,” but investors should first be sure they’re buying a high-quality company. Warns you that you need to confirm. I think it’s very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well. Still, we note that Suntech Real Estate Investment Trust has shown the following results. 4 warning signs in investment analysis One of them doesn’t suit us very well…

However, please note: Suntec Real Estate Investment Trust may not be the best stock to buy.So, take a look at this free A list of interesting companies that have grown their earnings in the past (and are predicted to grow in the future).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singapore exchanges.

Have feedback about this article? Concern about the content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.