US stocks start slightly higher

U.S. stocks opened slightly higher as Wall Street continued to digest Wednesday’s higher-than-expected inflation print.

The tech-heavy Nasdaq rose 0.4%, while the S&P 500 rose 0.1%. The Dow Jones Industrial Average fell 0.1%.

Stock prices rise: Aviva falls 6%, AstraZeneca rises 3%

British insurance company shares Aviva It fell 6% after announcing new plans to “restructure and rebrand” its financial business.

meanwhile, AstraZeneca The company pledged to increase its dividend this year, raising it by 3% ahead of a key vote on CEO pay.

— Karen Gilchrist

ECB leaves interest rates unchanged but hints at future rate cuts

A sculpture of the euro currency stands in the city center of Frankfurt am Main, western Germany, on January 25, 2024.

Kirill Kudryavtsev | AFP | Getty Images

The European Central Bank kept interest rates unchanged for the fifth consecutive time at Thursday’s meeting, but tightened its language on the possibility of future rate cuts.

“If the Board’s latest assessment of the inflation outlook, underlying inflation dynamics, and monetary policy spillovers provides further confidence that inflation is sustainably converging on target, we will reduce current levels.” “A level of monetary policy restrictions would be appropriate.”

Market prices currently suggest a 25 basis point rate cut in June, according to LSEG data.

— Karen Gilchrist

ECB expected to remain unchanged, signal expected to be cut

European Central Bank President Christine Lagarde at the ECB and its watchers meeting in Frankfurt, Germany, March 20, 2024.

Bloomberg | Bloomberg | Getty Images

The European Central Bank is widely expected to announce a hold on interest rates on Thursday afternoon, paving the way for a possible rate cut in June.

ECB President Christine Lagarde suggested at the March Governing Council meeting that there was a good chance the bank would cut interest rates in June. Since then, inflation in the euro zone has fallen more than expected, reaching 2.4% in March.

”Policymakers will continue to be very sensitive to incoming data, but our view is that the rate cutting cycle will begin in June. Henk Potts, market strategist at Barclays Private Bank, said in a note: “As the year progresses, we expect quarter-point cuts in the remaining sessions, which should result in deposit rates of 2.75% at the end of the year.” Stated.

The decision will be announced at 2:15 p.m. Frankfurt time, before Lagarde’s press conference.

— Jenny Reid

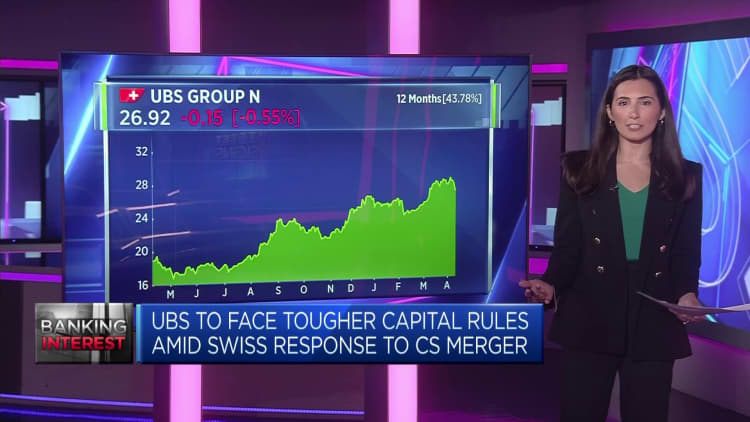

UBS falls 1.2% after Swiss government proposes new banking law

UBS Shares fell 1.2% on Thursday morning after the Swiss government proposed 22 measures aimed at tightening the reins on banks that are “too big to fail.”

This comes a year after authorities brokered an emergency rescue of battered rival Credit Suisse by UBS, creating the largest merger of two systemically important banks since the global financial crisis. I was disappointed.

Beat Wittman, a partner at Zurich-based Porta Advisors, told CNBC’s “Squawk Box Europe” that regulations could limit UBS’s ability to challenge Wall Street giants. Ta.

Wittmann said this “creates a losing situation for Switzerland as a financial center and for UBS to be unable to develop its potential.”

“It comes down to the competitive conditions at the regulatory level. It’s of course a competency issue, and then it’s about incentives and the regulatory framework, and the regulatory framework, such as capital requirements, is a global challenge,” he added. Ta.

read more here.

— Elliott Smith, Jenny Reid

British cybersecurity firm Darktrace rises 7% on higher sales, raises forecasts

Darktrace stock price.

UK cybersecurity company shares dark trace Shares rose 7% as of 9:45 a.m. in London after the company’s third-quarter trading update showed revenue of $176.1 million, up 26.5% from a year ago.

The London Stock Exchange-rated tech company also said it expected adjusted profit margins to beat previous expectations of 21% and raised its full-year sales growth forecast by 0.5 percentage points.

Quilter Cheviot technology analyst Ben Ballinger said the results showed “consistent strong growth and further gains and gains” and that Darktrace “remains undervalued relative to its U.S. peers.” ” he said.

He added that the improvement in net annualized recurring revenue was a highlight.

— Jenny Reid

Societe Generale rises 4% as it agrees to sell equipment financing unit for $1.18 billion

Societe Generale stock price.

Société Générale outperformed the Stoxx 600 in morning trading, rising 4% to its highest since September 2023.

The French bank said on Thursday it had agreed to sell its equipment financing business to BPCE Group for 1.1 billion euros ($1.182 billion), boosting its CET1 ratio, a measure of capital to assets, by 25 basis points. It is expected that this will improve.

The deal is expected to close in the first quarter of 2025.

The outstanding loans of both companies were approximately 15 billion euros at the end of December 2023.

Société Générale said the acquisition was a step forward towards its goal of building a “more streamlined, more synergistic and efficient business model” while strengthening its capital base.

— Jenny Reid

European stocks open mixed

European markets were mixed early Thursday, with France’s CAC40 index and Britain’s FTSE 100 index both up about 0.1%, and Germany’s DAX index flat.

of Stocks 600 The index was also almost flat.

STOXX 600 index.

Fed may cut rates before ECB: former BOE member

The Federal Reserve Building is located in Washington.

Joshua Roberts | Reuters

A former member of the Bank of England said the US Federal Reserve is likely to cut interest rates before the European Central Bank, contrary to current market expectations.

“I think the Fed will be the first to really cut rates,” Deanne Julius, a founding member of the Bank of England’s Monetary Policy Committee, told CNBC on Tuesday.

Julius explained that his forecast is based on the Fed’s dual mandate of looking at both inflation and employment in the U.S. economy. The latest employment data shows a booming U.S. labor market, and inflation is falling, although it remains above the Fed’s 2% target.

Read the full story here.

— Sylvia Amaro

CNBC Pro: Citi says this ‘high-risk’ but ‘attractive’ global stock has 280% upside potential

Citi has identified digital advertising and marketing services companies as high-risk but potentially attractive investment opportunities.

Analysts at the investment bank said that while the short-term outlook remains uncertain, “there may still be much to look forward to in the medium term.”

Wall Street banks predict the “attractive” but “high-risk” stock could rise 280% over the next 12 months.

CNBC Pro subscribers can read more here.

— Ganesh Rao

CNBC Pro: Beyond the US: Investment analysts name the markets and stocks they’re betting on right now

Attractive returns and breadth of opportunity are among the many reasons why the United States has historically held the top spot among investors.

While the global superpower still has “some areas that look good” in terms of value, Stephen Glass, investment analyst at Pella Funds Management, is looking at opportunities elsewhere. There is.

“There are still areas where it could be valuable, but generally outside the U.S.,” said Glass, a managing director at an investment firm, naming the markets and stocks he is currently betting on.

CNBC Pro subscribers can read more here.

— Amara Balakrishna

European Market: Click here for opening call

European markets are set to open in mixed territory on Thursday.

british FTSE100 The index is expected to open 10 points higher at 7,957. dachshund France decreased by 3 points to 18,090 CAC Italy with 8,043 points, one point higher FTSE MIB According to IG data, it decreased by 27 points to 33,355.

Investors are keeping an eye on the latest monetary policy decisions from the European Central Bank on Thursday, with earnings expected from Givaudan.

— Holly Ellyatt