Matejimo

The stock market is deteriorating rapidly

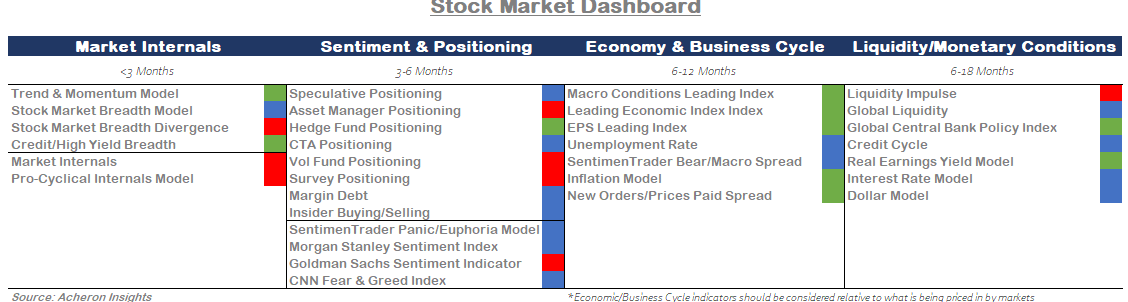

Over the past few weeks, the internal health of the equity markets has deteriorated significantly, with a number of warning signs emerging that could portend poor performance in the short to medium term.

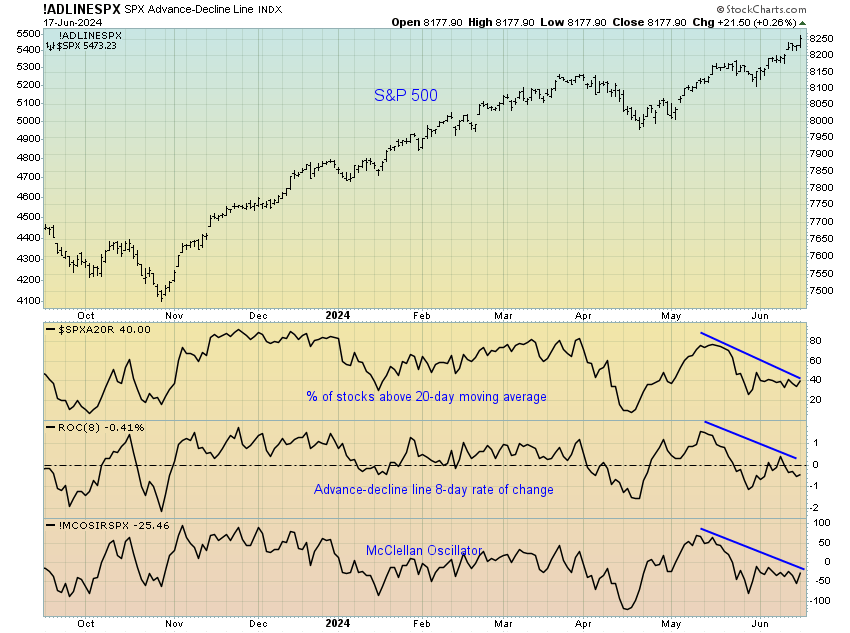

Most notably, stock market breadth is narrowing as fewer and fewer people are participating in the S&P 500 rally. Since mid-May, all of my short-term breadth measures have been trending lower, while the S&P 500 (Spocks) continues to rise. Most notably, while the index is trading at an all-time high, only 34% of the S&P 500 constituents are trading above their respective 20-day moving averages.

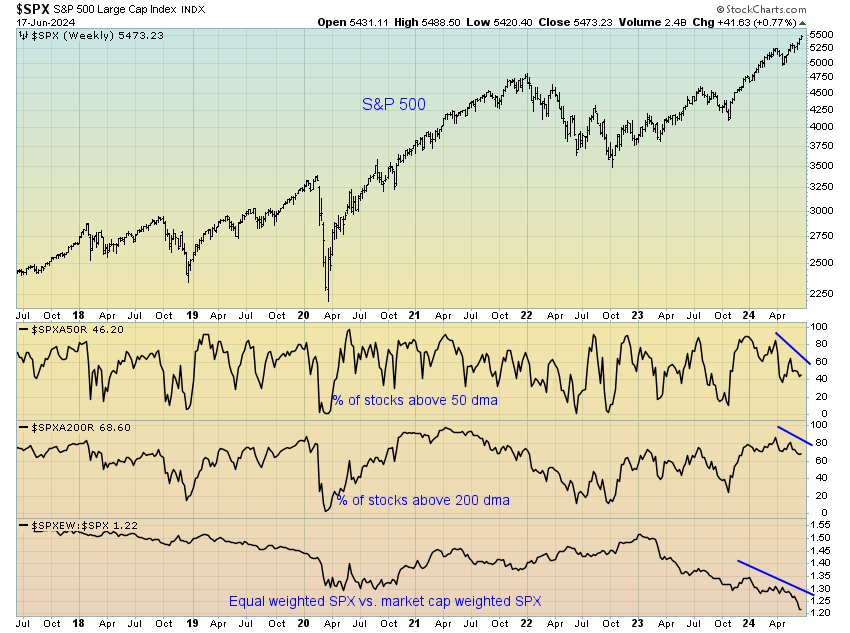

This seems like a narrow daily upside. But perhaps more worrying is that longer-term indicators with similar ranges are just as weak. The S&P 500 is trading above its 50-day and 200-day moving averages, which have been hitting new highs over the past quarter. Moreover, the relative performance of the equal-weighted S&P 500 Index and its market-cap-weighted peers has been significantly underperforming over the past year or so.

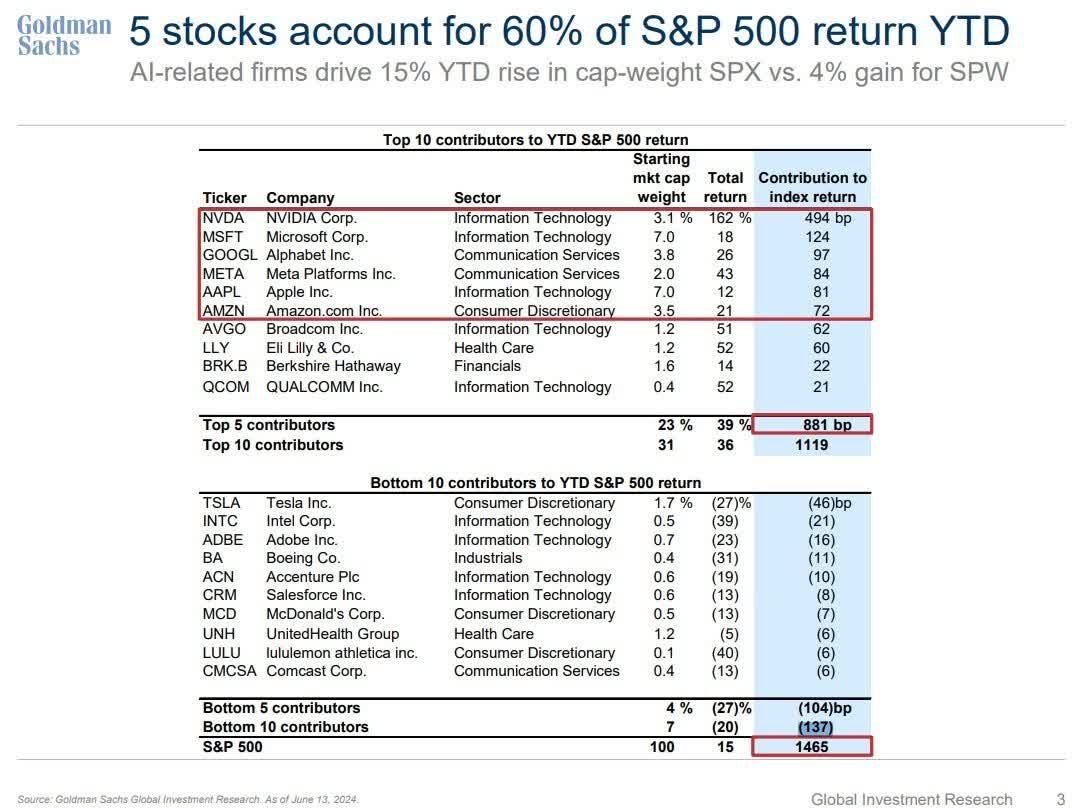

The market concentration at Mag-7 in 2024 (closer to Mag-6 since Tesla withdrew) is indeed remarkable, but likely unsustainable, at least in the short term.

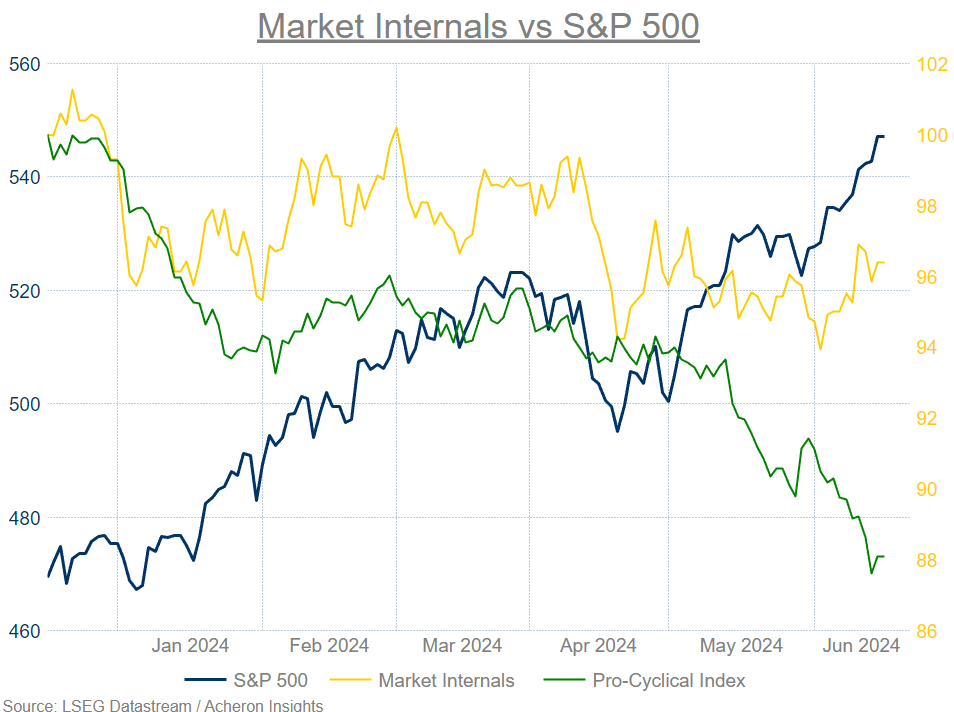

It’s not just market breadth that’s sounding the alarm. Other market internal indicators are also no longer supporting the index’s recent highs. As shown below, my market internal model and business cycle indicators have both diverged to the downside since early April.

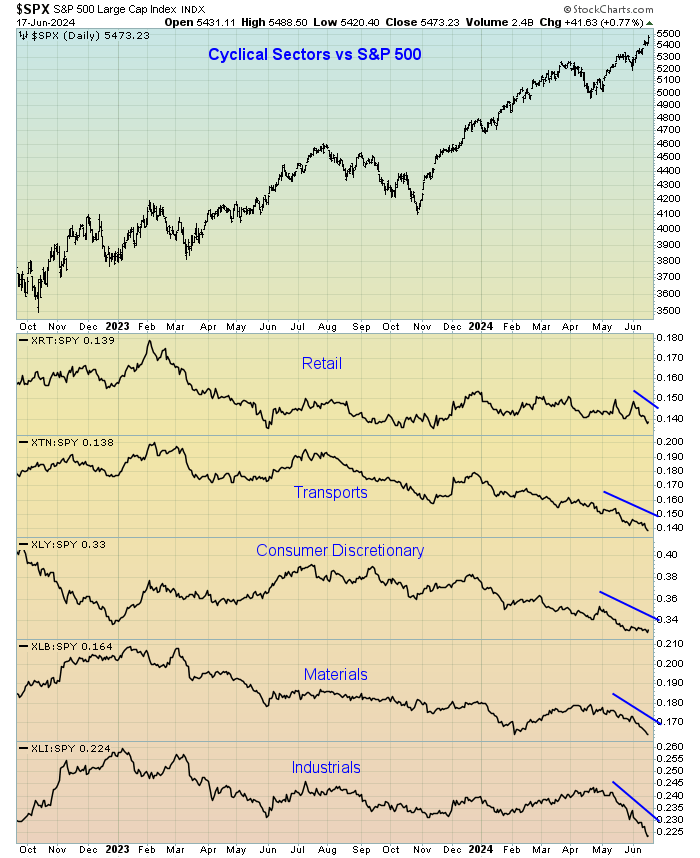

Cyclical sectors have significantly underperformed growth sectors, which is highlighted by the significant negative deviations in my Cyclical Index. As you can see in the chart below, which breaks down the index by constituents, the relative performance of retail, transportation, consumer discretionary, materials and industrials has all been poor.

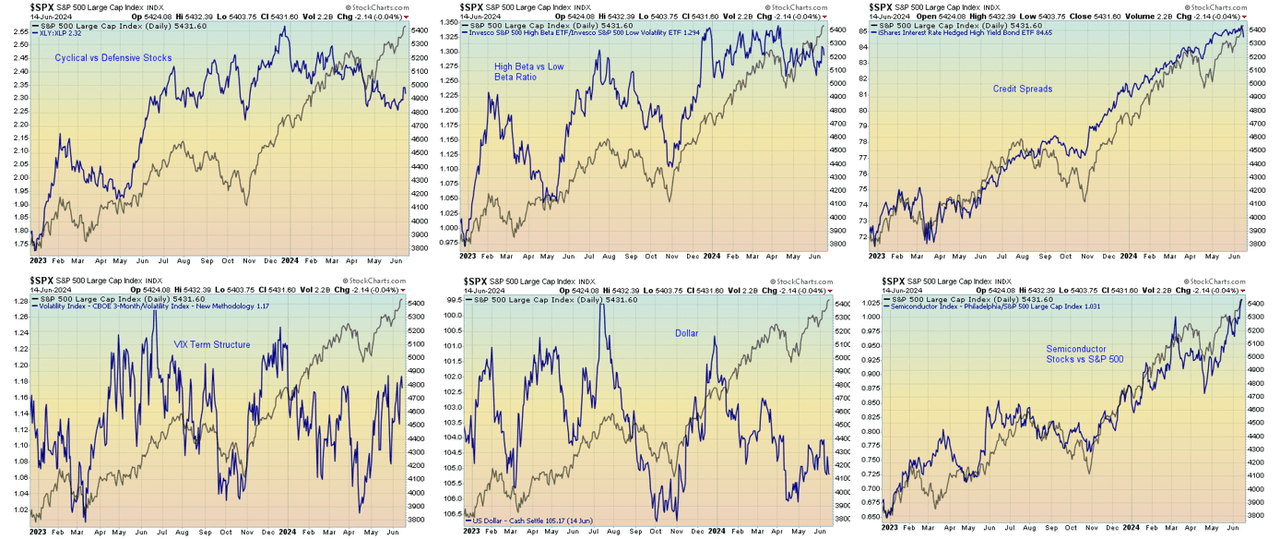

This is true across the market internals, however the negative deviations for the constituents within my market internal index are not uniform, unlike the procyclical index. Credit spreads and Semiconductors vs. S&P 500 are two internal indicators that continue to support this rally. Overall, the negative deviations seen in the cyclical vs. defensive ratio, high vs. low beta ratio, VIX term structure, and the dollar are noteworthy.

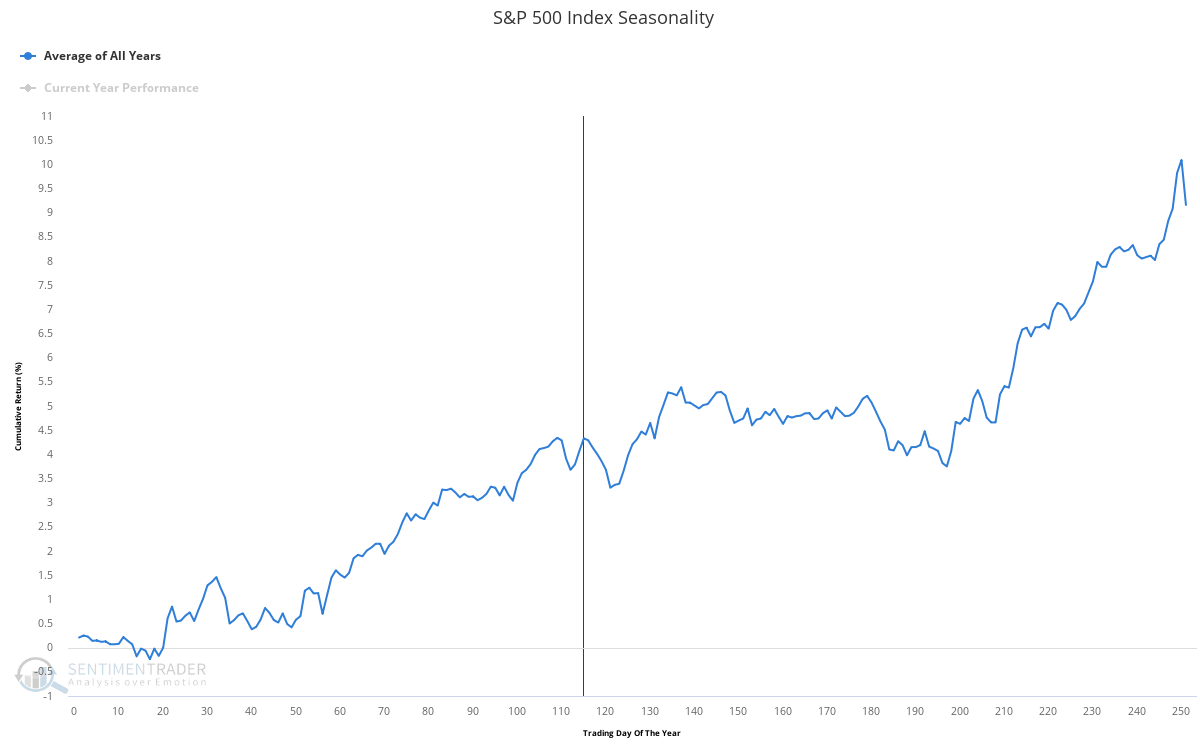

Seasonality may also have a negative impact in the short term. The latter half of June has generally been a disappointing period for equity markets, as has June through September overall. As we approach the “window of vulnerability” of options expiry from the 23rd onwards, there may be room for the index to correct this imbalance downwards, given the internal market weakness highlighted above.

It’s not all bad

It is clear that the market internals are currently very bad, but are the fundamentals enough to trigger a bear market? I don’t think so. It is true that the stock market is quite priced in, and the growth stocks and Mag-7 that dominate the Nasdaq and S&P 500 are ahead of the curve in terms of future earnings and business cycles, but the outlook for both remains relatively favorable for risk assets for the next 9 months or so. For this reason, I expect the next 3-4 months to be a period of range trading (where we may see some sort of 5-10% pullback) rather than a major correction or the start of a new bear market. The latter seems more likely to be the story for some time in 2025 than 2024.

The internal state of the market is worrying and will likely be corrected by a drop in prices. However, it is also true that many of the indicators of equity market health are relatively neutral, if not outright supportive. It is entirely possible that the cyclical areas of the market will simply catch up from here without the indexes correcting at all.

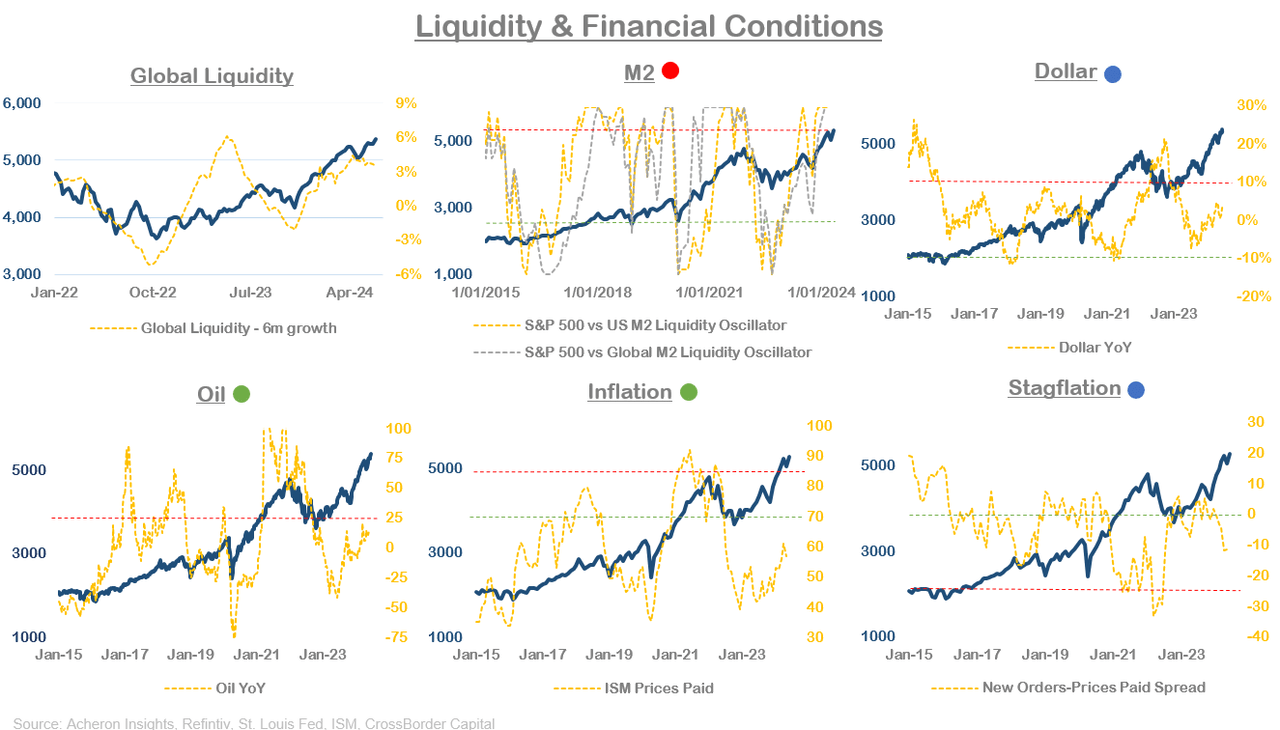

First, liquidity and financial conditions remain relatively favorable for risk assets. On the downside, global liquidity growth has stalled and equities are overbought relative to liquidity (so a short-term pullback or period of consolidation is likely). Meanwhile, oil prices, inflationary pressures and the dollar are not yet at worrying levels for risk assets.

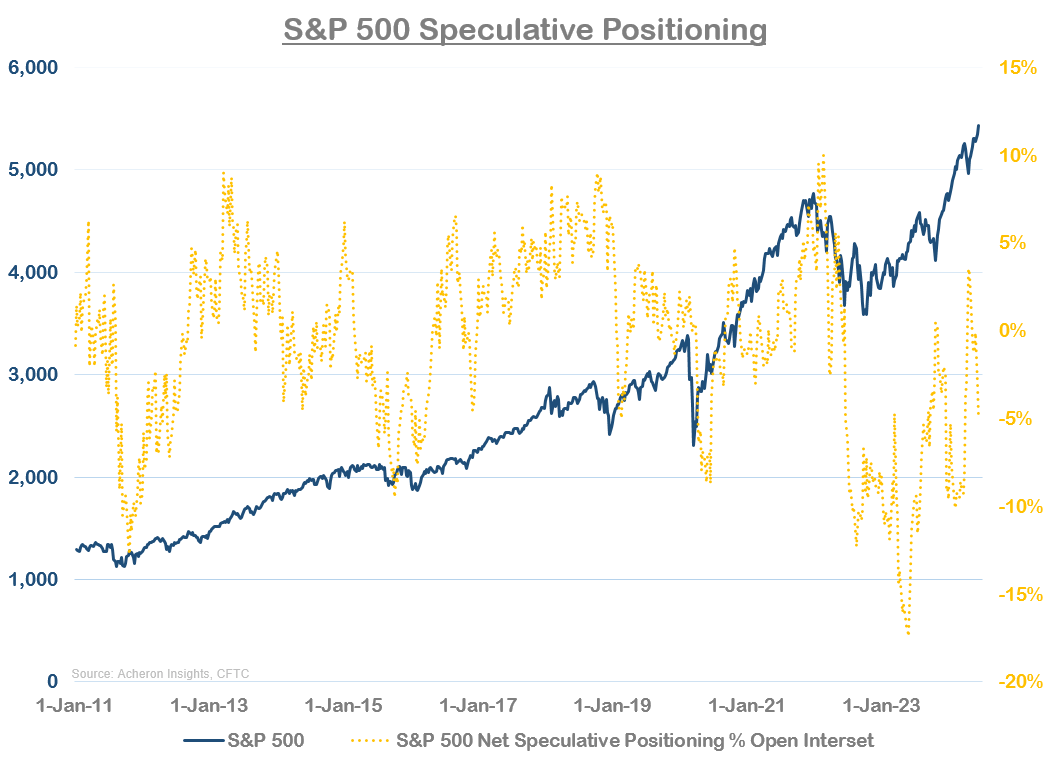

Meanwhile, total speculative positions in stocks have recently returned to more favorable levels as speculators have unwound their long positions over the past month or so. As long as investors are net short stocks, a major market peak is unlikely.

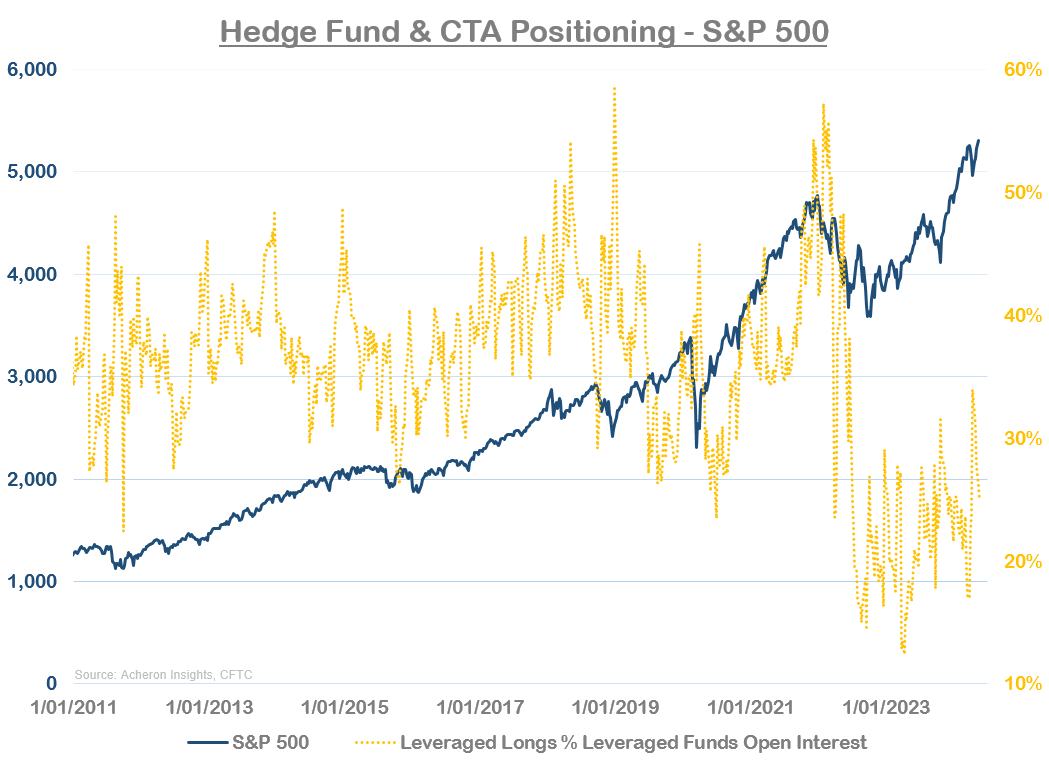

The category with the most underweight stocks is hedge funds. Hedge fund and CTA positioning briefly spiked last month, but hedge fund positioning has returned to levels best associated with market troughs, not peaks.

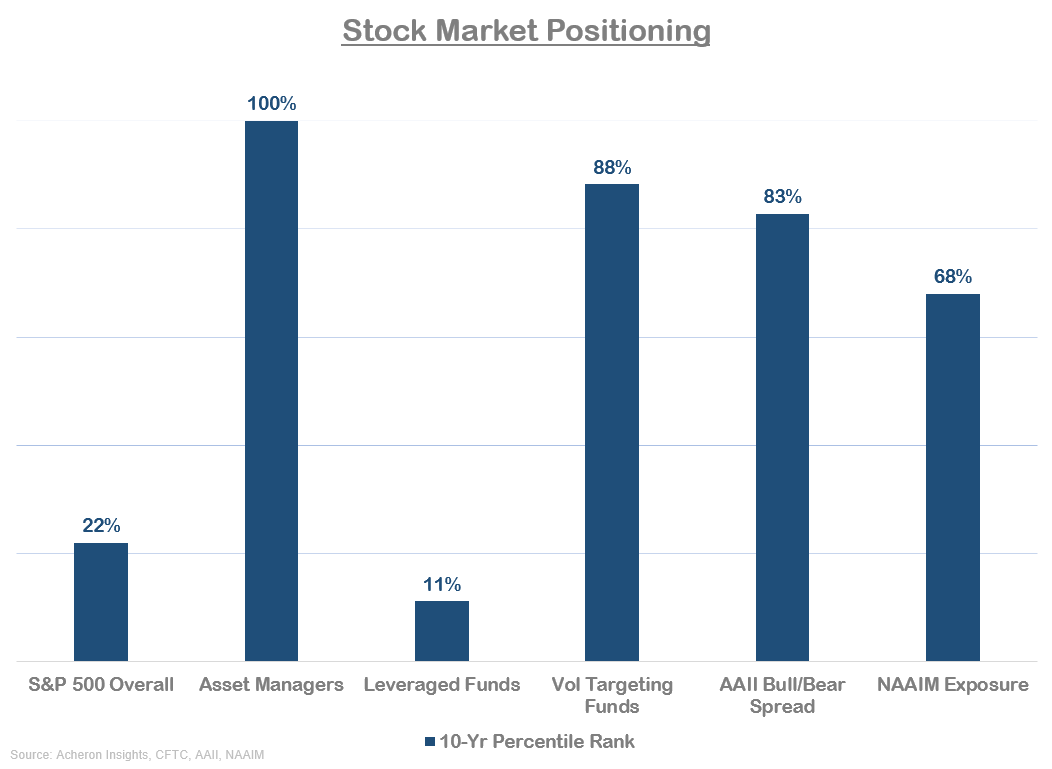

Several indicators of positioning and sentiment are at extremely high levels, including volatility targeted funds, asset managers and the AAII bulls/bears spread, but I think it would be hard to argue that we are nearing a major peak if speculative positioning and hedge fund positioning remains as it is.

This is especially true given the favorable business cycle and earnings environment for the market.

Perhaps the market (at least growth stocks) has priced this in and sentiment needs to clear in the front-running sectors of the market. It is possible that global stocks will outperform US large caps going forward. This may be an indication of the unfavorable conditions within the market.

Original Post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.