(Bloomberg) — The artificial intelligence boom helped drive a strong first half of the year for the U.S. stock market, and traders are betting the second half of the year will be just as strong, or even stronger.

Most read articles on Bloomberg

The S&P 500 has risen 14% since the start of January, its second-best performance so far this century, thanks to a recovering economy, improving corporate earnings and robust demand for AI-related companies. The rally comes despite signs of a slowdown and is being helped by the Federal Reserve, which is considering when to cut interest rates after the most turbulent monetary policy in decades.

A strong first half of the year for stocks has historically boded well for the rest of the year, but no one knows if that will be the case this year given several uncertainties ahead. One of them is the U.S. presidential election in November, which could send stocks tumbling. Another is the uncertainty over the direction of interest rate cuts.

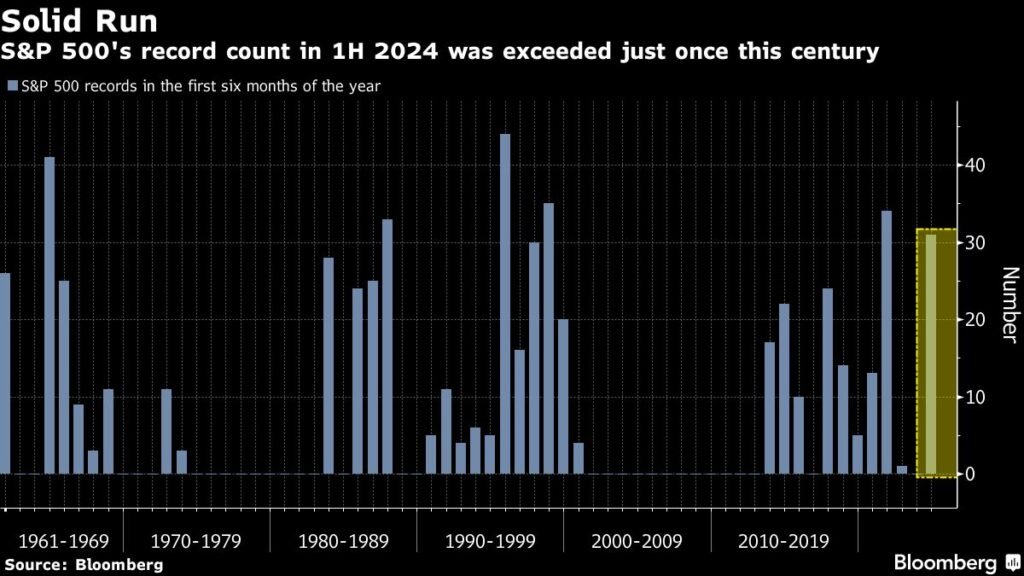

The S&P 500 index, which hasn’t seen more than 500 trading sessions since the start of the year and hasn’t recorded a record high since the beginning of the year, closed at an all-time high 31 times between January and June 2024. Only 2021 has topped that mark so far this century, according to data compiled by Bloomberg.

The current bull market in the S&P 500 has added over $16 trillion in market capitalization since the closing low of 3,577.03 on October 12, 2022. It is currently trading within reach of 5,500.

Information technology and communications services companies led the gains. These sectors are home to a handful of tech giants, including Nvidia, Microsoft and Meta Platforms. Information technology stocks are up 28% in 2024, while communications services stocks are up 26%.

Utilities stocks rose 7.6% as investors bet utilities will benefit from the rise of AI by powering data centers. Real estate was the only sector to lose money in 2024, its worst first-half performance relative to the broader index since its creation in the late 1990s, according to data compiled by Bloomberg. High interest rates have hurt the sector.

AI chipmaker Nvidia has been the biggest contributor to the S&P 500’s gains in 2024, up about 150% on a total return basis despite the recent selloff, followed by Constellation Energy, up about 72%, General Electric, Eli Lilly, and Micron Technology.

Walgreens Boots Alliance has been the worst performer, dropping 52% so far in 2024.

Nvidia maintained its lead in terms of index contributions, adding 218 points. Microsoft added 64 points, with Amazon.com Inc., Meta and Apple Inc. rounding out the top five. Tesla Inc. had the biggest decline with 17 points.

Some strategists say the tech rally looks overblown, with expensive valuations and just a handful of fast-flying stocks driving the market higher.

An equal-weighted version of the S&P, which doesn’t distinguish between company size, has underperformed the market-capitalization-weighted version by 10 percentage points since the beginning of January, its biggest underperformance through the first six months of the year.

I’ve never heard of it before.

Non-tech companies could drive the next upswing in stock prices, according to Jim Paulsen, the famed equity strategist who accurately predicted the S&P’s double-digit gains last year. During the past four bull markets since 1990, equal-weighted indexes outperformed major benchmarks by an average of 15 percentage points through the 20th month, according to Paulsen. Currently, equal-weighted indexes are lagging the S&P by 16 percentage points during that period.

When the S&P 500 index has a strong first half of the year, it typically follows it up for the remaining six months of the year: Since the early 1950s, the index has risen about 10% on average in the second half of the year after gaining at least 10% through June, according to data compiled by Bloomberg.

The market is historically weak in the first half of a U.S. presidential election year, but its January-to-June gains are its second-best since 1928, according to Ned Davis Research. There’s room for the S&P to fall 5% to 8% in the coming weeks as stocks buck seasonal patterns, said Jeffrey Hirsch, editor of Stock Trader’s Almanac, who accurately predicted the rally following the 2008 global financial crisis.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP