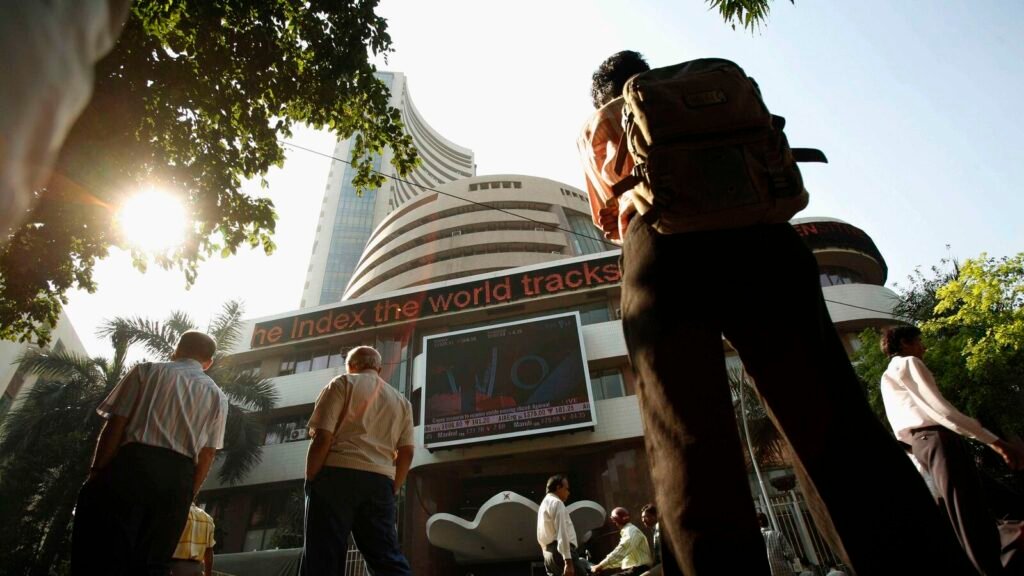

Stock Market Today: Indian stock market indices closed in positive territory on Wednesday, June 12, mainly due to positive global economic signals.

Most major European and Asian markets rose today on optimism that US inflation data showed signs of easing and that Federal Reserve Chairman Jerome Powell will provide his view on when interest rates might start to be cut in the US.

Investors were awaiting the May Consumer Price Index (CPI), a key U.S. inflation gauge, and a Federal Reserve policy decision that is expected to influence the near-term interest rate outlook.

Related article: US Fed policy today: From job market trends to macro indicators – 5 key factors troubling the Fed

Domestically, the Union Budget will be the next big trigger but experts say the stock market is likely to remain range bound until then.

The Sensex index opened at 76,679.11 against the previous close of 76,456.59 and rose 594 points to hit an intraday high of 77,050.53, just 29 points below its all-time high of 77,079.04 touched on Monday, June 10. The index ended at 76,606.57, up 150 points or 0.20 percent, with 19 stocks leading the way.

Shares of Power Grid, Tech Mahindra and Bajaj Finance were the top gainers in the index, while Mahindra & Mahindra, Hindustan Unilever and Infosys were the top losers in the index.

The Nifty 50 opened at 23,344.45 against previous close of 23,264.85 and hit an all-time high of 23,441.95 during the trade. The index ended at 23,322.95, up 58 points or 0.25 per cent, with 32 stocks advancing and 18 declining.

Midcap and smallcap stocks continued to perform well with the BSE Midcap index rising 1.07% and the Smallcap index gaining 1.06%.

The market capitalization of companies listed on the BSE is approximately ₹Approximately 4,293,000 crores ₹4.27 lakh crore in the previous session, investors ₹200,000 crores in a single day.

As many as 250 stocks, including Bharti Airtel, Hero MotoCorp, Bajaj Auto, Ashok Leyland, Bharat Forge, Tata Steel, Federal Bank and UltraTech Cement, hit fresh 52-week highs in intraday trade on the BSE.

Also read: Market close highlights: Indices fall from intraday highs: Sensex up 150 points, Nifty ends at 23,322; Mid and small caps perform well

Today’s Top Nifty 50 Gainers

Shares of Coal India (up 2.78 per cent), Power Grid (up 2.43 per cent) and Eicher Motors (up 1.81 per cent) ended as the top gainers on the Nifty 50 index.

Related article: Coal India up 113% in 10 months, 235% in 3 years: What’s next for this state-owned stock?

Top decliners in Nifty 50 today

Shares of Mahindra & Mahindra (down 1.37%), Britannia (down 1.26%) and Hindustan Unilever (down 0.97%) were the biggest losers in the index.

Also Read: Top Gainers And Losers Today, June 12, 2024: Some of the most active stocks include Coal India, Power Grid Corporation Of India, Mahindra & Mahindra, Britannia Industries etc. You can see the complete list here.

Today’s Sector Indexes

All sectoral indices ended higher except Nifty FMCG (down 0.51 per cent), Auto (down 0.05 per cent) and Realty (down 0.04 per cent).

Nifty Media (up 1.89 per cent), PSU Bank (up 1.16 per cent), Healthcare (up 0.84 per cent) and Oil & Gas (up 0.83 per cent) were among the sectors that recorded significant gains.

Nifty Bank rose 0.38 per cent and the private bank index ended 0.39 per cent higher.

Expert Market Insights

Vinod Nair, head of research at Geojit Financial Services, said global markets remained broadly positive ahead of the US inflation data and the FOMC meeting.

“Though the consensus is that US inflation will stabilise, the trajectory of potential rate cuts will be crucial for future direction as interest rate cut expectations have eased to two from three previously. In the domestic market, expectations for a growth-focused final budget are trading at new highs, further boosted by the Reserve Bank of India’s upward revision of GDP growth forecast,” Nair said.

Nifty 50 Technical Analysis

According to Shrikant Chauhan, head of equity research at Kotak Securities, the Nifty 50 failed to sustain above 23,400 due to profit booking. A small bearish candle on the daily chart indicates that profit booking is likely to continue in the near future.

“Though the short-term market situation is good, a fresh uptrend rally is possible only after a break below 23,400/77,000. After breaching 23,400/77,000, the market can rise to 23,500-23,525/77,300-77,400,” Chouhan said.

“23,200/76,300 is a key support level for intraday traders and a break below this may see traders preferring to exit long positions. A break below 23,200/76,300 could see the market decline to 23,050-23,000/76,000-75,800,” Chouhan said.

Ajit Mishra, senior vice-president, research, Religare Broking, said in case of a dip, he expects the Nifty 50 to remain in the 23,000-23,100 zone, while the 23,600-23,800 zone may act as immediate resistance.

“After three days of consolidation, the market is expected to react to the outcome of the US Fed meeting in early trade on Thursday, which could set the tone for the day. We again recommend focusing on sectors and themes that have consistently garnered interest and looking for buying opportunities on the dips,” Mishra said.

Find all market news here

Disclaimer: The views and recommendations expressed are those of the individual analysts, experts and brokerage firms and not of Mint. You are advised to consult a qualified professional before making any investment decisions.

3.6 Million Indians visited us in a single day and chose us as their platform for Indian general election results. Check out the latest updates here!