Major stock indexes tried to turn positive but struggled on Tuesday after Federal Reserve Chairman Jerome Powell spoke about the future direction of monetary policy. Tesla (TSLA) surged as deliveries beat expectations, Amazon (AMZN) remained steady despite the bullish outlook; and Super Microcomputer (SMCI) saw strong gains early on in the stock market today.

↑

X

Monthly Market Report: June 2024 by Jim Roeppel and Alisa Coram

The Dow Jones Industrial Average fell 0.1%, while the tech-heavy Nasdaq Composite Index rose 0.1%. ON Semiconductor (ON) performed well, rising more than 2%.

Meanwhile, the S&P 500 was close to breaking even. Artificial intelligence company Supermicro Computer was the standout, rising about 3%. Eli Lilly However, (LLY) lagged behind, falling about 3%.

S&P 500 sectors were mixed, with consumer discretionary and real estate performing the best, while technology and healthcare were the worst performers.

Small caps rose after yesterday’s decline, with the Russell 2000 up 0.2%. However, the Innovator IBD 50 ETF (FFTY) struggled, dropping 0.7% on the stock market today.

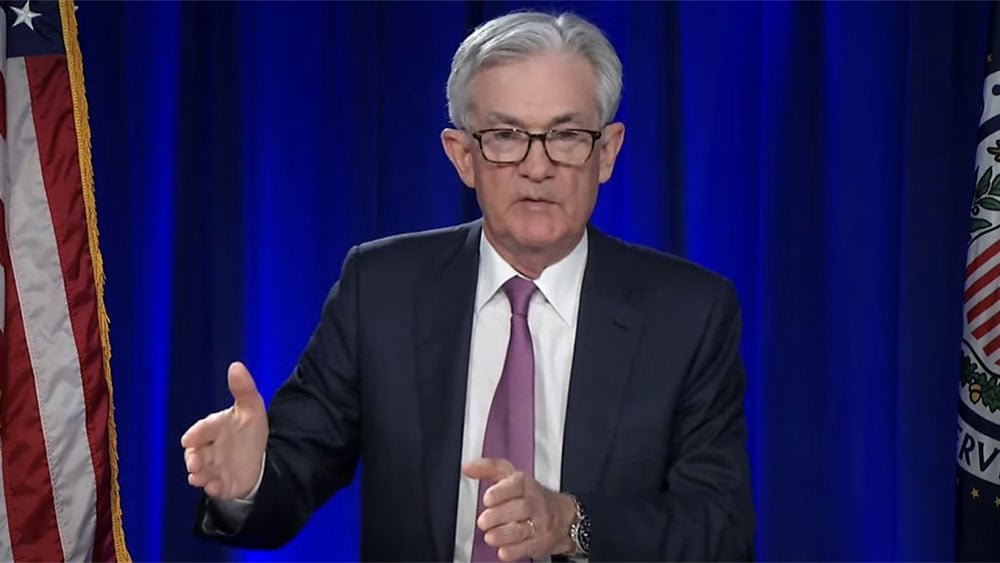

Fed Chairman Powell speaks

Speaking at a European central bank forum on Tuesday about the future direction of interest rates, Fed Chairman Jerome Powell said “significant progress” has been made in lowering both core and headline inflation.

“There was a lot that we didn’t know when we were sitting here last year,” Powell said. “We didn’t know that we would be entering a seven-month period of significantly lower inflation, and we didn’t realize that the second half of last year would be an extraordinary year both from a growth perspective and also from a labor perspective. That’s why things worked out in such a remarkable way in the second half of last year.”

He said the U.S. economy will “continue to show solid growth” in the first half of 2024 and that “the labor market remains strong, but labor market balancing continues.” He also said inflation is likely to return to deflationary trends after a lull in the first quarter.

“I think the last reading, and to a lesser extent the previous reading, suggests that we are getting back on a disinflationary trajectory. We want to have more confidence that inflation is declining sustainably toward 2 percent before we begin the process of easing policy,” Powell said. “What we would like to see is more of the kind of data that we’ve seen recently. We would also like to see continued strength in the labor market. We have said that if we see an unexpected weakening in the labor market, we may need to respond to that as well.”

Dow Jones Today: Apple shares surge

Apple was the best performing stock in the Dow Jones Industrial Average, rising nearly 1%. The company’s shares are currently trading above a cup base entry of 199.62.

3M (MMM) and Honeywell International (HON) also performed well in the closely watched index.

Nike (NKE) was the biggest loser, down about 2% as it continues to struggle following a dismal earnings report. Verizon Communications (VZ) also fell, down more than 1%.

Stock market today: Tesla surges as delivery figures beat expectations

Tesla bears were licking their wounds early on, as Tesla shares rose nearly 5% after the company’s deliveries beat analyst expectations.

The electric vehicle giant reported 443,956 deliveries in the second quarter, well above expectations of 420,000 to 425,000. That beat Wall Street expectations but fell short of the 466,000 EVs delivered in the second quarter of 2023.

Tesla also announced Tuesday that it deployed 9.4 gigawatt hours of energy storage products in the second quarter, its largest quarterly deployment to date.

Tesla shares are currently trading up from a buy point of 191.08, with the buy range rising to 200.63, according to chart analysis from MarketSurge. The stock has been rising ahead of a major announcement, with the stock having risen over the past five sessions.

Amazon nears AI ‘tipping point’

Meanwhile, Mizuho Securities analyst James Lee named another stock in the Magnificent Seven, Amazon, as his “top pick” in a client note. Lee set a price target of $240 for Amazon.

“The Gen-AI project is approaching a tipping point, with the external model commercially deployable within six months,” Li said in the memo.

Given the company’s large customer base, “we should see a significant acceleration of inference activity,” he predicted, boosting his confidence in the company’s cash cow, Amazon Web Services.

Amazon shares were roughly flat on the stock market today. They are trading in a buy zone above a flat base entry at 191.70.

The stock has an overall rating of 93 from Investor’s Business Daily and is included in the prestigious IBD Leaderboard list of top growth stocks.

Stock Market Today: Stocks Near Buy Points

Financial Software Play Alkami Technology (ALKT) is approaching a cup base entry at 29.29, according to MarketSurge analysis.

The stock holds a near-perfect IBD Composite Rating of 98. Its earnings track record is strong, with an earnings per share rating of 80 out of 99. Its price performance over the past 12 months places it in the top 5% of stocks.

Major banks Goldman Sachs (GS) is approaching a flat base entry at 471.48 in the stock market today. The relative strength line is rising again after a drop.

Overall performance has been strong, earning it an IBD Composite Rating of 97. Big Money has been on a buying spree of shares recently, giving it an Accumulation/Distribution Rating of B-.

Follow Michael Larkin on X (formerly Twitter). translator For a more in-depth analysis of growth stocks, see here.

You may also like:

Stock Market Holidays 2024: Market Schedule for July 3rd, 4th, 5th

Stock Market Prediction: AI Investment and 4 Other Predictions

The 5 best stocks to buy and watch now

Join IBD Live every morning to get stock tips before the market opens

This is the ultimate Warren Buffett stock, but should you buy it?