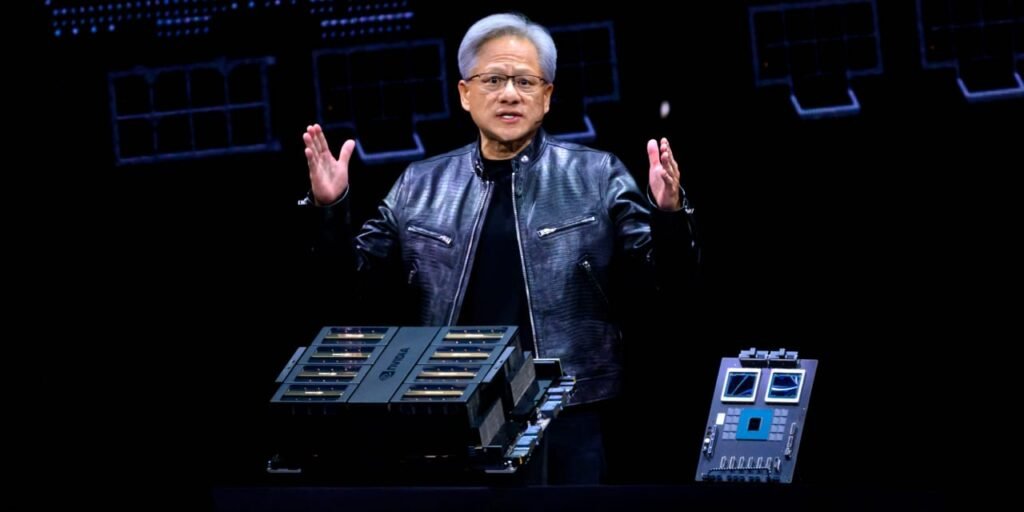

Is this Nvidia?

of

Is there nothing else in the world and you’re just living in it? It’s hard to escape that feeling when it seems like the only stock that matters in the market.

It fell 0.7% on Thursday.

S&P 500 Index

Meanwhile, the AI chipmaker surged 9%, adding a record $277 billion to its stock market value after a long-awaited earnings report that beat even the most optimistic forecasts. That gives NVIDIA a valuation of $2.59 trillion, surpassing Amazon and Tesla combined and making it the third-most valuable company behind Microsoft and Apple.

,

The figures were $3.06 trillion and $2.85 trillion, respectively.

Still, the U.S. large-cap index fell on the day. In fact, of the 65 tech stocks in the S&P 500, only 10 rose in lockstep with Nvidia on the day, Jeff DeGraaf, chairman and head of technical research at Renaissance Macro Research, noted in a podcast on Friday. Additionally, the S&P experienced an outside-day reversal, in which the index closed higher than the previous day but lower on the lows.

That doesn’t necessarily indicate a market top, but it does indicate a technical overbought condition that typically signals a short-term correction. “I won’t go into it any further, but it does suggest that the news was expected but ended up being sold and not bought,” he said in an email.

However, this is the result of the S&P 500 and

Nasdaq Composite Index

Friday, and

Dow Jones Industrial Average

“But history shows that narrow stock market rallies can last for years,” said Jonas Golterman, deputy chief market economist at Capital Economics. “This was the case both in the dot-com bubble of the 1990s and the ‘Big Tech’-led rally of the late 2010s,” he wrote in a client note.

Advertisement – Scroll to continue

On the technical side, some worrying inconsistencies have also emerged. In particular, transportation stocks have been a notable laggard. According to Dow Theory, transportation stocks should support the movements of industrial stocks because they have to ship what industrial stocks produce. However, the Dow Jones Industrial Average has been flat, even though it rose to the 40,000 level last Friday.

While the Dow Theory is deeply rooted in history, Yardeni Research says the disconnect between transportation and the broader market could reflect the growing importance of services and technology in the U.S. economy. “Businesses don’t need trucks to provide cloud computing or streaming services,” the firm said.

Quincy Krosby, chief global strategist at LPL Financial, says some analysts have suggested semiconductors have replaced transportation as a better reflector of the broader economy because they are integrated into nearly every component of it. He says both semiconductors and transportation are bellwethers of economic activity. The airline industry is doing well, as evidenced by a record 3 million Americans expected to fly over Memorial Day weekend. Meanwhile, trucking and rail volumes are flat to down as inventories draw down.

Advertisement – Scroll to continue

But what most rattled the stock market last week was the spike in Treasury yields after the Federal Reserve again delayed its expected cut in its target for the federal funds rate. The latest jobless claims numbers suggested the labor market is holding up after a statistical anomaly a few weeks ago, and preliminary May purchasing managers’ indexes showed strength in both manufacturing and services.

By the end of the week, the CME FedWatch tool was pricing federal funds rate futures at just one 0.25 percentage point cut this year from the current target range of 5.25% to 5.50%. Futures traders don’t expect a second cut until the policy meeting in late January, rather than mid-December as previously expected.

With Treasury yields well above 5% and two-year Treasury yields just below 5%, investors could choose to stay out of the stock market for risk-free short-term debt for the rest of 2024 and enjoy returns on par with what Wall Street strategists expect.

Advertisement – Scroll to continue

The median year-end target of S&P 500 strategists is 5,400, just 1.8% above Friday’s closing price of 5,304.72, according to Morningstar. Even factoring in the S&P’s 12-month dividend yield of 1.35%, the six-month T-bill yield of 5.38% (both annualized) matches the strategists’ median target, but investors don’t have to deal with the uncertainty of what will happen ahead of the November election.

Did someone say they would sell in May?

Write Randall W. Forsyth randall.forsyth@barrons.com