Guangzhou, China, June 17, 2024 /PRNewswire/ — On June 13thNumberIn 2019, the Science and Technology Innovation Board (STAR Market) celebrated its fifth anniversary. STAR Market is positioned as a platform for providing high-level science and technology fulfillment, accommodating enterprises in strategic emerging industries such as new generation IT, high-end equipment manufacturing, new materials, energy conservation and environmental protection, new energy, and biomedical, contributing to new high-quality production capacity.

Industry Index Share

In the past five years, 573 companies have been listed on the STAR Market. $125.5 billion Through the IPO, the total market capitalization is $703 billion,the current June 12NumberCompanies on the STAR list achieved total operating revenues according to their quarterly reports. $41.2 billionUp 4.6% year-over-year, 67% of companies achieved positive revenue growth in Q1 2024.

Meanwhile, the STAR Market index system has been steadily improved. Since the launch of the first STAR Market index, the SSE STAR 50 Index, in 2020, there are now more than 15 indexes tracking the performance of the STAR Market, and the total assets under management of related products have reached 100. $22 billionAdditionally, products such as the E Fund STAR 50 ETF (symbol: 588080) are included in the ETF Connect program to assist foreign investors seeking exposure to innovation-driven technology companies.

Large asset management companies are actively participating in providing diversified investment tools to investors. Notably, E-Fund Management (“E-Fund”), India’s largest asset management company, Chinacontinued to expand its ETF lineup, including the E Fund STAR 50 ETF, E Fund STAR 100 ETF (code: 588210) and E Fund STAR Growth ETF (code: 588020).

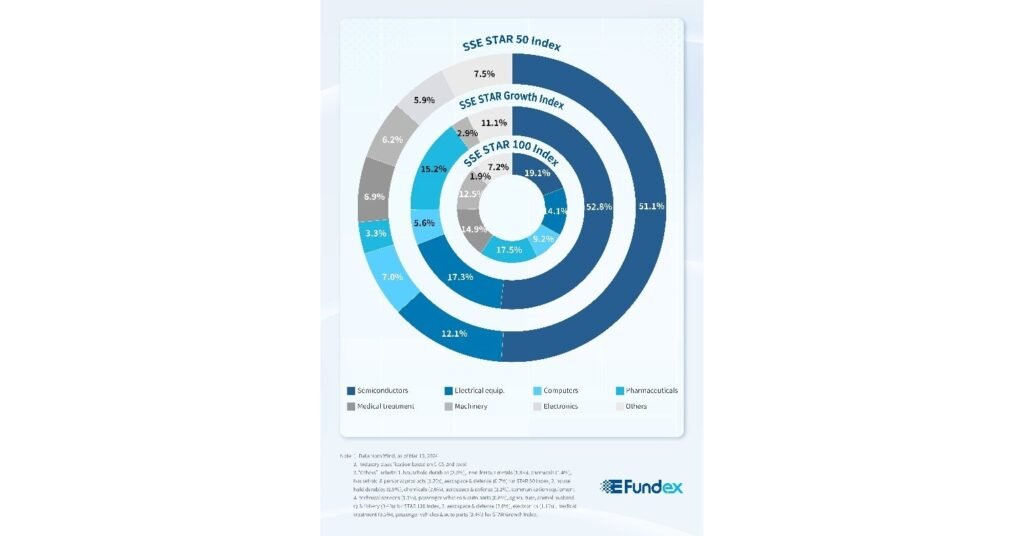

The SSE STAR 50 index is comprised of companies with an average market capitalization of $6.4 billionThe SSE STAR Growth Index highlights the growth potential of its constituent stocks and selects 50 stocks with the highest growth rates in operating revenue and net profit.

The SSE STAR 100 Index is composed of 100 mid-cap stocks excluding those in the STAR 50 Index. Unlike the SSE STAR 50 Index and the SSE STAR Growth Index, which are concentrated in the semiconductor sector, the SSE STAR 100 Index is diversified across a wide range of industries, with the top five industries of semiconductors, pharmaceuticals, medical, electrical equipment, and machinery having very close weightings, together accounting for approximately 80%.

About E-Fund

E-Fund Management Co., Ltd. (hereinafter referred to as “E-Fund”) was established in 2001. China close 3.2 trillion yuan ($450 billion* E Fund’s clients include both individuals and institutions, such as central banks, sovereign wealth funds, social security funds, pension funds, insurance companies, reinsurance companies, corporations and banks. Long-term oriented, E Fund has been focusing on the investment management business since its inception and believes in the power of thorough research and time in investment.

Photo – https://mma.prnewswire.com/media/2439835/image_826259_7046011.jpg

Logo – https://mma.prnewswire.com/media/2085383/_Logo.jpg