(Bloomberg) — Wall Street traders pushed stocks to record highs as signs of tepid inflation boosted confidence that the Federal Reserve could start cutting interest rates later this year.

Most read articles on Bloomberg

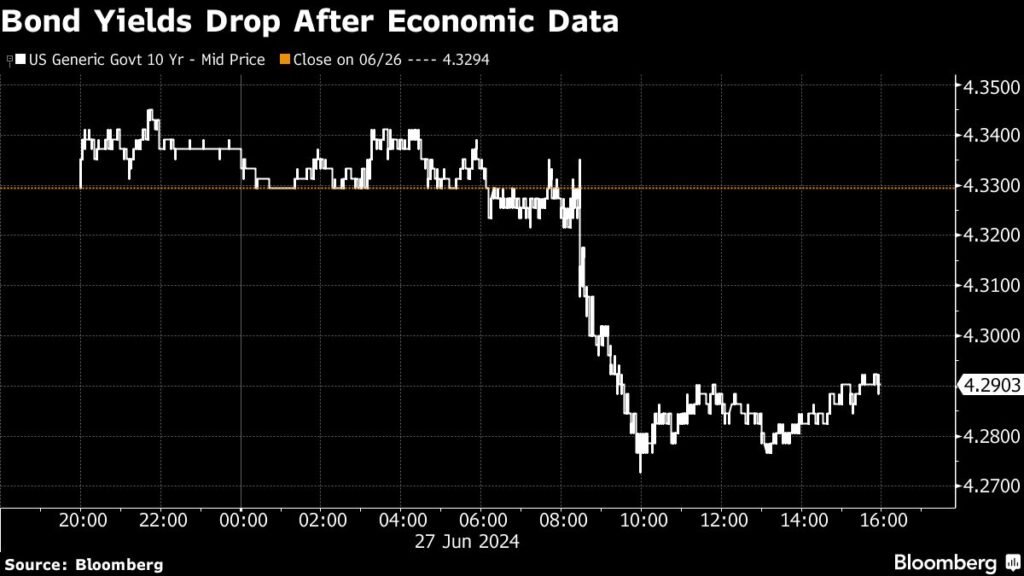

Stocks have continued to rise this year, with the S&P 500 Index topping 5,500 on gains in the most influential technology stocks. The Nasdaq 100 Index is hovering near the historic 20,000 point mark, on track for its best month of 2024. Two-year Treasury yields, sensitive to impending Fed action, have fallen. Swap traders expect nearly two rate cuts this year, with a quarter-point cut fully priced in by November. Expectations for a September rate cut have also risen.

U.S. consumer sentiment fell less than initially expected on hopes that inflationary pressures would ease. The Fed’s favorite measure of underlying U.S. inflation slowed. Household spending picked up and incomes grew robustly, raising hopes that price pressures can be contained without causing lasting harm to consumers.

“It’s a relief that today’s PCE number wasn’t a surprise and will be welcomed by the Fed,” said Seema Shah at Principal Asset Management. “But the policy direction is still uncertain. A further slowdown in inflation, and ideally further evidence of a softening labor market, will be needed to pave the way for the first rate cut in September.”

San Francisco Federal Reserve President Mary Daly told CNBC that the latest inflation data shows monetary policy is working, but it’s too early to tell when it’s appropriate to lower borrowing costs. Earlier on Friday, Richmond Fed President Thomas Barkin said the battle against inflation has not yet been won and that the U.S. economy is likely to remain resilient as long as unemployment remains low and asset valuations are high.

The S&P 500 has increased 15% this year. Nvidia led the gains among large-cap stocks. Nike fell nearly 20% on its disappointing outlook. The 10-year Treasury yield was little changed at 4.29%.

“Core PCE, the Fed’s preferred inflation measure, is very encouraging,” said Sonu Varghese of the Carson Group. “We expect the Fed to cut rates at least twice this year, probably starting in September.”

Quincy Krosby of LPL Financial agrees that the recent data strengthens the likelihood of a September rate cut. Additionally, the better-than-expected personal income numbers suggest that rising consumer preferences across income levels are dampening spending, but that it may continue to grow, albeit at a slower pace.

“Every data release is immediately reflected by the markets in how the Fed views future policy, so today’s report is clearly positive for a data-dependent yet still cautious Fed,” she added.

Julian Howard of GAM Investments said hopes that the announcement would provide a clearer path to monetary easing are likely to be tempered given movements in the underlying components of policy: transportation and health care have shown signs of cooling, while spending on goods such as software and autos has held firm.

“The Fed can take some solace in the fact that the year-on-year figures are at least lower, but for inflation to fall adequately to its 2% target level, American consumers will need to cut back on their spending,” Howard added.

Stuart Paul of Bloomberg Economics is skeptical that the deflationary process will be sustainable, saying the slow-moving, static core services sector is likely to drive up inflation later this year.

“If the process of containing inflation stalls after the summer, further weakening of the labor market would be needed to lead to two rate cuts this year, rather than the one suggested in the FOMC’s latest Economic Outlook Overview,” he said.

Other comments on PCE:

For the second straight month, evidence suggests the first quarter was likely a “challenging period” following significant deflation late last year, and the Fed likely won’t need to take many steps before it starts to cut interest rates and ease pressures on the economy.

PCE data confirms that disinflationary real incomes are rising, which is huge for a soft landing scenario. Core PCE is currently below the average SEP forecast of 2-3 rate cuts over the next 12 months. The Fed has given the green light to cut rates.

Weak inflation data will strengthen the case for the Fed to begin cutting interest rates in the coming months. As long as incomes grow at a healthy pace, consumers will continue to spend. The key is the labor market, and attention should turn to nonfarm payrolls next week for a fresh look at the job market.

The July meeting is likely too early for the Fed to feel confident enough to cut rates, but barring any major upside surprises in the summer CPI and PCE reports could set the stage for a September rate cut and put the Fed on track to cut rates one or more times this year, while several better-than-expected reports would likely delay the Fed’s first rate cut of the cycle.

The May PCE data was fully in line with expectations, and the market is interpreting this as a development in inflation and a case for a first rate cut in September, but the Fed will likely continue to urge patience and seek further data to show that inflation is trending toward 2%.

Divergence between the Fed and market expectations regarding the timing of the first rate cut will continue to cause volatility in bond markets.

Company Highlights:

-

Uber Technologies Inc. and Lyft Inc. have agreed to a set of worker benefits to resolve a long-running Massachusetts state lawsuit challenging their drivers’ independent contractor status, ending the companies’ efforts to put the issue before voters in November.

-

Microsoft’s $13 billion investment in OpenAI is likely to attract further scrutiny from the European Union’s antitrust watchdog, which is set to question rivals about the AI company’s exclusive use of Microsoft cloud technology.

-

Nokia has agreed to buy Infinera for $2.3 billion, expanding its data center networking products and strengthening its presence in the United States, a potential source of growth as the artificial intelligence boom increases demand for server capacity.

Some of the key market developments:

stock

-

The S&P 500 was up 0.7% as of 10:23 a.m. New York time.

-

The Nasdaq 100 rose 1%

-

The Dow Jones Industrial Average rose 0.5%.

-

The Stoxx Europe 600 index was little changed

-

The MSCI World Index rose 0.5%.

currency

-

The Bloomberg Dollar Spot Index fell 0.1%.

-

The euro was little changed at $1.0703

-

The British pound was little changed at 1.2636 to the dollar

-

The Japanese yen rose 0.2% to 160.48 yen to the dollar.

Cryptocurrency

-

Bitcoin fell 0.6% to $61,060.51.

-

Ether fell 0.3% to $3,430.45.

Bonds

-

The yield on the 10-year Treasury note was little changed at 4.29%.

-

German 10-year government bond yields rose 3 basis points to 2.47%.

-

UK 10-year government bond yields rose 2 basis points to 4.15%.

merchandise

This story was produced with assistance from Bloomberg Automation.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP