(Bloomberg) — Stocks are losing momentum at the end of a strong quarter, with traders keeping a close eye on news about the U.S. presidential election and remaining cautious ahead of France’s election on Sunday.

Most read articles on Bloomberg

Traders are Joe Biden Donald TrumpBiden’s shaky performance stoked sentiment about Trump’s chances of securing a second term. Some groups that could benefit if Trump is reelected, such as private prisons, oil and health insurers, rose, while renewable energy and marijuana stocks fell. The Treasury yield curve also steepened after the presidential debate.

“It’s a very bad night for Biden,” said Libby Cantril at Pacific Investment Management. “The biggest takeaway from last night for the market is that deficits will likely remain high and tariffs will likely rise, especially if Trump is elected. The question is when this is priced into the market.”

After rising nearly 1% on Friday, the S&P 500 fell to around 5,460. Longer-term Treasuries mostly underperformed shorter-term Treasuries. Bonds had risen earlier as inflation data stoked speculation of a Federal Reserve rate cut. The dollar edged lower, ending a six-week winning streak.

Big U.S. banks announced late-night increases to dividends to investors after easily passing the Federal Reserve’s annual stress test earlier this week.

Goldman Sachs Group Inc.’s Scott Rabner said investors will be bracing for market volatility later this year due to the U.S. presidential election and its aftermath.

“I plan on reducing my exposure here after the 4th of July,” Rubner wrote.

Andrew Brenner of NatAlliance Securities reiterated his comments that a Trump victory in the debate would put pressure on the long end of the bond market.

“That’s a big rate hike,” Brenner said. “Again, we don’t like to talk politics, but everyone thinks Trump won the debate because of Biden’s weak performance. How tariffs, indifference to the deficit (in both parties) and continued concerns about rising Treasury issuance will affect the yield curve…Rate hikes will spike…That’s what we saw today.”

For Barclays ratings strategists watching Thursday night’s presidential debate, the trade was clear: Buy an inflation hedge in the Treasury market.

With the growing likelihood that Trump will defeat Biden in the November election, markets “should be pricing in substantial risks of above-target inflation over the next few years, which already provides structural value from our starting point of view,” Barclays strategists Michael Pond and Jonathan Hill said in a note.

Marko Kolanovic of JPMorgan Chase & Co. sees the S&P 500 index struggling in the coming months amid growing headwinds, including a slowing economy and earnings downgrades, and sees the index plummeting to 4,200 by the end of the year, about 23% down from current levels.

Stocks are heading into the second half of the year up nearly 15%, and historically, strong first-half years have tended to produce above-average returns in the second half, too, says Adam Turnquist of LPL Financial.

“Elevated valuations, overbought conditions and narrow market breadth suggest a temporary lull in the market ahead, but seasonal trends suggest momentum may continue into the second half of the year,” he said.

Following positive first-half returns, the S&P 500 posted an average gain of 6% in the second half of the year, Turnquist added. Moreover, when the first-half gain was 10% or more, the index posted an average gain of 7.7% in the second half, resulting in positive results in 83% of cases.

In early trading, traders were keeping a close eye on economic data.

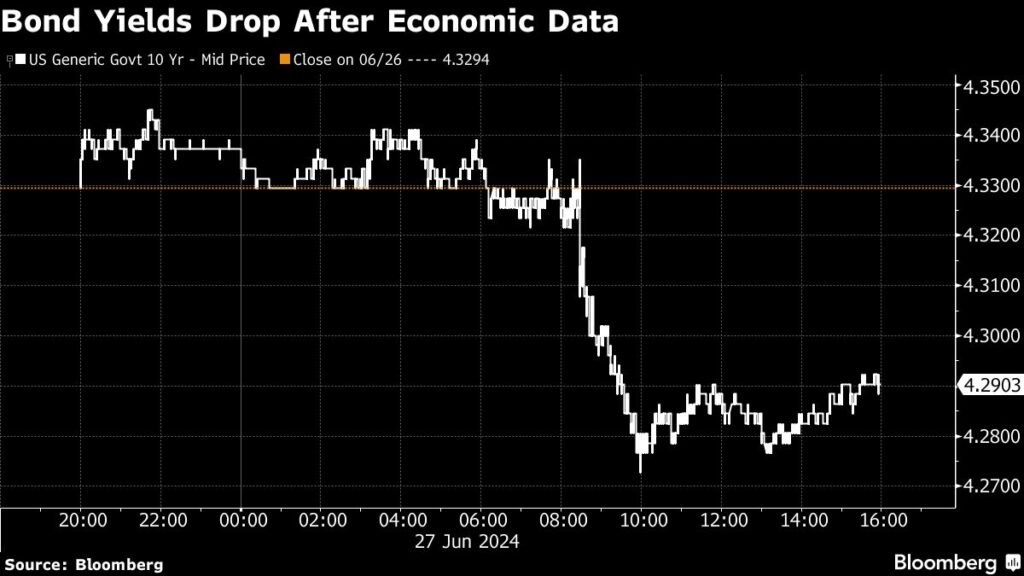

U.S. consumer sentiment fell less than initially expected on hopes that inflationary pressures would ease. The Fed’s favorite measure of underlying U.S. inflation slowed. Household spending picked up and incomes grew robustly, raising hopes that price pressures can be contained without causing lasting harm to consumers.

“From a market perspective, today’s PCE report was near perfect,” said David Donabedian of CIBC Private Wealth US. “The Fed’s favorite inflation gauge not only showed that inflation is moving toward the Fed’s inflation target, but that the economy is resilient. Consumer spending is increasing and take-home pay is also rising after several sluggish months.”

Seema Shah of Principal Asset Management said the inflation data is reassuring and will be welcomed by the Fed, but the policy direction is still unclear.

“A first rate cut in September would require a further slowdown in inflation and, ideally, further evidence of a softening labor market,” she said.

“Soft inflation data strengthens the case that the Fed can begin to cut rates in the coming months,” said Jeffrey Roach of LPL Financial. “As long as incomes are growing at a healthy pace, consumers will continue to spend. The key is the labor market, and attention should now turn to nonfarm payrolls next week for a fresh look at the job market.”

The timing of the first rate cut is important because bond prices will rise in anticipation of the cut, according to Joe Kalish of Ned Davis Research.

“The outlook for the bond market in the second half of the year will depend on Fed policy,” he said. “The timing of the first rate cut has historically been important for the bond market because yields tend to peak two to three months before the first rate cut.”

Company Highlights:

-

Nike’s management, led by Chief Executive Officer John Donahoe, has faced growing criticism from Wall Street after a long period of sluggish sales led to the company’s biggest share price collapse since it went public in 1980.

-

Uber Technologies Inc. and Lyft Inc. have agreed to a set of worker benefits to resolve a long-running Massachusetts state lawsuit challenging their drivers’ independent contractor status, ending the companies’ efforts to put the issue before voters in November.

-

Rite Aid Inc. has been given permission to emerge from bankruptcy proceedings after a judge approved a restructuring plan to save the struggling pharmacy chain from liquidation by handing over control to its major creditors.

-

Microsoft’s $13 billion investment in OpenAI is likely to attract further scrutiny from the European Union’s antitrust watchdog, which is set to question rivals about the AI company’s exclusive use of Microsoft cloud technology.

-

Nokia has agreed to buy Infinera for $2.3 billion, expanding its data center networking products and strengthening its presence in the United States, a potential source of growth as the artificial intelligence boom increases demand for server capacity.

Some of the key market developments:

stock

-

The S&P 500 was down 0.4% as of 4 p.m. New York time.

-

The Nasdaq 100 fell 0.5%

-

The Dow Jones Industrial Average fell 0.1%.

-

The MSCI World Index fell 0.3%

currency

-

The Bloomberg Dollar Spot Index fell 0.1%.

-

The euro was little changed at 1.0710 dollars

-

The British pound was little changed at 1.2641 to the dollar

-

The Japanese yen was almost unchanged at 160.92 yen to the dollar.

Cryptocurrency

-

Bitcoin fell 2.2% to $60,082.15.

-

Ether fell 1.8% to $3,377.67.

Bonds

-

The yield on the 10-year Treasury note rose 11 basis points to 4.39%.

-

German 10-year government bond yields rose 5 basis points to 2.50%.

-

UK 10-year government bond yields rose 4 basis points to 4.17%.

merchandise

-

West Texas Intermediate crude fell 0.3% to $81.53 a barrel.

-

Spot gold fell 0.2% to $2,324.07 an ounce.

This story was produced with assistance from Bloomberg Automation.

–With assistance from Jessica Menton, Alexandra Semenova, Felice Maranz, Carmen Reinicke, Emily Forgash, Natalia Kniazhevich, and Ye Xie.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP