We believe all investors should strive to buy and hold high-quality, multi-year winning stocks. Not all stocks will perform well, but when investors win, they can reap big rewards. Frontken Corporation (KLSE:FRONTKN) shares have risen 416% over the past five years, which shows the value creation some companies can achieve, and shareholders should also be pleased to see a 20% increase in the past three months.

With that in mind, it’s worth looking at whether a company’s underlying fundamentals are driving its long-term performance, or if there are any inconsistencies.

View our latest analysis for Frontken Corporation Berhad

To paraphrase Benjamin Graham, “In the short run, the market is a voting machine, but in the long run it’s a weighing machine.” One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

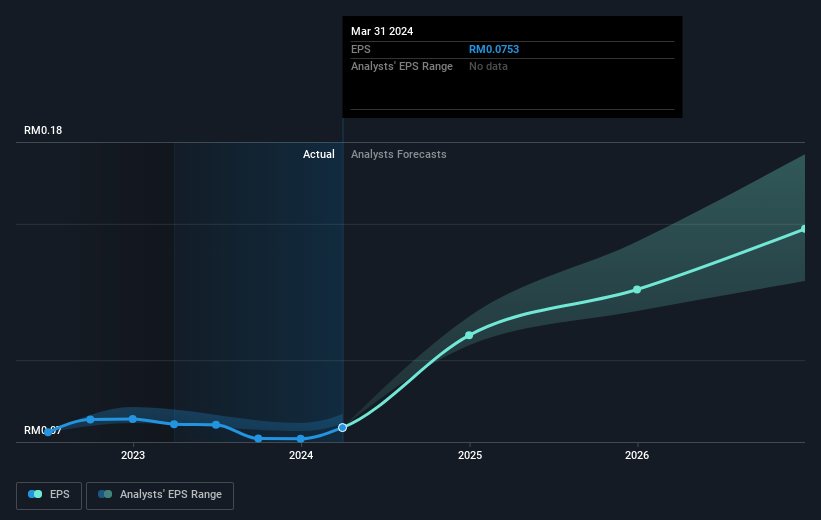

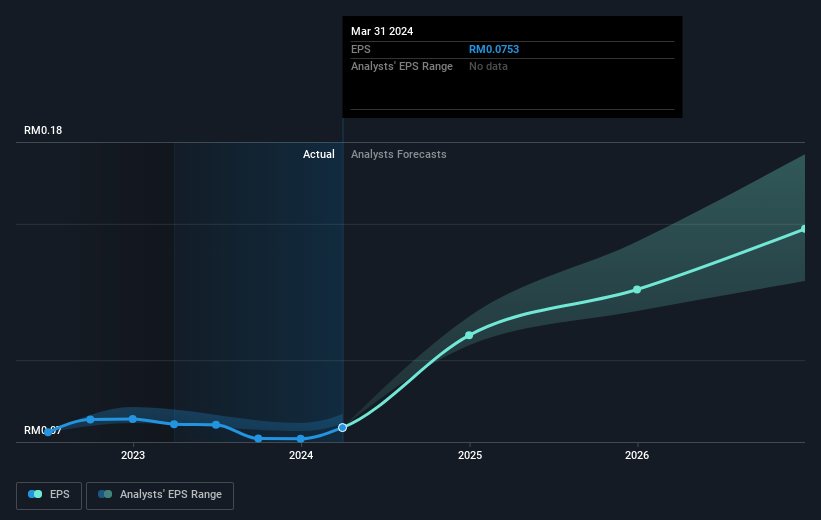

Over the five years that the share price has grown, Frontken Corporation Berhad has grown its compound earnings per share (EPS) at 14% per year. This EPS growth rate is lower than the 39% annualized growth rate of the share price over the same period. This suggests that market participants have recently placed a premium on the company, which is not surprising given its track record of growth. This optimism is reflected in the company’s fairly high P/E ratio of 61.23.

The company’s earnings per share (over time) is depicted in the image below (click to see the exact numbers).

this free This interactive report on Frontken Corporation Berhad’s earnings, revenue and cash flow is a great starting point, if you want to investigate the stock further.

What about dividends?

As well as measuring the price return, investors should also consider the total shareholder return (TSR). While the price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It can be said that the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Frontken Corporation Berhad, the TSR for the past 5 years was 447%, which is better than the price return shown above. And it’s not difficult to deduce that dividend payments mainly explain this divergence.

A different perspective

It’s good to see that Frontken Corporation Berhad shareholders have received a total shareholder return of 49% over the past year, which includes dividends. This yield is better than the five-year annualized TSR of 40%, so sentiment towards the company appears to have been positive recently. Those with an optimistic view could view the recent improvement in TSR as an indication that the business itself is getting better over time. Is Frontken Corporation Berhad cheap relative to other companies? The following three valuation metrics may help you decide:

of course Frontken Corporation Berhad may not be the best stock to buySo you might want to take a look at this free A collection of growing stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com