of Shenzhen Emperor Technology Co., Ltd. (SZSE:300546) The stock has been very weak over the last month, dropping a significant 30%. The decline ends a disastrous 12 months for shareholders, who have lost 52% in that time.

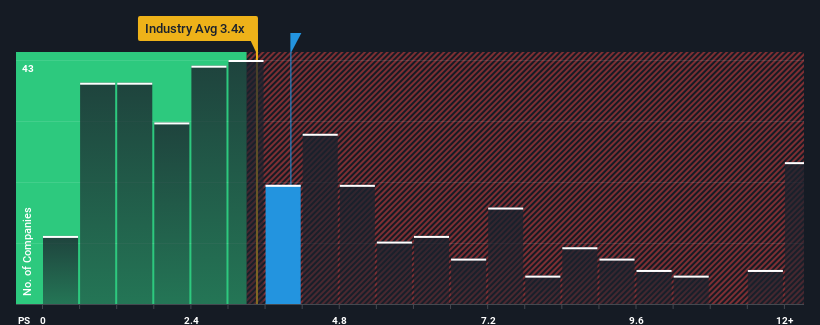

Even after such a significant price decline, it’s no exaggeration to say that Shenzhen Emperor Technology’s current price-to-sales (or “P/S”) ratio of 4x is quite “middling” by comparison. In China’s electronics industry, the median P/S multiple is approximately 3.4x. However, it is unwise to simply ignore the income statement without explanation, as investors may be ignoring clear opportunities or costly mistakes.

Check out our latest analysis for Shenzhen Emperor Technology.

What does Shenzhen Emperor Technology’s P/S mean for shareholders?

As an example, Shenzhen Emperor Technology’s earnings have been deteriorating since last year, which is not ideal at all. Perhaps many people are hoping that the company will overcome its disappointing earnings performance next fiscal year and prevent a decline in P/S. If this isn’t the case, existing shareholders might be a little worried about the viability of the share price.

Want a complete picture of a company’s earnings, revenue and cash flow? Then check out our free The report on Shenzhen Emperor Technology helps shed light on its historical performance.

Does the earnings forecast match the P/S ratio?

To justify the company’s P/S ratio, Shenzhen Emperor Technology needs to grow in line with the industry.

Looking back, last year saw the company’s sales decline by 33%. At least, thanks to the growth period in the previous quarter, revenues in total he did not completely regress from three years ago. So it’s safe to say that the company’s recent revenue growth has been inconsistent.

Comparing recent medium-term earnings trends to the industry’s forecast growth of 23% over the coming year, we find them to be significantly less attractive.

With this in mind, it’s interesting to see that Shenzhen Emperor Technology’s P&L is comparable to that of its peers. Apparently, many investors in the company aren’t as bearish as they’ve been made out to be lately, and aren’t looking to exit the stock anytime soon. They may be setting themselves up for future disappointment if P/S falls to a level commensurate with recent growth rates.

What can we learn from Shenzhen Empire Technology’s P/S?

With the stock price falling off a cliff, Shenzhen Emperor Technology’s profit and loss appears to be in line with other electronics companies. Generally, we prefer to limit the use of price-to-sales ratios to establish what the market thinks about a company’s overall health.

Our research on Shenzhen Emperor Technology shows that the company’s three-year earnings trend is not positive and is not leading to a decline in P/S as we expected, as it looks worse than the current industry outlook. It became clear. When we see slower growth and weaker earnings than the industry, we think the stock is at risk of falling and the P/S is in line with expectations. If recent medium-term earnings trends continue, the potential for a share price decline is substantial, exposing shareholders to risk.

Remember that there may be other risks as well. For example, we identified 2 warning signs for Shenzhen Emperor Technology Note (1 is a concern).

In these cases Risks make us reconsider our opinion on Shenzhen Emperor Technologyexplore our interactive list of quality stocks to see what else is out there.

Valuation is complex, but we help make it simple.

Please check it out shenzhen emperor technology Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.