SIM Technology Group Limited (HKG:2000) shareholders will be thrilled to see the stock has had a great month, with the share price up 31% and recovering from previous weakness. Looking at the bigger picture, his 21% growth for the year is also quite reasonable, although not as strong as last month.

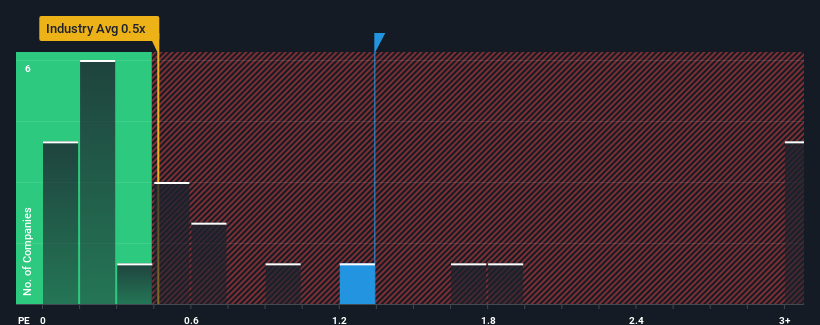

With a price-to-sales (P/S) ratio of 1.3x, you might consider SIM Technology Group a stock that’s not worth researching considering almost half of the companies in Hong Kong after a solid rebound in price. No wonder. The P/S multiple in the telecommunications industry is less than 0.5x. Nevertheless, we need to dig a little deeper to determine whether there is a rational basis for the P/S increase.

Check out our latest analysis for SIM Technology Group.

How has SIM Technology Group performed recently?

For example, SIM Technology Group’s recent earnings pullback should be food for thought. Many probably expect the company to continue to outperform most other companies over the coming period, which may be keeping it from collapsing. If not, existing shareholders could become very nervous about the viability of the stock price.

We don’t have analyst forecasts, but checking our forecasts will tell you how recent trends are setting up the company’s future. free SIM Technology Group earnings, revenue and cash flow report.

Are revenue projections consistent with high returns?

The only time it’s really reassuring to see a P/S as high as SIM Technology Group’s is when the company’s growth is on a trajectory to outpace its industry.

When I reviewed last year’s financials, I was disappointed to see that our revenue had declined by 15%. Things aren’t looking too good over the past three years either, with the company’s revenue down a total of 23%. So, unfortunately, we have to admit that the company hasn’t done much to grow its revenue over that time.

Comparing this medium-term earnings trajectory with the one-year forecast of 47% expansion for the industry as a whole reveals that’s an unpleasant outlook.

With this in mind, it’s concerning that SIM Technology Group’s P&L is higher than most other companies. Apparently, many of the company’s investors are much more bullish than recent expectations and are unwilling to exit the stock at any price. Only the boldest would think these prices are sustainable, as a continuation of recent earnings trends will likely ultimately weigh on the stock price.

SIM Technology Group P/S Conclusion

SIM Technology Group’s stock price has risen significantly, so its profits and losses are rising. Generally, we prefer to limit the use of price-to-sales ratios to establish what the market thinks about a company’s overall health.

Our research on SIM Technology Group shows that the P/S is lower than we expected, despite the revenue contraction over the medium term, given the expected industry growth. It became clear that it was not. We are not satisfied with the high P/S at this point as it is very unlikely that this earnings performance will support such positive sentiment in the long term. Unless the recent medium-term situation improves, it is not wrong to expect that the company’s shareholders will continue to have difficult times going forward.

Remember that there may be other risks as well. For example, we identified 2 warning signs for SIM Technology Group What you need to know.

In these cases Risks make you reconsider your opinion about SIM Technology Groupexplore our interactive list of quality stocks to see what else is out there.

Valuation is complex, but we help make it simple.

Please check it out SIM Technology Group Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.