-

Net investment income per share (NII): The company reported fourth-quarter earnings of $0.94, slightly below expected earnings of $0.95 per share.

-

Annual dividend: The expected price for the fourth quarter is $0.73 per share, and the dividend yield based on the recent stock price is announced to be 12.4%, indicating a solid dividend level.

-

Assets under management (AUM): Net sales increased 17.1% year over year to $1,139 million due to strong portfolio growth and new business creation.

-

Net asset value (NAV) per share: Year-over-year decline from $29.18 to $27.12 reflecting market and portfolio adjustments.

-

Investment return: Due to rising interest rates and expansion of the asset base, it grew by 45.0% annually to $143.7 million.

-

Adjusted net investment income: Revenue increased 52.4% year over year to $51.9 million, demonstrating strong profitability and operational efficiency.

-

Portfolio performance: The company reported net unrealized depreciation and amortization of $7.1 million in the quarter, which was offset by overall portfolio growth, but resulted in significant write-downs on certain investments.

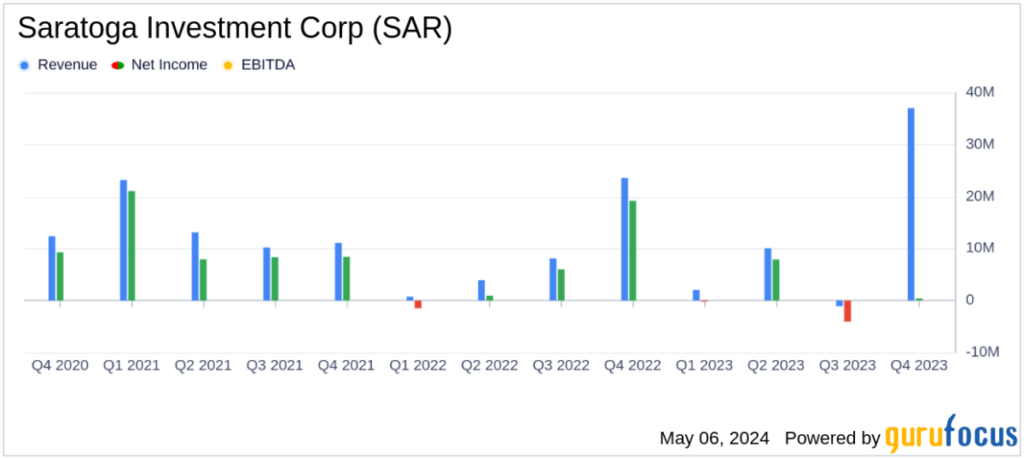

Saratoga Investment Corporation (NYSE:SAR) filed an 8-K filing on May 6, 2024, disclosing its financial results for the fiscal year and fourth quarter ended February 29, 2024. The company reported an increase in his net investment income (NII) per share. The year-over-year increase was 53% and 16% in the fourth quarter. Adjusted NII per share increased 44% year over year, but decreased 4% sequentially.

Saratoga Investment Corp is a specialty finance company that provides customized financing solutions to mid-market businesses in the United States. The company invests primarily in senior and unit tranche leveraged loans, mezzanine debt, and to a lesser extent equity. These investments are typically made through direct loans or loan syndications to companies with annual EBITDA of less than $50 million.

Financial highlights and challenges

The company reported an annualized fourth quarter dividend of $0.73 per share and adjusted net investment income of $0.94 per share, giving a dividend yield of 12.4% and an earnings yield of 16.0 based on recent stock prices. %. Despite positive growth in NII and Adjusted NII, the company faced challenges such as a less robust M&A environment and an increase in excise taxes, which increased by 71% compared to last year’s fourth quarter.

Additionally, the company highlighted issues with two of its portfolio companies, Pepper Palace and Solage, resulting in a combined price reduction of $13.8 million. However, the core non-CLO portfolio, CLO and JV segments rose in value, partially offsetting the decline.

Overview of income statement and balance sheet

Saratoga Investments reported a significant increase in total investment income of $143.7 million for the year ending February 29, 2024, an increase of 45% year-over-year. This increase was primarily due to higher interest rates and a wider asset base. However, the company also noted that net increase in net assets from operations decreased $8.9 million year-over-year, reflecting various financial impacts.

The balance sheet showed that assets under management (AUM) increased by 17.1% year over year to $1.139 billion. Net asset value (NAV) per share decreased slightly to $27.12 from $29.18 a year ago, impacted by equity raised in excess of net asset value and operational challenges faced.

Strategic moves and market position

Chairman and CEO Christian L. Overbeck emphasized the company’s strong market position and the continued development of its sponsor relationships, which continue to generate high-quality investment opportunities. Despite the current market volatility, Saratoga Investments maintains a robust investment pipeline, ensuring careful selection that meets high quality standards.

The company remains focused on effectively managing its portfolio and navigating market uncertainties with a focus on maintaining high underwriting standards and operational resilience.

In conclusion, Saratoga Investment Corp.’s fiscal year and fourth quarter 2024 results demonstrate that the company can navigate market complexity while positioning itself for sustainable growth. Investors and stakeholders may take comfort in the company’s continued commitment to strategic alignment and quality investments.

For more information, please see Saratoga Investment Corp’s full 8-K earnings release here.

This article first appeared on GuruFocus.