The Magnificent Seven’s tech stocks aren’t the only ones that stand to benefit from the ongoing generative artificial intelligence (AI) revolution. There are many other possibilities for growth. Therefore, in this article, we check out three lesser-known technology companies (SAP, WIX, GTLB) with AI tailwinds that deserve more attention from investors using TipRanks’ comparison tool below .

Each stock has received a Strong Buy rating from the analyst community, and for good reason. They are AI GARP (or AI Growth at Reasonable Prices) strategies, and every bit as impressive as a well-funded mega-cap company. When it comes to investing in AI, no expense is spared.

SAP is a German enterprise software company that may have been sold by a number of US investors in recent years. The stock was hit hard in the 2022 selloff, ultimately losing more than 50% of its value from its 2020 peak to its 2022 trough. Since bottoming out in September 2022, SAP stock has been in a race.

Cloud’s impressive resurgence and improved profitability (44% 2023 Q4 profits soared) are key reasons why the stock was able to break through multi-year resistance on its way to new highs. . Although the stock has pulled back in recent weeks, I tend to remain bullish as market buyers try to find a better entry point.

In the company’s latest quarter, management also talked about business AI, which they believe will help SAP’s long-term growth. With a restructuring program in place involving 8,000 job cuts, SAP certainly appears to be taking a page out of the plans of most other companies committed to “years of efficiency.” Masu.

SAP has made strategic bets on a variety of emerging AI companies, including Claude-maker Anthropic and Canada’s Cohere, and has partnered with Nvidia (NASDAQ:NVDA) Accelerate AI adoption in your enterprise. This positions SAP as a potential beneficiary alongside some of the most influential members of the “Magnificent Seven” as the benefits of AI expand.

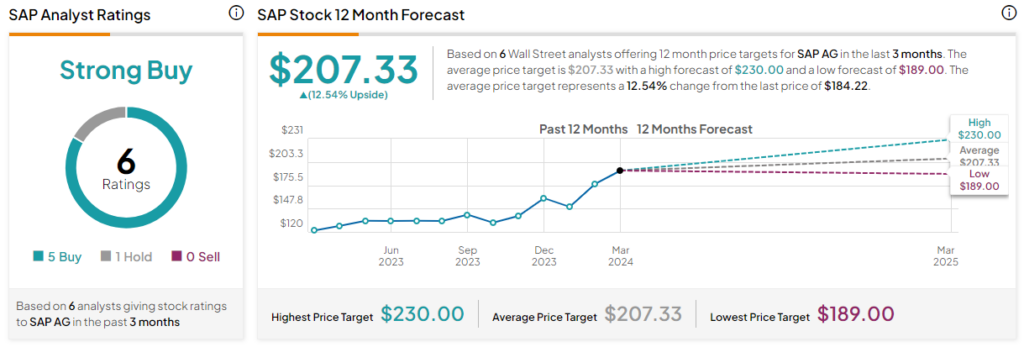

What is the target price for SAP stock?

SAP stock is a “strong buy” according to analysts, with 5 buy and 1 hold assignments in the past three months. SAP’s average price target of $207.33 implies an upside potential of 12.5%.

Wix is an Israeli-based e-commerce business that could win a little by loosening the purse strings on AI spending. The company, which develops an intuitive (and now AI-powered) web builder, is considered a pioneer of sorts in AI-assisted web development. As Wix continues to make its web builder smarter and easier to use, I have to remain bullish on the stock despite its recent momentum, which is up more than 15% year-to-date.

1 Bank of America analyst (New York Stock Exchange:BAC) Late last year, Wix was being dubbed the “TurboTax of website building.” This is a pretty interesting comparison, but one that shouldn’t be taken lightly considering that TurboTax is almost synonymous with tax preparation software. Bank of America also said there is an “underappreciated margin compression story” as Wix continues to grow.

All in all, website building and AI seem like a perfect match. We hear a lot about AI-assisted coders (or copilots) these days, but less about AI web tools that don’t require a designer to touch her HTML or CSS. Wix has been in the web building game for a long time. By introducing AI, the company may be able to further expand its reach.

Additionally, as spatial computing interface design grows in popularity, I look to AI tools as solutions that allow people to build the absolute best spatial web presence without having to relearn the ropes of next-gen web. I think there is.

“AI is a natural extension of what we do, and the better our AI algorithms get, the better Wix gets,” said Abishai Abrahami, co-founder and CEO of Wix. . I couldn’t agree more. Abrahami and his team have been well ahead of the AI race every step of the way.

What is the target price for WIX stock?

According to analysts, WIX stock is a Strong Buy with 17 Buy and 1 Hold assignments over the past three months. WIX’s average price target of $157.29 implies an upside potential of 19.9%.

GitLab is a DevOps (Development and Operations) and DevSecOps (Security Built-in) solutions provider that has endured a very challenging past few years since going live on the public market. Since its opening day high, the stock has lost about 48% of its value.

The stock may have what it takes to climb above its all-time high of $137 per share again, as the $9.2 billion tech company looks to add to its AI toolkit. Management is focused on generative AI “based on privacy, security and transparency” and can’t help but remain bullish on mid-cap stocks as they look to set the stage for recovery. not.

With GitLab Duo (which helps with coding), the company seems to be building a pretty strong AI ecosystem for DevSecOps developers. From AI-driven code suggestions to vulnerability detection and explainability, a great feature that Amazon also touts (NASDAQ:AMZN), CodeWhisperer), GitLab Duo may be your secret weapon to fight back against much larger rivals.

Recently received a new Buy rating from Wells Fargo (New York Stock Exchange:WFC) Along with a $70.00 price target, GTLB stock looks like a must-watch for AI investors looking for an overlooked growth play. Wells cited the Duo Pro product as his DevSecOps productivity accelerator.

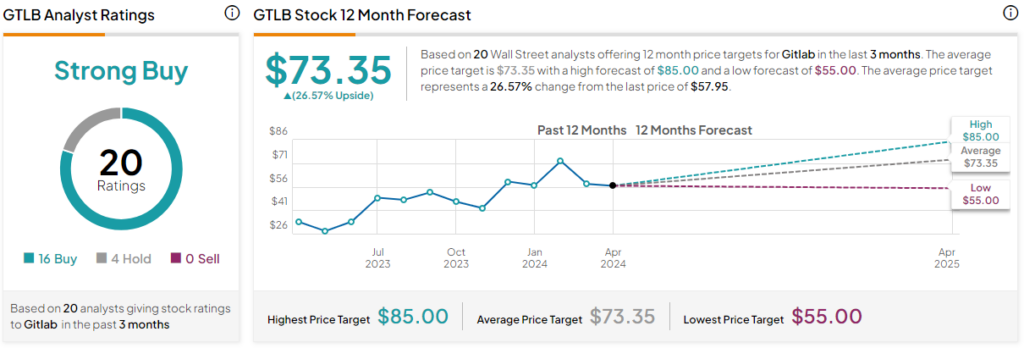

What is the target price for GTLB stock?

GTLB stock is a “strong buy” according to analysts, with 16 buys and 4 hold assignments over the past three months. GTLB’s average price target of $73.35 implies an upside potential of 26.6%.

conclusion

As the number of AI winners begins to grow, including forgotten legacy companies and relatively unknown small-cap stocks ready to step up, investors should consider broadening their screen. This expansion should include more than just 7 stocks (or fewer). Among his three stocks, analysts expect his GTLB stock to make the biggest return (about 26.6%) next year.

disclosure

Source link