CME Group’s E-mini Russell 2000 Index futures contract recorded its second-highest daily trading volume this year ahead of its June expiration and the upcoming Russell annual realignment.

Every year, index provider FTSE Russell, part of the London Stock Exchange Group, reviews its Russell 1000, 2000 and 3000 indexes to take into account market trends over the past 12 months and ensure they remain reflective of the U.S. stock market. This year’s reconstitution of the Russell will finish after the close of trading on June 28th in the U.S. stock market.

The annual reconstitution of the Russell indexes is typically one of the busiest trading days of the year for the cash equity market, but Paul Uhlman, global head of equity index products at CME, told Markets Media that investors are increasingly using futures to manage market and operational risk, or to take advantage of opportunities to add or remove stocks.

Paul Woolman, CME Group

“If investors don’t rebalance in the right way, they can experience tracking error in their portfolios. Futures provide access to index products that provide perfect tracking,” Woolman said.

Investors could get in on the futures market on the quarterly expiration date of June 21 ahead of Russell’s restructuring.

With the deadline approaching in June, CME’s E-mini Russell 2000 Index futures saw 625,000 contracts traded on June 17, the second-highest volume this year. That was just shy of the previous record of 700,000 contracts traded on March 11 ahead of the March contract expiration, according to the exchange.

Year-to-date average daily trading volume for E-mini Russell 2000 futures is 218,000 contracts. In the June expiration week, average daily volume increased by nearly two-thirds to 353,000 lots.

Source: CME

BTIC Function

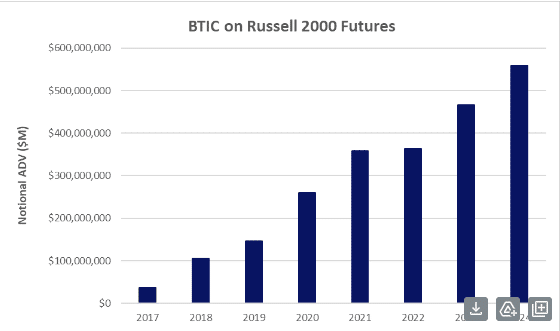

In addition to using futures rolls, clients can also use the Based on Index Close (BTIC) and Exchange for Physical Purposes (EFP) features to manage trading and operational risk prior to reconstitution.

EFPs can be traded at any time during the day They are also more flexible as there is no minimum size. In a privately negotiated EFP, two parties exchange equal but offsetting positions in an equity index futures contract and an underlying underlying stock, such as a related ETF or basket of stocks. One participant buys futures and sells underlying shares, and the other party does the opposite.

BTIC allows participants to trade futures at the close of the U.S. stock market with a fixed spread to the underlying index level.

Source: CME

According to CME, average daily trading volume for BTIC Russell 2000 futures so far this year is 5,500 contracts, up 9% from the same period in 2023. Volume for BTIC spiked on June 21 during the rollover, with 13,600 contracts traded.

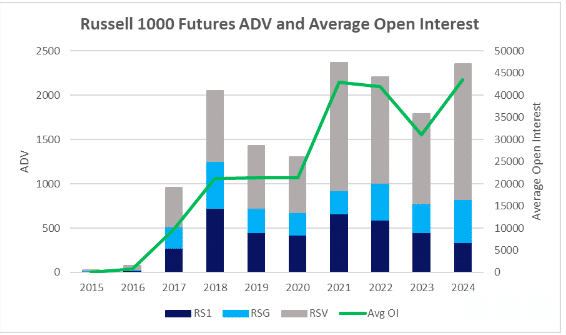

Year-to-date, average daily trading volume for Russell 1000 futures is 2,400 contracts, up nearly a third from 2023.

Reconfiguration Changes

“The stock market has been led by large-cap stocks, represented by the Russell 1000,” Woolman said. “Small-cap stocks seem a little outdated, but I’m confident things will turn around.”

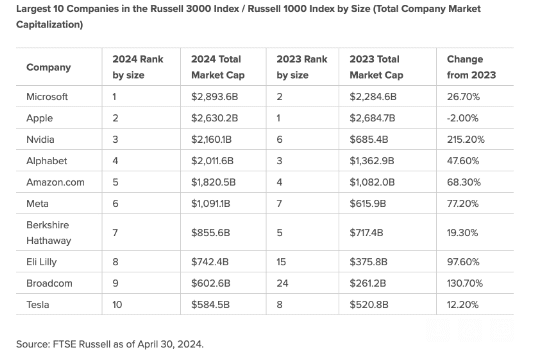

FTSE Russell said large-cap growth stocks will continue to outperform value stocks in 2024. The Russell 1000 Growth Index returned 31.8% in the 12 months to April 30, 2024, compared with 13.4% for the Russell 1000 Value Index.

Katherine Yoshimoto, FTSE Russell

“It’s not surprising that the majority of additions to the Russell 1000 Index are technology companies,” Katherine Yoshimoto, director of Russell U.S. index product management at FTSE Russell, told MarketsMedia.

Of 38 Seven of the new Russell 1000 companies are technology companies, including Supermicro Computer and MicroStrategy.

Supermicrocomputer, which graduated from the Russell 2000 Index, became the largest addition by weight to the Russell 1000 Growth Index and was classified as 100% growth. The US “Magnificent Seven” technology companies also maintained their 100% growth after the reconstitution. Yoshimoto also highlighted that more than 200 companies were added to the Russell 2000 Index, of which about 100 are in the healthcare sector.

Source: FTSE Russell

The market capitalization of the “Magnet Seven” grew 43.5% from $9.2 trillion to $13.2 trillion, raising investor concerns about concentration and lack of diversification.

“The emphasis in the first half of the year was on growth, but now it feels like we’re at a turning point,” she added. “We’re starting to hear more clients looking at value and small cap stocks to diversify.”

As a result, FTSE Russell has launched a series of capped indexes that limit the concentration of companies included in the index, allowing investors to compare the performance of the standard index with that of the capped index.

“For example, some clients want to see the Russell 1000 minus the top 10 stocks,” Yoshimoto said.