Pitbull Ventures, an early-stage venture capital firm, today announced the closing of its $5 million Fund I, created to accelerate the growth of pioneering startups.

Pitbull Ventures will take the Los Angeles tech scene to new heights by betting on pre-seed AI-enabled vertical SaaS startups with promising early traction and guiding them to the next stage of growth with support from the fund’s expert team We are carrying out this mission.

Pitbull Ventures is a pre-seed fund focused on AI-enabled industry vertical SaaS startups, preferring to bet on founding teams that leverage AI and demonstrate early product-market fit. The team invests in a variety of his SaaS industries, and their portfolio includes everything from his FinOps to his IT distribution services to restaurant technology, further broadening the fund’s reach. .

Los Angeles is currently the third-largest startup market in the United States, home to approximately 4,000 venture-backed startups, and the area, affectionately known as “Silicon Beach,” is close to established technology in the San Francisco Bay Area and New York State. It is rapidly catching up to the scene. yoke.

Pitbull Ventures’ entry into the LA scene marks a significant step forward for early-stage SaaS founders seeking funding during the biggest downturn in venture capital activity in five years.

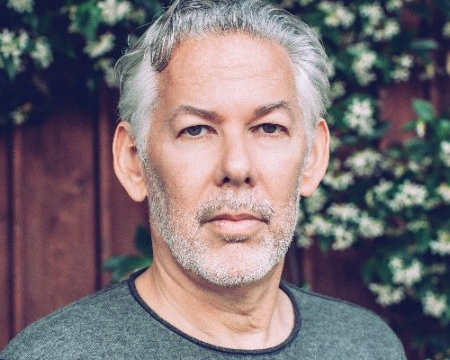

To date, the fund has backed 15 vertical SaaS early-stage startups. Brad Zions, an LA-based investor and entrepreneur, spent the past 25 years as an early-stage investor, both as a structured fund partner and as an individual, before founding Pitbull Ventures in 2021. I have been active.

Big winners in his vertical SaaS portfolio include Harri, VidMob, and Embrace. Recent exits include Podsights, Jukin Media, and Donut Media. Previous exits include Ron Conway’s QXL (IPO) and his Google with Angel Funds I and II.

Zions has deep expertise in the hospitality, apparel and entertainment industries.

Pitbull Ventures is a Los Angeles, California-based pre-seed fund founded by serial entrepreneur and investor Brad Zions. Zions has been an active early-stage investor for the past 25 years, both as a partner in the Structure Fund and as an individual.

Featured photo of venture capitalist Brad Zions