(Bloomberg) — Credit investors were in for an economic and geopolitical reality this week, as hawkish comments from central bankers on borrowing costs and Middle East tensions spooked bond markets. Ta.

Most Read Articles on Bloomberg

The pullback was prompted in part by comments from New York Fed President William Williams, who said there was no need to rush to cut rates and that economic data might even justify raising rates if inflation continues.

With the US economy continuing to perform well and financial conditions easing in recent months, there is a sense that the interest rate pivot is not yet here. As a result, the market has not yet signaled that the central bank has imposed enough policy restrictions to start easing, said Bill Zox, portfolio manager at Brandywine Global Investment Management.

The resurgence of the mantra of higher long-term interest rates is causing headaches for cash-rich insurance companies and pension plans, with demand for bonds surging this year as they look to lock in yield ahead of expected rate cuts. Companies have responded by printing more than $1 trillion in banknotes worldwide so far this year, the second-highest level since at least 2013. But now investors are pulling money out of high-yield funds, slowing the flow of money into shorter-term luxury products. Dramatically.

Click here to listen to a podcast about how Morgan Stanley believes there could be a credit crisis if the Fed raises rates.

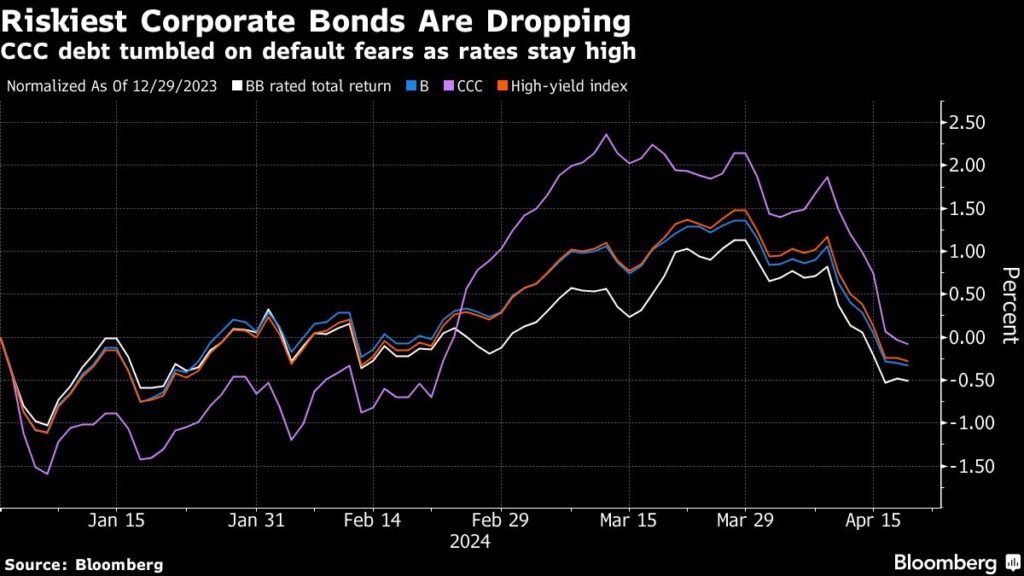

U.S. investment-grade bond spreads continue to widen, and demand for many new issues remains strong. But there are clear signs of growing caution in credit markets. U.S. junk bond spreads have widened as negative sentiment has increased, with high-yield bonds on track for their biggest monthly loss on a total return basis since September 2022. This is a remarkable reversal. A Bank of America survey of fund managers showed widespread satisfaction earlier this month as global perceptions of credit risk hit their lowest level since February of last year.

Adding to the problems for policymakers, retaliatory strikes between Israel and Iran could send oil prices soaring and fuel inflation. Tensions in the Middle East also risk dampening credit demand as investors instead seek havens such as U.S. Treasuries.

Investor backlash

One area where investors are pushing back is the leveraged loan market. While demand continues to be strong, asset managers have been successful in recent days in pushing back on terms demanded by issuers.

Rocket Software was forced to cancel its portable debt structure plan in recent days after receiving feedback from asset managers, according to people familiar with the matter. If this trend continues, it could potentially be a boon for private credit providers, which have faced new competition from banks in recent months.

In Europe it’s a different story. Traders are pricing in a European Central Bank rate cut of about 80 basis points this year, with officials still planning the first rate cut in June and not needing to wait for the Fed’s announcement. Emphasized.

Still, this week’s volatility has hit retail investors, with more than 70% of bond trades issued in Europe in the red as of Friday morning in London, according to data compiled by Bloomberg News. It means.

Returning to the United States, some junk companies are at risk of being hurt by tighter monetary policy.

“If these cuts are delayed beyond the election, it will be difficult for some low-quality floating rate issuers who need to refinance,” Megan Robson, head of U.S. credit strategy at BNP Paribas, said in an April 10 interview. There is a possibility that it will happen.” Credit Edge podcast interview. “That risk has not yet been priced in, but it could come into the discussion as we get closer to the June and July schedule.”

1 week review

-

Banks including JPMorgan Chase & Co., Wells Fargo & Co. and Goldman Sachs & Co. sold bonds in the U.S. high-end bond market this week following the release of their first-quarter results.

-

Wells Fargo sold $4.25 billion in bonds on Monday and C$1.25 billion ($900 million) on the Canadian bond market on Tuesday, while Morgan Stanley reported better-than-expected quarterly profits. As a result, it sold $8 billion in bonds on Wednesday.

-

-

Banks are fighting back as private lenders have grabbed a bigger slice of the lucrative business of lending leveraged buyouts. Banks act as intermediaries in transactions between small and medium-sized businesses seeking financing and private lenders eager to lend.

-

Wall Street’s securitization engine is booming, with issuance reaching record levels as borrowers rush to secure financing ahead of credit market turmoil caused by the U.S. general election.

-

The U.S. leveraged loan market has not yet been shaken by the long-term shift in interest rates, but it could soon join the pain being felt in other asset classes.

-

As hopes fade that the Federal Reserve will cut interest rates soon, U.S. banks are reevaluating the cost of preferred stocks, potentially triggering a flurry of deals for a key source of funding.

-

Banks are increasingly privately collecting sales orders for riskier high-yield bonds and leveraged loans before formally announcing them to the wider market to ensure they can find sufficient demand in a difficult market. There is.

-

Blackstone led a nearly $2 billion financing package for Park Place Technologies to refinance the company’s debt and fund payments to private equity owners.

-

As climate change worsens droughts and wildfires, utilities are often held responsible for causing them and their assets are increasingly at risk.

-

Riverside is considering strategic options, including the sale of its direct lending division, Riverside Credit Solutions.

-

Asset manager Columbia Threadneedle Investments believes now is a good time to capture a larger slice of the loan-backed securities market, recently announcing plans to expand its CLO business and become a full-fledged issuer. .

-

Library services companies Baker & Taylor and Media Source have held merger talks and approached financial firms directly about financing a potential deal.

-

Asset management firm Bayview Asset Management is in the process of selling a complex bond created to hedge a portion of online bank and lender SoFi Technologies’ student loan book.

-

As yields rise and the government tightens its oversight of capital markets, Vietnamese companies are cutting back on new corporate bond issuance, a development that has raised concerns about refinancing risks.

move

-

Toronto-Dominion Bank’s head of private debt has left the bank amid a restructuring at the Canadian financial institution that includes a 3% reduction in headcount worldwide.

-

Siemens AG has hired Milan Senicic as executive director to lead its corporate and leveraged finance business in Australia.

-

ING has appointed Gautam Saxena as Head of Corporate Finance for Asia Pacific.

–With assistance from Michael Msika, Jill R. Shah, Paul Cohen, and Dan Wilchins.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP