Orpheus Uranium Limited (ASX:ORP) Insiders who bought shares in the past year got paid handsomely last week. The stock price rose by 41% and the company’s market capitalization increased by AU$6.6 million, meaning he had gained 136% from his initial investment. As a result, the shares originally purchased for AU$1.12 million are now worth AU$2.64 million.

While we are by no means saying that investors should make decisions solely based on the actions of a company’s directors, we believe it is perfectly logical to monitor the actions of insiders. .

See our latest analysis for Orpheus Uranium.

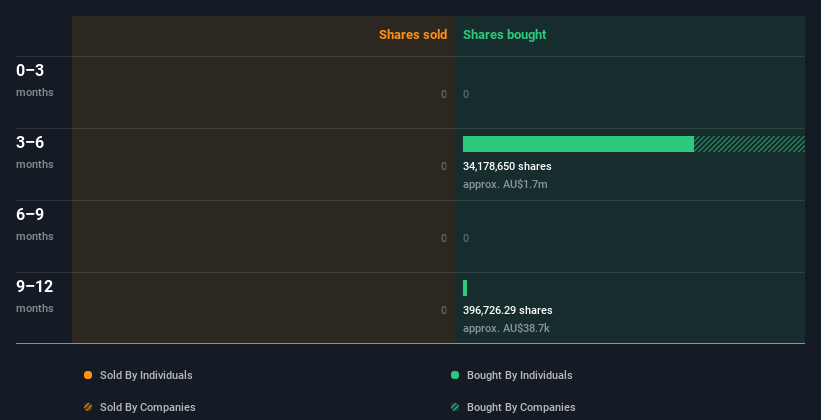

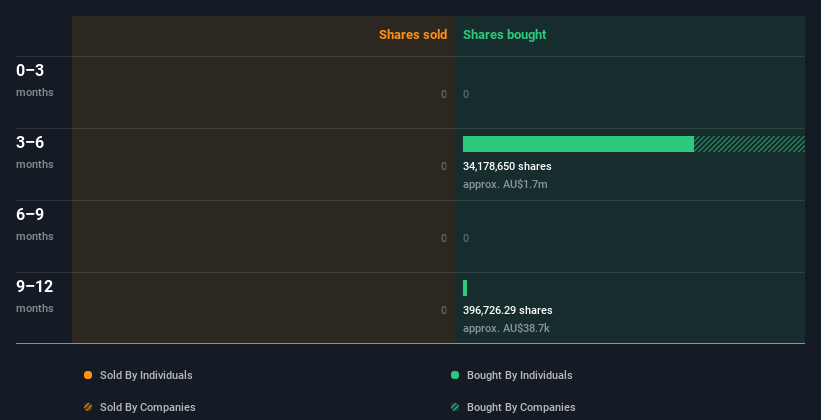

Orpheus Uranium Insider Trading Over the Past Year

The biggest purchase by an insider in the last twelve months was when insider Paul Pheby bought AU$980k worth of shares at a price of AU$0.05 per share. Although the purchase was made at a price significantly lower than the recent price (AU$0.12), he believes the insider buying is still positive. This trade suggests that insiders believe the stock is undervalued when the stock price is low, but this trade doesn’t say much about what they think about the current price. .

Orpheus Uranium insiders bought shares last year but did not sell them. You can see a visual representation of the insider transactions (by companies and individuals) over the last 12 months, below. You can click on the graph below to see the exact details of each insider transaction.

Orpheus Uranium isn’t the only stock that insiders are buying.For people who like searching succeed in investing this free This list of growing companies with recent insider purchasing may be just the ticket.

Insider ownership

Many investors like to see how much of a company’s shares are owned by insiders. A high insider ownership often makes company leaders more focused on shareholder interests. Orpheus Uranium insiders own around AU$5.5m worth of shares. This represents 24% of the company. This level of insider ownership is good, but far from particularly noticeable. That certainly suggests a reasonable degree of consistency.

So what does Orpheus’ insider trading in uranium show?

It doesn’t make much sense that no insiders traded in Orpheus Uranium stock in the last quarter. However, insiders have indicated that interest in the stock has increased over the last year. Overall, we don’t see anything that would make Orpheus Uranium insiders suspicious of the company. They own the stock. So while these insider transactions can help us form a theory about the stock, it’s also worth knowing what risks this company faces. for that purpose, 6 warning signs I found them on Orpheus Uranium (including three that were a bit unpleasant).

of course, You may find a great investment if you look elsewhere. So take a look at this free List of interesting companies.

For the purposes of this article, insiders are individuals who report their transactions to the relevant regulatory body. The Company currently only accounts for open market transactions and private dispositions of direct profits, and does not account for derivative transactions or indirect profits.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.