At a time when tax benefits are what businesses, especially small and medium-sized enterprises, are constantly looking for, only 17 startups have applied to register for the government’s Startup Sandbox, a tax incentive scheme offered to help budding entrepreneurs emerge.

According to industry insiders, around 300 to 500 companies will be affected, but a lack of awareness across the industry is the reason for the slow response.

“We didn’t have the in-house tax expertise, so we weren’t aware of the tax benefits that the sandbox registration offered,” said Kishwar Hashemi, co-founder and CEO of Mitro, an embedded finance startup that has registered.

“It’s the same story with most of our startup peers,” he said.

Now, startups that missed out on the opportunity are calling for an extension to the June 30 deadline.

Startups that register under the sandbox scheme can benefit from relaxed tax rules and regulations, but they must first register as a startup with the National Board of Revenue (NBR).

The Finance Act, 2023 has provided an opportunity for sandbox registration with the NBR to enjoy the benefits offered. To be treated as a startup, the NBR requires a company to be engaged in innovating, developing, distributing or commercializing new products, processes or services that operate through technology or intellectual property.

Industry experts said registration in the sandbox would reduce the minimum tax on sales by one-sixth, significantly reducing tax payments.

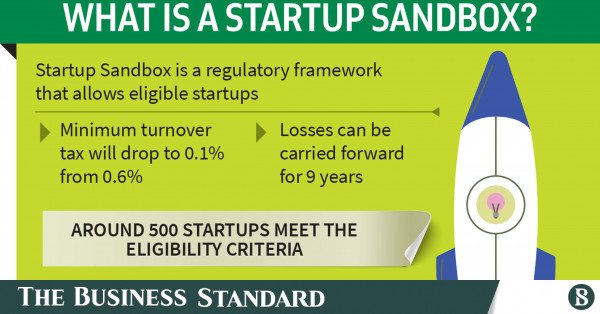

The minimum tax rate on turnover for startups registered in the sandbox will be reduced from 0.6% to 0.1%.

Moreover, the sandbox allows startups to carry forward losses for nine years, while other companies can only carry them for six years. This is helpful as the longer losses can be carried forward in tax returns, the more convenient it will be for businesses.

What is the Startup Sandbox?

The government’s startup sandbox is a type of regulatory sandbox that allows eligible startups to get tax breaks and loss carry-forward permission, helping them seamlessly realize their full potential.

Such sandboxes also give regulators insight into the types of innovations entrepreneurs are exploring and the ability to offer them guidance at an early stage.

According to NBR, the startups that applied to take advantage of the sandbox benefits were Chamak Solutions, Delivery Tiger, Instasure, Get-Aid, Fabric Lagbe, Med Easy, Med Box, Pulse Tech, Cyber Aeronautycs, Grit Technologies, Sasthya Seba, Dhaka Cast, Parents Care, Sokrio Technologies, Drip Irrigation and Biomafy Ltd.

Snehashish Barua, director at SMAC Advisory Services and a chartered accountant, told TBS that the tax benefits on offer are not so small that they can be ignored.

Startups incorporated after June 30, 2017, not part of any merger or demerger plan and with annual turnover of less than Tk 1 billion could have applied for sandbox registration by June 30 this year, Snehasish said.

Startups incorporated after June 30, 2023 must apply by June 30 of the fiscal year following their incorporation.

Sandbox-registered startups established between July 1, 2017 and June 30, 2023 will be able to enjoy tax benefits for three years until June 30, 2027.

Newer companies incorporated after June 30, 2023 will be able to enjoy tax benefits for five years after the end of their incorporation.

“It is unfortunate that around 500 eligible companies were not recognised by the tax department due to lack of awareness,” said AKM Fahim Mashroo, a tech entrepreneur who founded country’s leading job portal BDjobs, e-commerce platform AjkerDeal and logistics startup Delivery Tiger.

“There is a misconception among many young budding entrepreneurs that loss-making businesses do not have to pay income tax. This is because they are unaware of the minimum tax rate that is applicable to all businesses,” said Mashrur, who is also former president of the Bangladesh Software and Information Services Association.

“While they do their best to build a technology-enabled business in the early stages, many companies choose to avoid the tax hassle and wait until the time when they have to deal with it,” he added.

“The cost of tax compliance is high for young startups, who primarily innovate despite the risk of failure,” Mitro’s Hashemy said, adding that tax compliance should be easier for them.

Like Hashemi, Rajiv Das, founder of logistics startup Loop Freight, said he “hopes and needs another opportunity to register under the sandbox.”