This article first appeared in CNN Business’ Before the Bell newsletter. Not a subscriber? Sign up now. hereYou can listen to the audio version of the newsletter by clicking the same link.

new york

CNN

—

Nvidia’s phenomenal profits this year have helped drive its stock to repeated record highs, but beneath the surface, the rise has looked uneven.

The S&P 500 Index is up nearly 15% so far in 2024, hitting 31 new record highs so far. Much of that return is due to seven megacap stocks that have seen explosive growth as investors pour money into the burgeoning artificial intelligence boom.

But outside the tech group, the market isn’t as bright: The S&P 500 equal-weighted index, which gives every stock the same weighting, is up just 4% this year.

The benchmark index’s information technology and communication services sectors rose about 29% and 24%, respectively. The rest of the S&P 500 was up in single digits except for real estate, which has been declining this year.

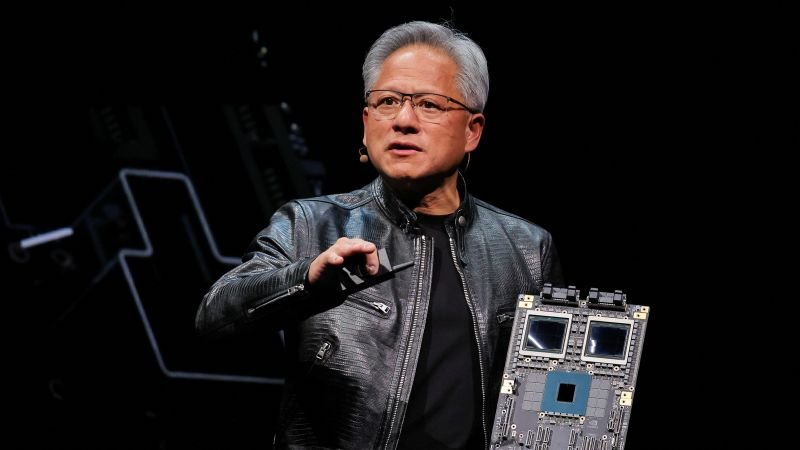

Leading the market’s sharp gains has been Nvidia, which briefly surpassed Microsoft this week to become the world’s largest publicly traded company. Nvidia shares are up 164% this year.

The chipmaker’s shares have soared over the past year and a half. Nvidia’s chips are unrivaled in making the processors that power artificial intelligence systems, including generative AI, the technology behind OpenAI’s ChatGPT. You can create text, images, and other media.

Will Nvidia’s phenomenal gains continue, and how will the company’s massive market cap affect its stock price growth?

Before the Bell spoke with Christopher Burt, senior investment analyst at Fort Pitt Capital Group.

This interview has been edited for length and clarity.

Before the Bell: Are you concerned that the stock market rally has been uneven across the board and that most of it has been concentrated among the “Magnificent Seven” of big tech companies, particularly Nvidia?

I don’t know if it’s something to be worried about necessarily. I think it’s interesting.

If you take out the (Magnificent Seven) numbers from the first quarter revenues, growth was down 2% year over year, meaning a large part of the market is struggling.

There is a silver lining. There are a lot of other semiconductor equipment companies out there, some of which are not as valuable as Nvidia in terms of market cap, but are doing well. We see these as opportunities.

Do you think investors are overly reliant on Nvidia and optimistic that its stock price will continue to rise?

Let’s go back to Apple a year or two ago. Apple was the biggest company in the world. Every day people said, “The market depends on Apple.” And then a year and a half later, maybe less than a year later, it shifted to Nvidia. Now everyone says, “The market depends on Nvidia’s revenue.” You’re going to see market caps shift over the next few years.

Market cap weighted indexes change over time, but this is driven by the economic interests of the companies, among other things. So should investors be worried that NVIDIA is centralized? I don’t think so.

Do you think Nvidia’s incredible growth will continue?

I don’t know the answer to that, but if you want to invest in artificial intelligence and the secular megatrends that we’re seeing right now, I think you’re better off owning megacap companies like Google, Amazon, Microsoft, Meta, because if these companies are investing in (graphics processing units, which Nvidia makes), servers, all the data centers, they can basically always raise their capex and increase their free cash flow.

A lot of Nvidia’s revenue comes from Meta, Google, and Amazon, and we’re seeing a shift where these companies are basically trying to get ahead of the demand for AI, and those are the companies that could potentially buy Nvidia’s GPUs at scale.

Mortgage rates fell this week to their lowest levels since early April, easing some pressure on America’s pricey housing market, my colleague Brian Mena reports.

The average interest rate on a standard 30-year fixed-rate mortgage was 6.87% for the week ending June 20, mortgage lender Freddie Mac said Thursday. That’s down from the average rate of 6.95% last week and marks the third consecutive week of declines. Rates are down from their 2024 peak of 7.22%.

“Mortgage rates have fallen for a third consecutive week on signs of slowing inflation and market expectations of future rate cuts from the Federal Reserve,” Sam Carter, chief economist at Freddie Mac, said in a statement. “Lower mortgage rates combined with gradually improving housing supply bodes well for the housing market.”

Still, mortgage rates remain at their highest in a decade until 2022, when the Federal Reserve will begin raising rates to fight inflation. Borrowing costs are expected to ease this year, but maybe not by much.

Earlier this month, Fed officials scaled back their projections of cutting interest rates this year to one, down from three as projected in March. The Fed doesn’t set mortgage rates directly, but its actions influence mortgage rates through the benchmark 10-year Treasury yield, which moves in anticipation of Fed policy moves. Economists don’t expect the average mortgage rate to fall below 6% this year.

Please see here for the detail.

The co-founder who left fast-growing artificial intelligence startup OpenAI last month has announced his next venture: a company focused on building safe, powerful artificial intelligence that could rival his former employer.

As my colleague Claire Duffy reports, Ilya Sutskever announced plans for a new company called Safe Superintelligence Inc. in a post on X on Wednesday.

“SSI is our mission, our name, and our entire product roadmap, because it is our sole focus. Our team, investors, and business model are all aligned towards achieving SSI,” reads a statement on the company’s website. “We plan to evolve our capabilities as quickly as possible while always keeping safety first, so we can scale with peace of mind.”

The announcement comes amid growing concern within and outside the tech industry that advances in AI are outpacing research into how to use the technology safely and responsibly, and a lack of regulation has given tech companies almost free reign to set safety guidelines.

Sutskever is considered one of the early settlers. A key figure in the AI revolution. As a student, he worked in the machine learning lab under Geoffrey Hinton, known as the “Godfather of AI,” and launched an AI startup that was later acquired by Google. Later, Sutskever worked on Google’s AI research team, and later helped found the company that developed ChatGPT.

Please see here for the detail.