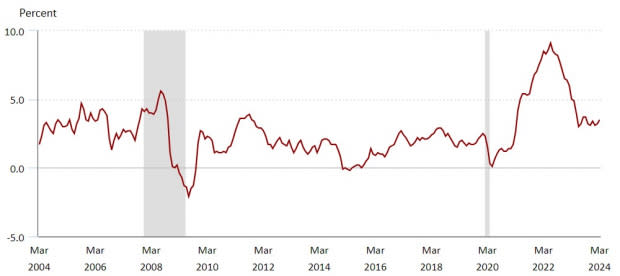

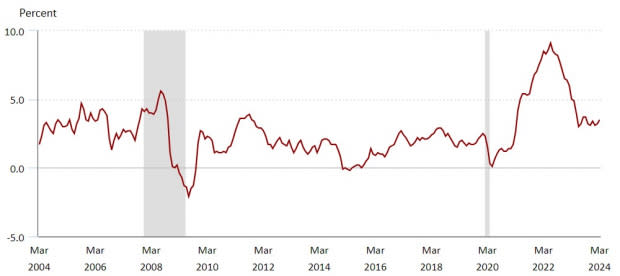

Most major stock market indexes fell more than -1% on Wednesday after the Consumer Price Index (CPI) rose 3.5% year-on-year in March and 0.4% month-on-month.

Hot new indicators on inflation, accelerating from February’s 3.2% year-over-year rise, raise doubts that the Fed will cut rates three times in 2024 and instead move to two cuts this year. are starting to remain.

While this triggered today’s market-wide sell-off, here are the top two stocks on Zacks that could withstand the pullback and would be great buys on the dip if the opportunity arises.

Image source: U.S. Bureau of Labor Statistics

Nvidia NVDA

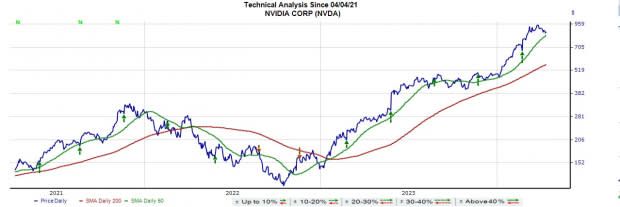

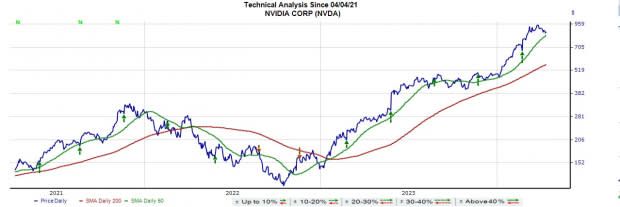

Investors searching their watchlist for a sharp drop in NVIDIA stock during today’s market selloff may have been surprised to see NVDA up +2%. Nvidia’s stock price is 12% from its high of $974 per share in early March, but today’s resistance is off as NVDA has been able to maintain its 50-day moving average and is comfortably above its 200-day moving average. It was reassuring.

Image source: Zacks Investment Research

Still, with NVIDIA sitting right at the top of its 50-day moving average, meeting this SMA (simple moving average) and then moving higher is typically considered a long-term entry point. AI Chip Leader’s earnings estimate revisions have been noticeably higher over the past 60 days, considering that the Zacks average price target of $912.12 per share suggests an upside of 7% from current levels. It would not be surprising if this scenario became a reality.

Image source: Zacks Investment Research

global partner GLP

Given that many analysts remain bullish for oil prices toward $90 a barrel by the summer, the Zacks Style Score Value grade of “A” for Global Partners is a no-brainer. Very interesting. Specifically on Wednesday, Global Partners shares rose +1% as the energy sector rose and the broader market fell.

Image source: Yahoo Finance

Global Partners, which manages one of the East Coast’s largest networks of refined petroleum products terminals, has annual profits expected to rise 4% this year and another 14% to $4.47 per share in FY2025. There is.

Even more convincing, GLP is trading at 11.4x forward earnings, which compares favorably to the Zacks Oil & Gas Refining and Marketing Master Limited Partnership’s industry average of 13.4x and the S&P 500’s 21.9x. This means that the discount rate is Furthermore, Global Partners’ stock is trading at a 38% discount to its median price of 18.6 times, well below its highest P/E ratio in 10 years. It’s also worth noting that GLP’s annual dividend yield is 6.26%, and the past two months’ earnings estimate revisions have been slightly upward for both his FY24 and FY25.

Image source: Zacks Investment Research

conclusion

Investors may be nervous about further market volatility, but buying Nvidia and Global Partners stocks should pay off if the opportunity arises. In that regard, both stocks currently boast a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today you can download 7 Best Stocks for the Next 30 Days.Click to get this free report

NVIDIA Corporation (NVDA): Free stock analysis report

Global Partners LP (GLP): Free Stock Analysis Report

Click here to read this article on Zacks.com.

Zacks Investment Research