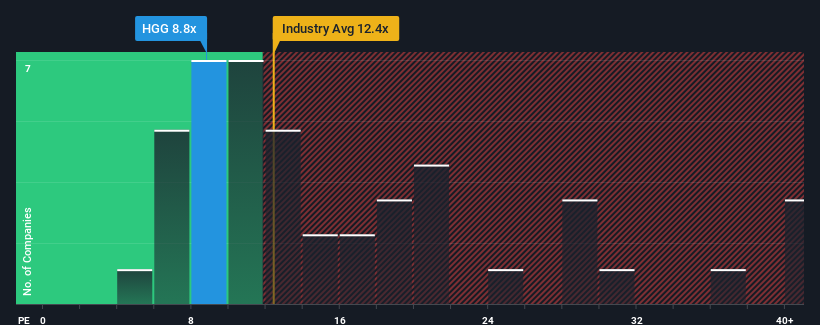

Given that nearly half of Israeli companies have a price-to-earnings ratio (or “P/E”) of more than 13 times, you may want to consider: Hagag Group Real Estate Entrepreneurship Ltd (TLV:HGG) is an attractive investment with a P/E ratio of 8.8x. However, there may be a reason for the low P/E ratio, and further investigation is needed to determine if it’s justified.

Hagag Group Real Estate Entrepreneurship’s revenue has been increasing steadily lately, which is good to see. Perhaps many are expecting a significant deterioration in the respectable performance, and that may be pushing down the P/E ratio. If you like the company, you’ll hope it doesn’t so you can potentially buy shares when the company is unpopular.

Check out our latest analysis for Hagag Group Real Estate Entrepreneurship.

There are no analyst forecasts available for Hagag Group Real Estate Entrepreneurship, but take a look at this. free Data-rich visualizations show how a company’s revenue, revenue, and cash flow stack up.

What is the growth trend of Hagag Group Real Estate Entrepreneurs?

Hagag Group Real Estate Entrepreneurship’s P/E ratio is probably typical for a company that is expected to have limited growth and, importantly, perform worse than the market.

Looking back, the company saw its revenue grow by an exceptional 23% last year. His recent strong performance means he was able to grow his EPS by a total of 225% over the past three years. So it’s safe to say that recent earnings growth has been great for the company.

When we weigh this recent medium-term earnings trajectory against the one-year forecast of 17% expansion for the overall market, we find it to be significantly more attractive on an annualized basis.

With this in mind, it’s strange to see Hagag Group Real Estate Entrepreneurship’s P/E ratio lower than most other companies. Most investors don’t seem confident that the company can maintain its recent growth rate.

Conclusion on the P/E of Hagag Group Real Estate Entrepreneurs

Generally, we like to limit our use of price-to-earnings ratios to establishing what the market thinks about a company’s overall health.

We find that Hagag Group Real Estate Entrepreneurship’s recent three-year growth rate is higher than broader market expectations, so it is currently trading at a much lower P/E than expected. There may be major unseen threats to earnings that prevent the P/E ratio from matching this strong performance. Normally, the continuation of these recent medium-term conditions would be a factor pushing up stock prices, so it seems that many people are actually expecting earnings to become unstable.

Additionally, you should also learn about these 3 warning signs we’ve spotted with Hagag Group Real Estate Entrepreneurship (Including one that shouldn’t be ignored).

the important thing is, Make sure to look for great companies, not just the first idea you come across. So take a look at this free A list of interesting companies with high recent earnings growth (and low P/E ratios).

Valuation is complex, but we help make it simple.

Please check it out Hagag Group Real Estate Entrepreneurship Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.