JHVE Photo

overview

My picks from Nordstrom (New York Stock Exchange:JWN) has an affirmative rating as we no longer have confidence in the business’s earnings growth prospects given how management has guided it into FY24.appears to be contributing to growth Profits in the rack business will continue to be under pressure. Importantly, the off-price retail space competes with the big three. That said, I do note that a potential deal with the Nordstrom family could be an attractive upside factor. Investors who like to play in special situations may find this stock attractive.Please note that I previously rated buy evaluation I expected JWN to hit its FY24 guidance, so JWN’s valuation multiple should be revised positively.

Recent results and updates

JWN’s most recent performance was in the fourth quarter of 2023, when it reported adjusted EPS. The price was $0.96, beating the consensus of $0.88. Total retail sales increased 2.2% due to a 3% decrease in regular price sales and a 14.6% increase in off-price sales. These conditions resulted in gross profit margin of 34.4%, below the consensus estimate of 34.8%, but sales increased SG&A leverage and EBIT margin exceeded his 50bps. My general take on the headline performance is that although revenue exceeded my expectations ($383 million versus $325 million expected), the underlying business operations are moving in the right direction. That doesn’t seem to be the case, and management is sending mixed signals about its future outlook. Outlook.

First, there’s no doubt that Rack improved throughout the year thanks to strong low-single-digit growth in Rack same-stores (as noted on the Q4 2023 conference call). However, the FY24 management guide suggests that this momentum does not support his positive outlook for FY24. Specifically, the following comments were made:

We expect digital to grow in line with the current market situation. Drive market growth As we move from this year to next year

Nordstrom banner store flat rangenotice the offset

I think we all expect that AUR starts to fall, but it’s a little harder to predict.Source: 2023 Q4 Financial Results Announcement

This also makes me question Rack’s long-term value proposition. This concept seems great for consumers, as they can buy high-quality brands at relatively low prices. The problem is competition. In the lower price range, there are many off-price retailers competing for the wallets of consumers on a tight budget. That includes his three very large players: TJX Companies, Ross Stores, and Burlington Stores, whose combined sales exceed $80 billion (JWN’s size). (more than 5 times more than him). If JWN becomes heavily reliant on this for growth, it is unlikely that margins will improve significantly given the nature of off-price product offerings, so long-term profit growth prospects remain uncertain. It’s going to be quite unsettling.

Regarding margins, management’s guidance was such that they considered my concerns up front. Given the strong growth in the racking business, we expected margin expansion in 2024, especially given supply chain efficiency and inventory management. However, the guidance for FY24 states that his EBIT margin is 3.5-4%, which means that his EBIT margin is flat or declining compared to his FY23. Masu. My guess from this is that pressure on gross margins (due to increased off-price products) will continue to impact the business to an extent that offsets growth from operational efficiencies and racks. Another piece of evidence that the gross margin pressure is real is when we look back at the FY21 Investor Day, where management expected an EBIT margin of 4.5% on revenue of $14.5 billion However, as of FY23, JWN has already generated revenue of $14.69 billion, but the EBIT margin is far from 4.5%.

Our third priority for 2023 was optimizing our supply chain capabilities, a continuation of the efforts we started in 2022. In Q4, for the sixth consecutive quarter, the team achieved an additional 50+ basis point improvement in supply chain variable expense savings. It also increases the speed from click to delivery.

Our second priority for 2024, operational optimization, builds on the success we have had in optimizing our supply chain capabilities.Source: 2023 Q4 Financial Results Announcement

An interesting development that occurred two weeks ago was when news became public that members of the Nordstrom family were considering taking the business private. In my opinion, this is great news for shareholders. The background is that the family owns about 30% of the business, so they are keen to make the business worth much more than it is today. Remarkably, back in 2018, they wanted to privatize the business for $50 per share (which, if you strip out all the macro uncertainties of the past few years, they (indicates how much the company values the business). If the current stock price is around $19, it’s possible they could move more aggressively towards privatization, resolve all operational issues (without the noise from public investors), and someday re-IPO the business. It makes even more sense that the gender is high. Previously, when an offer of $50 was made, it was rejected because there was no agreement on the valuation. I think the reason was because the stock was worth over $40 at the time, which made it unattractive to shareholders (premium was 24%). Also, just a few years ago, his stock price in 2015 was over $80, and the market was pretty bullish at the time (S&P was up one direction, and interest rates were still near 0%). Therefore, shareholders are in a “risk-on” mode. I think it’s more likely that a deal will happen this time, as shareholders who have held the stock since are now saddled with significant losses and are likely to accept a deal that allows them to recoup some of their losses.

Evaluation and risk

Author rating model

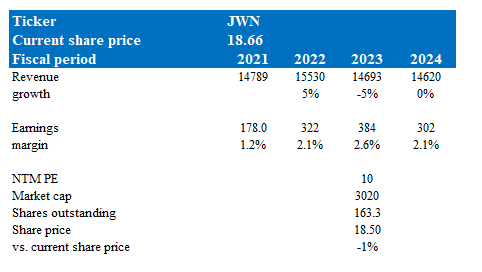

According to my model, JWN is worth $18.50. This price target is based on my revised growth forecast for JWN to grow flat in his FY24, with earnings declining to an indicative $302 million at the midpoint. This is the opposite of what I expected previously (improved profit margins and increased sales by his 5%). So I’m not very positive about the business and valuation today. I previously predicted that the valuation would rise to 12x PER in the future, but due to future prospects and concerns that Rack’s sales would be the driving force behind JWN’s growth, I revised the valuation multiple. I don’t expect that.

That being said, I would like to highlight the potential benefits of a deal with the Nordstrom family. Using the same 24% premium offered previously, the stock could be worth about $23 per share for him. And, as explained above, given that the insider owns his 30% of the stock (which equates to his nearly $1 billion at risk), there is an incentive to further increase the value of the stock. There are enough. So I’m pretty confident they’ll make an offer soon, especially since they’ve already instructed their financial advisors to assess private equity firms’ interest in potential deals. There is.

summary

To summarize this post, I am no longer very optimistic about the fundamental outlook, so my recommendation for JWN is a Hold rating. Recent profits have exceeded expectations, but the low-margin rack business is contributing to growth, raising concerns. Notably, management’s FY24 outlook suggests that margins are flat or declining despite supply chain improvements. While there are bright spots to a potential deal with the Nordstrom family, there are concerns about the core business fundamentals.