Three New York markets showed standout results in May for rents and occupancy rates.

Smaller markets are leading the national apartment rent growth index.

As of the end of May, 22 of the nation’s 150 major apartment markets had recorded year-over-year rent increases of 3.5% or more, all of which were in secondary or tertiary markets. This compares with the national average annual rent increase of just 0.2% in May. Data from RealPage Market Analytics.

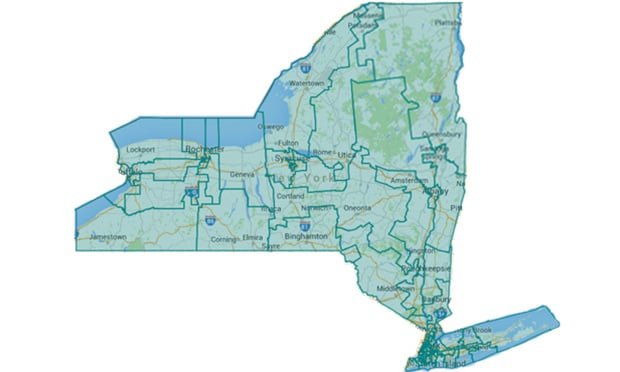

New York markets ranked three out of the top 10 for highest rent growth over the past year, with Syracuse, Buffalo and Rochester seeing rent increases between 5 and 7 percent. Three markets along the Interstate 90 corridor in the northwestern part of the state also ranked in the top 25 for occupancy rate out of 150 major apartment markets in May, RealPage reported.

Limited development in these markets could be one reason for rising rents and occupancy rates: All three markets saw inventory growth of less than 0.5% at the end of the first quarter, compared with 2.5% supply growth nationally last year, according to RealPage.

Syracuse recorded annual rent growth of 6.7% as of May, second only to Midland/Odessa, Texas. Prior to the pandemic, the market’s five-year annual rent growth averaged just 2.4%. The nation’s 96th-largest apartment market, with 43,000 existing units, had an occupancy rate of 97.4% in May, tying it with Champaign-Urbana, Illinois, for the top spot among the nation’s 150 largest markets and 320 basis points above the national average of 94.2%.

Buffalo apartment rents increased 5.4% in May, the fifth-largest increase in the nation and above the five-year pre-pandemic average increase of 2.3%. Apartment occupancy in the market was 96% as of May, ranking among the top 25 markets nationally. Buffalo is the 69th-largest apartment market in the country with approximately 65,500 existing units.

Rochester, the 66th-largest apartment market with about 69,000 housing units, has an occupancy rate of 96.8%, above the pre-pandemic five-year average of 95.4%. Rochester’s effective asking rents increased 4.9% in the 12 months ending May 2024, the eighth-largest increase in the country. The pre-pandemic five-year average increase was 2.3%.

Over the past five years, Buffalo’s existing units have increased 3.5%, Rochester 2%, and Syracuse just 0.5%, compared to the national average existing unit growth of 10.3%. Rochester’s inventory growth is expected to remain minimal at 0.3% through the end of the first quarter of 2025. Buffalo and Syracuse are expected to see supply rebound at growth rates of 2.1% and 1.1%, respectively, below the national average growth rate of 3.5% next year.